I often describe myself as lazy - although this is not quite the right word. The more correct word would be efficient. I tend to calibrate effort to potential reward. Back in 2011, the entire financial community was convinced that inflation was going to surge, and if anything, there was a preference for commodities over financial assets. At the time, China was obviously heading for trouble, and policy in the West was deflationary. It was a no-brainer trade to be long bonds and short equity, and go round marketing myself as the most bearish fund manager in the world. I was basically playing two trends - one that bond yields were going to remain in a down trend, which continued to be true until 2020.

The other trend was that the Chinese stock market (and commodities) was going to disappoint.

At the time, I had a clear idea of the end game - China devaluing, particularly against Yen, just as the Koreans had done in 1998 and 2008. This would be the signal of the ultimate deflationary bust. In 2016, and again in 2020 we got close, but in both cases, the Yuan held is value. I was targeting a level of 10 on this cross rate, but the yuan weakness reversed in 2016 (circled below), and then again in 2020. I knew this trade was done, and the world was a different place to the one I had grown up in. I did not really have a clear view on where markets were going, or what the end game was. It was time to take a break.

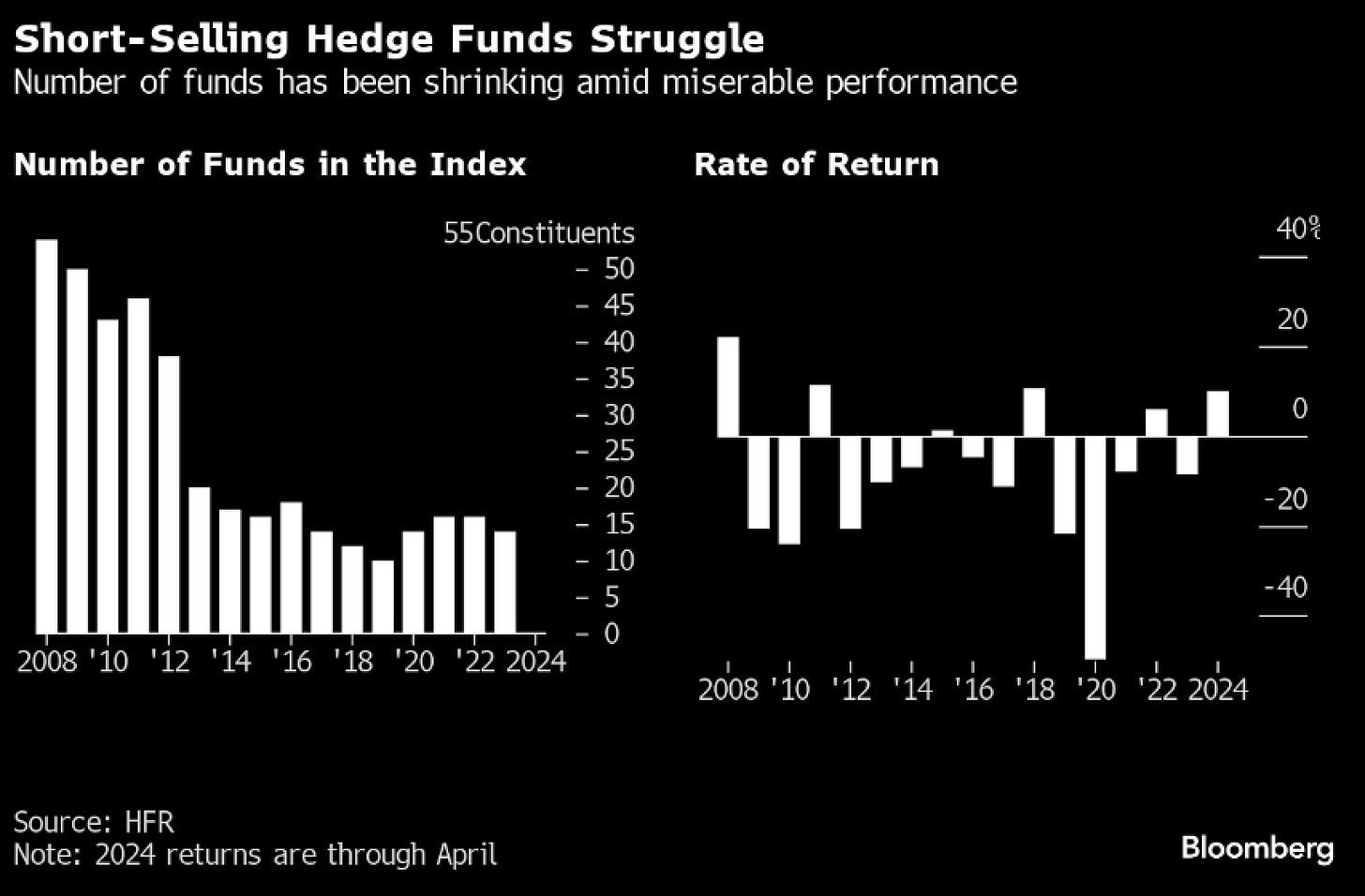

As you can tell from above, I looked to currencies as a good indicator for risk, and for trading, and I always felt that Yen was undervalued - a view that has not really changed that much. The point of this, is that changing market behaviour, and changing politics has made short selling much more difficult. As I was reading a Bloomberg article on short selling that I was interviewed for, there were some striking graphics. The number of funds has collapsed. I was also surprised that short selling funds did not do better in 2022.

I used to use things like NIIP as timing tool for short selling, but that has also not worked as it used to. Now in my view, successful short sellers are smarter than average (I am talking my own book), but I DO think Soros is better investor than Buffett, but Buffett is a better business man. Why are short sellers better? To make money shorting, they need to understand the market better than at least 90% of the other people in markets. Stick an average punter in the market, and tell them they can only be long, and they will more than likely make money. Stick the average punter in the market and tell them they can only short, and watch the losses roll in! See chart above. The obvious question then is do I think I understand markets better than 90% of market participants? At the moment, probably yes. Why? Because this market is politically driven, not fundamental driven, and the average fund manager is a political dunce at best, and dogmatic as worst.

Since the GFC, Western governments have slowly taken on corporate risk. Explicitly this happened during Covid, which is hard to argue with. But it has also happened implicitly with clearinghouse reform. For those you without the patience to go through the 20 presentations I have done on this, basically all you need to know is that banks used to price risk, with clearinghouses acting as a useful anonymous market when banks needs to hedge themselves. Regulators moved clearinghouses from a sideshow to the centre of the financial system. Regulators have made clearinghouses the central risk pricing party, but incentivised them to maximise volume, but with no risk of bankruptcy. If you wonder why market volatility has collapsed, clearinghouse reform is a good place to look. Essentially, bankruptcy risk that used to reside at banks, to ensure they priced risk correctly, has now been socialised and guaranteed by governments.

Regulators love it, as it has neutralised the risk of credit crises. Even with the end of QE, corporate credit spreads have remained tight.

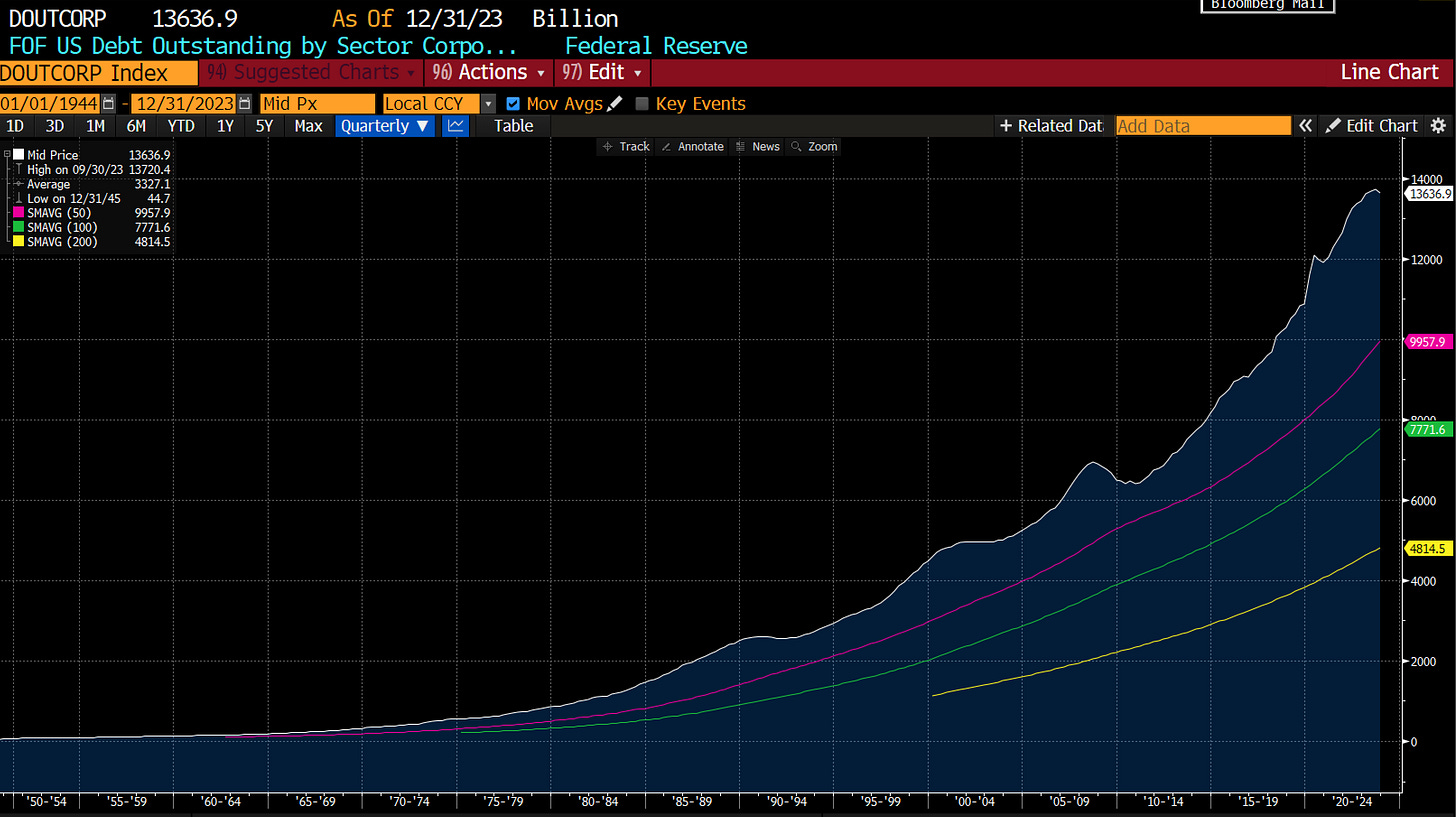

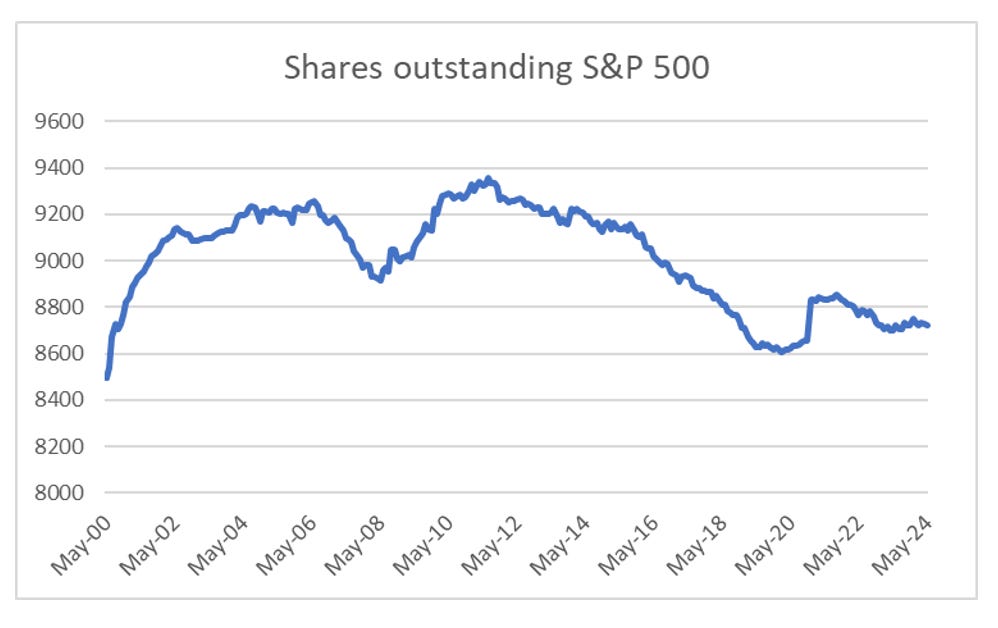

With corporate credit markets now backstopped by governments, and bank default risk also backstopped by governments, US corporates in particular have been incentivised to swap equity for debt. Corporate debt has surged.

And share buybacks make sense, even when stock markets are at all time highs. With government guarantee for corporate debt markets, there will never be a need to hold cash for a period when credit markets are closed.

The rise of private equity and private credit also reflect this extension of government balance sheet to the corporate sector. Interestingly, the US government balance sheet extension reminds me greatly of the same guarantees that AIG was issuing on MBS. Without AIG and its balance sheet extension, the GFC would have never been possible. What is really interesting about AIG, is that its equity began underperforming the US market in 2004, well before the broader markets topped out. Credit markets took longer to signal problems.

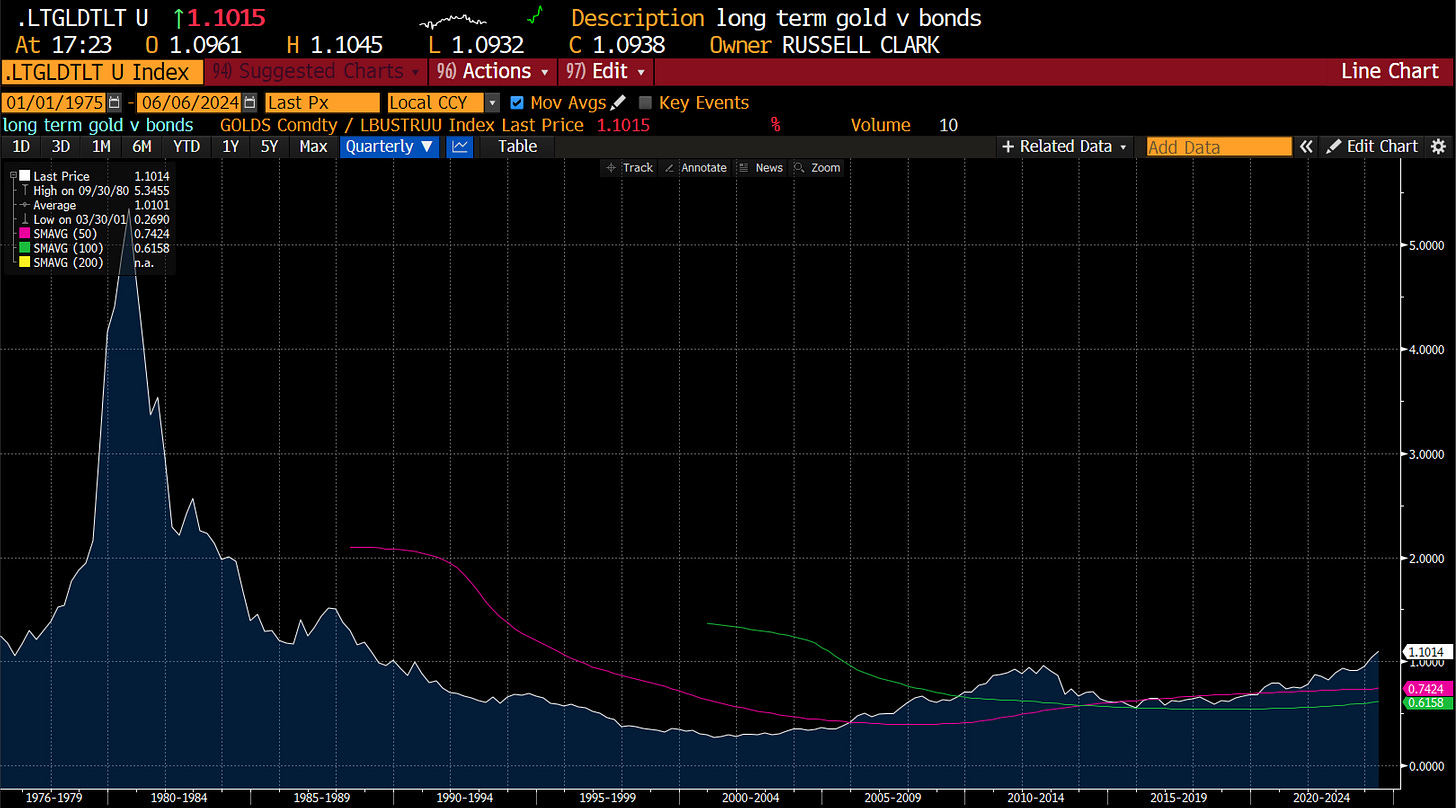

When I look at the current price action of gold versus long dated treasuries, the market knows that US treasuries are not a “safe asset”. Just as equity investors knew that AIG was not a safe asset. I suspect that some people will feel this is a stretch, but the logic of it is pretty sound. The profit seeking nature of capitalism is always looking to exploit any mispricing. AIG credit rating was mispriced, and MBS industry flourished off it. US treasury risk is mispriced, and the entire US corporate sector is flourishing off it. Here is where it get interesting. AIG extended its balance sheet, as its managers did not know any better. The US government has extended its balance sheet, because it took the view that US voters were tired of austerity, and love strong stock markets , and that the wealth effect was a tried and tested vote winner. Politicians do what politicians do and took a political not financial calculation. The problem, which is increasingly obvious, is that politicians are very wrong about the vote winning potential of asset inflation.

The FTSE is at all time highs, and the Tories are heading for annihilation. Sensex is at all time highs, and Modi suffered a significant political reversal. S&P 500 is at all time highs, and Biden is fighting for re-election. The list goes on and on. Conversely in Mexico, ALMO’s chosen successor has romped home in elections. To make an incredibly obvious point, rampant asset inflation, rising income inequality, the perceptions of being in corporate pockets is now a VOTE LOSER. I can see it, clearly, and you dear reader should also see it clearly. So the political winds are changing. And the market is reflecting this in the changing fortunes of gold versus treasuries. The market is trying to push governments to cut its guarantees. But my guess is politically, cutting guarantees to corporates and for asset markets is much more likely than cutting guarantees to workers.

So this has left me with two options that will allow me to have the wind at my back. One is to be a left wing populist railing against big business and their tax shenanigans. I could easily start publishing a policy suite of ideas to make US corporates pay appropriate levels of tax. They range from recognising Ireland as a tax haven and cancelling the tax treaty we have it, or proposing asymmetrical regulation against any large corporate that operates in the UK but pays no tax. Other ideas would be a levy on digital data collection by non-domiciled corporates are just a few ideas. The problem is that UK politics is an ugly business, and I love my family too much to subject them to that.

So this leaves option 2 - start a hedge fund looking to short companies about to lose politically. For me, its easy to see that “good” politicians (i.e. those that know how to win elections) - will avoid any austerity, and start going after corporates for more tax and wage increases. Or as I put in a recent post, its time to leave a horse head in the bed for large corporates. Oddly enough, Horse Head Capital seems like apposite name for this venture. Seeing Bill Ackman do a stake sale, and potential IPO of his business makes me think smart money is seeing the political winds changes as well. Time to push the hedge fund button.