During the crisis years of 2008 to 2011, investors learnt that safe assets (or risk free assets) were US Treasuries, JGBs, German bunds, US Dollar, Yen and Swiss Franc. Yen in particular had a very strong propensity to rally over this period.

The long end of the JGB market also had the tendency to rally (yield falls) when there was trouble in markets. The meant that the dollar returns to owning a long dated JGB were immense during crisis periods.

It is a fundamental truth in financial markets is that if an asset has behaved a certain way, then a narrative will be built that explains it, and markets will generally accept it and then expect it. However, this month neither JGBs or Treasuries have acted as a safe haven asset.

Why is this? To me the answer is obvious, mainly as I lived and traded through that period - but I am going to guess that most people will not grasp it. From 1990 onwards, the market was obsessed with carry trades. The carry trade came in many many guises. The convergence of European sovereign bond yields, was a carry trade. The convergence of Italian and German bonds began in the 1990s, and moved on to every other nation that joined the Eurozone. In this case, a long Italian bond, short German bond trade was the carry trade.

Emerging markets US bond spreads converged massively from 2002 onwards. In this case, owning lets say Brazilian USD bonds (C-bond) and short Treasuries was the carry trade.

In currency markets, you also had a huge carry trade in emerging markets. Long high yielding emerging market currencies, while short the Yen or the Swiss franc was extremely popular. This trade also leached into the banking system, where Yen and Swiss franc mortgages became extremely popular (you are long a Polish home, while borrowing Yen).

Subprime trade was also a carry trade. You have to remember is that while most fund managers and hedge fund strategies present themselves as complex and sophisticated, they are often at their heart, very simple. Carry trade is extremely popular, as it generates a positive carry, and from 2003 to 2006 also produced capital return. The point of this history lesson is that as we can see above, the carry trade worked until 2009 or so, and has been a failure more or less since. The reason assets like Treasuries, JGBs, Yen and Swiss Franc traded as safe havens was that they were the short legs of carry trades. When markets turned, fund managers were forced to buy them back. They were safe haven as the market was short of these assets.

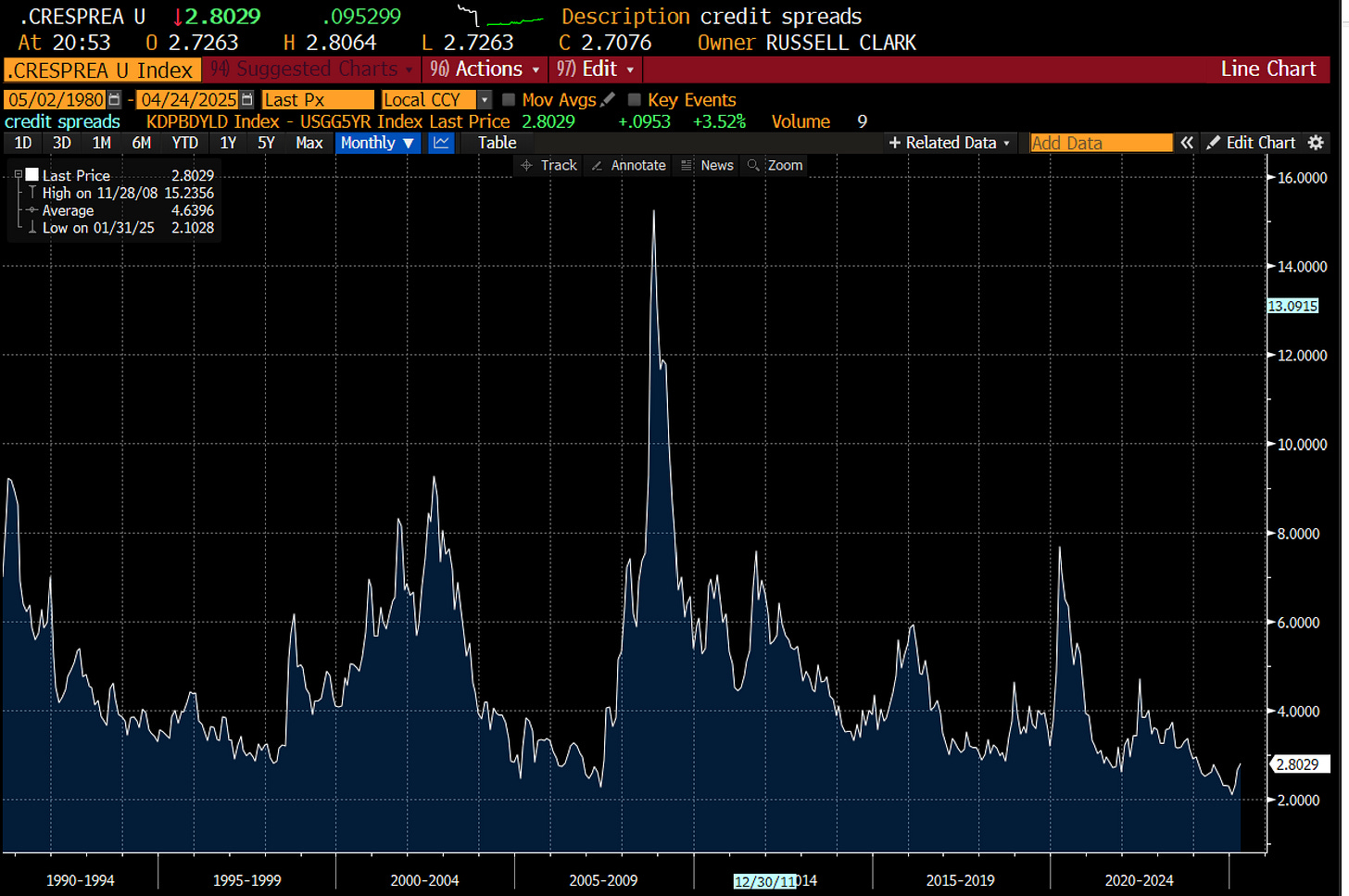

So when markets are weak now, and the old “safe haven” trade don’t work - what does that tell us? It tells me, the market is long treasuries and long risky assets. Why is that? For me, the efforts of central banks, governments, regulators and clearinghouse reforms since the GFC has in effect mutualised risk - that is corporate risk and government risk are now one in the same. In simple terms, the US government has dedicated so much of itself to preserving and protecting corporate America, there is no real distinction anymore. Despite the market ructions this year, US high yield credit spreads are still close to all time lows..

That is the trade since COVID has been to basically assume government risk and corporate risk is the same. We can already see that when TLT is weak, US equities now tend to follow as in 2022 and this year.

This is actually not a new phenomenon. It was true of the US in the 1960s and 1970s, when government was much more directly active in the economy, and has been true in emerging markets, where foreign investors basically see corporates and governments being fused together. The only really novel thing is that the US government has protected the corporate sector, while asking for NOTHING in return. In the 1970s, federal guarantees where given in return for high tax takes. In the 2000s, the corporate sector has been protected, while also receiving tax breaks, the end result is sky high government debt.

What in essence I am saying is that in 1990s to 2010s, the dominant trade was long high yield or risky assets, short low yielding boring assets. Since the 2010s, the issuers of low yielding boring assets have extended guarantees to in effect make all assets low yielding (or expensive). There is essentially no short leg to this carry trade - hence there is so safe asset. Perhaps the only asset that could be argued to be under owned in gold. If sovereign bonds are not considered safe - then gold is under owned by central banks. The other asset I suspect might be under owned is cash. Of course a big exception to this is Warren Buffett. He has a lot of cash. But then again, he has been around a lot longer than most investors, and does not try and pretend his investing strategy is complicated or sophisticated.