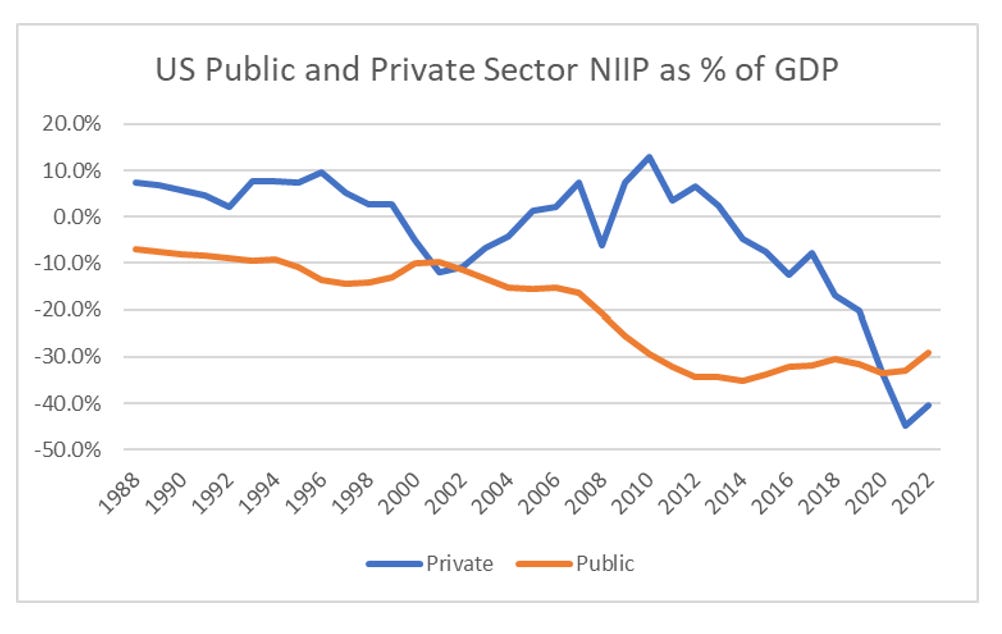

This is a follow-on to my previous post “A Better Strong Dollar Model” and a companion piece to a post from over a year ago “Are Macro Investors Idiots?”. In my entire investing career, I always had one rule. If you don’t trust the currency, don’t invest in the market. This was originally from investing in emerging markets, where it was extremely rare for the currency and equity markets to move in the opposite direction. When I became a global investor, this rule was tweaked, where I would not buy Japanese equities if I though the yen was going to strengthen. What I found was the net international investment position (NIIP) which captured asset flows was very good at signalling inflection points in currencies. I have written about it extensively, so if you are interested please look at previous posts. When I applied NIIP analysis to the US, I found it signalled the top in the dot com bubble when private sector NIIP deficit got to 10% of GDP. So being a macro investor, I was much more bullish on the dollar from 2010 that anyone else, and much more bearish on emerging markets than anyone else. This was a career making trade. Given the success of this model, I became far more bearish on the US dollar and US equities in 2016 onwards. This was a career ending trade. The macro investors referred to in the title is yours truly.

Being a slave to macro data, I began to look for US focused financial structures that looked unsustainable or unstable at least. I found plenty. There was the clearinghouse structure, which is designed to fail. I have written in detail on the foolishness of this structure, but has had no effect on US equities or the US dollar. I also found huge growth in the autocallable structure, a financial product that has a long and glorious history of destroying everyone involved in is propagation. Problems here seem to have had no effect on US equities or the US dollar. I had potentially resigned myself to the idea that loose monetary policy from the Federal Reserve could keep this NIIP balance going indefinitely. But with Federal Funds Rate at 5.25%, even that excuse looks weak these days.

The answer now, seems blindingly obvious. The NIIP data is not correct. In one of my first posts, I noticed that there was a big gap opening up between reported NIIP surpluses and NIIP deficits. In effect it was saying that the US was seeing huge inflows, but those inflows were not coming from traditional sources, like Europe or Japan. At the time I guessed it was hidden Chinese flows. That is the positive Chinese NIIP should be much higher. I now think that was incorrect

So where are those offsetting flows to the increase in US NIIP coming from?