As explained in a post from a year ago - there are three profit centres to short selling. Capital gains, carry and currency.

Capital gains is the easiest to understand, and strangely the least profitable of the three centres. Why least profitable? In my experience crowded shorts tend to visit huge losses on short sellers. GME and AMC are recent examples, but for many years Tesla was the biggest short in the market. These shorts suffered significant capital losses. As a rule, I avoided crowded shorts, which I define as a short with a borrow cost over 2%. For much of the period from 2010 to 2019, the borrow cost was well above 2%, so shorts in Tesla suffered from carry costs as well as huge capital losses.

Short selling disasters like Tesla has virtually destroyed the short selling community of hedge funds. HFRI used to publish a short bias index, but discontinued some time ago. Barclays also had a short bias index, also discontinued. It is the green line below, the grey line is the S&P 500 and the blue line is the Barclays CTA index. 2008 was the hey day for short selling, and its been miserable ever since.

Another way to see this is the collapse in short selling in the US market. Unfortunately there is not a single data source we can use, but we can splice together two similar data sources to see that short selling is at close to historical lows.

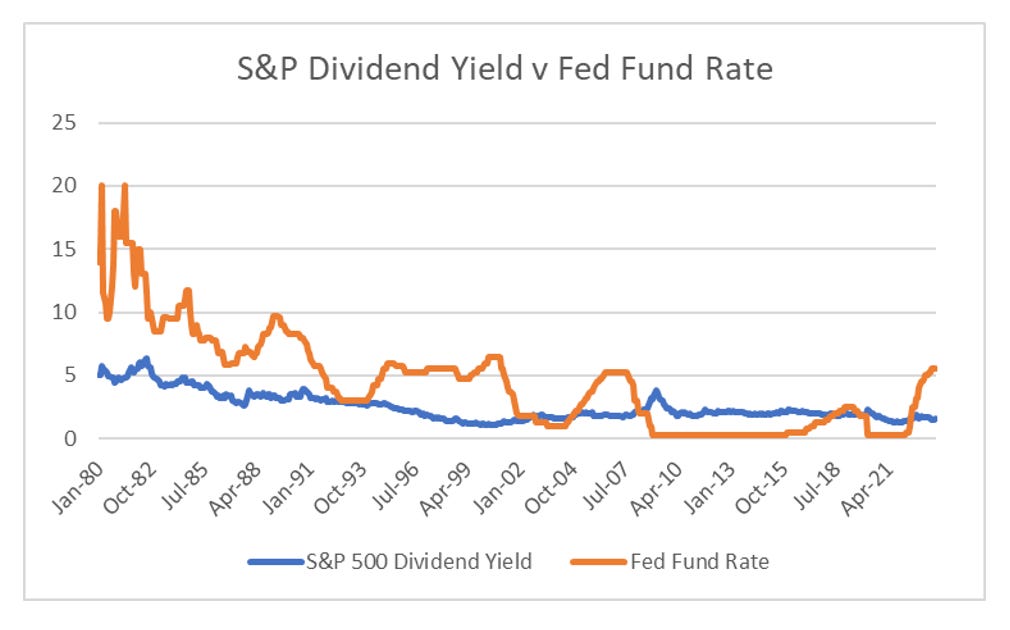

The cause of the destruction of the short bias hedge fund is not hard to find. From 1980 through to 2007, the Fed Fund rate was above the dividend yield of the S&P 500. Which meant that as long as short borrow cost for shorting was low, you could earn carry on short selling. Carry is the interest you earn on the cash you raise from short selling. When you short sell, you borrow shares from a long term holder for a fee. You sell the shares in the market, and receive cash. the interest you earn on that cash is called carry. From 2008 until 2022, the Fed fund rate was below the S&P 500 dividend yield, meaning that short selling had a negative carry. As most short sellers do not make any capital gains (see Tesla, GME or AMC), without carry, their funds could not generate any returns.

You might be saying to yourself, I am sure Russell was net short from 2011 through to 2020, why could he make money, when all other short funds imploded. Well I used to exploit one recurring feature of the pro-capital era - currency devaluations. Currency is the third profit centre of short selling. When profits and credit quality comes under pressure, most countries chose devaluation to restore profits and export competitiveness at the expense of workers. The key to profiting from currency devaluation was to make sure you shorted an exporter to devaluating nation that would have a strong currency. Devaluation is explicitly exporting your problems to your trade partners. From 2010 to 2016, there was good money in exploiting the mispricing of currency risk in equities. The key was to be short in a “hard currency” - such as USD, Euro or even Yen. The US dollar line of Brazilian Banks was an example of this.

As we move back to a pro-labour world, the implication is that currency as profit centre will be limited. In a pro-labour world, governments try to keep the currency strong to keep wage growth strong. This implies tighter monetary policy, which is what we have seen. With S&P 500 dividend yield at close to all time lows, and the Fed Fund Rate at 5.5%, the carry trade and the opportunity for some capital gains makes short selling look attractive to me again.