I was wondering why US stocks have continued to do well when GLD/TLT is also trading so well. I thought that the continuing boom in tech stocks recalled the dot-com era, but as interest rates normalised, the boom would end. This was the case with a subsection of the tech area - mainly the speculative area that ARKK specialises in.

While I knew that many of the leading tech companies were much better finances than the typical speculative tech company, I also was negative on the larger tech companies due to the experience in China. As regulators broke down switching barriers, and the harvesting of data, the “flywheel” of big tech went into reverse. While the rhetoric from both the Republican and Democratic party has turned anti big-business, the US legal system seems to be working hard to prevent any decisive anti-big business policies to be implemented.

I should define platform businesses to make sure we are on the same page. Platform stocks are businesses that other businesses need to operate, and face limited competition, and hence are able to extract rent. They are either closed gardens (that is you can only use their software and payment systems, and switching cost are high) or have very dominant market share - monopolies or duopolies. Apple, Microsoft, Amazon, Meta, Google, Visa, Mastercard. You could also throw in the rating agencies - Moody’s and S&P Global. You could also throw in other businesses such at MSCI, and Exchanges. Fast food chains like McDonalds also share some similarities. They represent the best of American capitalism, and the pinnacle of globalisation. A large number of these businesses have been subject to antitrust investigations. My biggest issue is that the rise of the platform company and the associated performance of the S&P 500 now has almost a negative correlation with the US budget deficit. Or as share holders get richer, the government gets poorer.

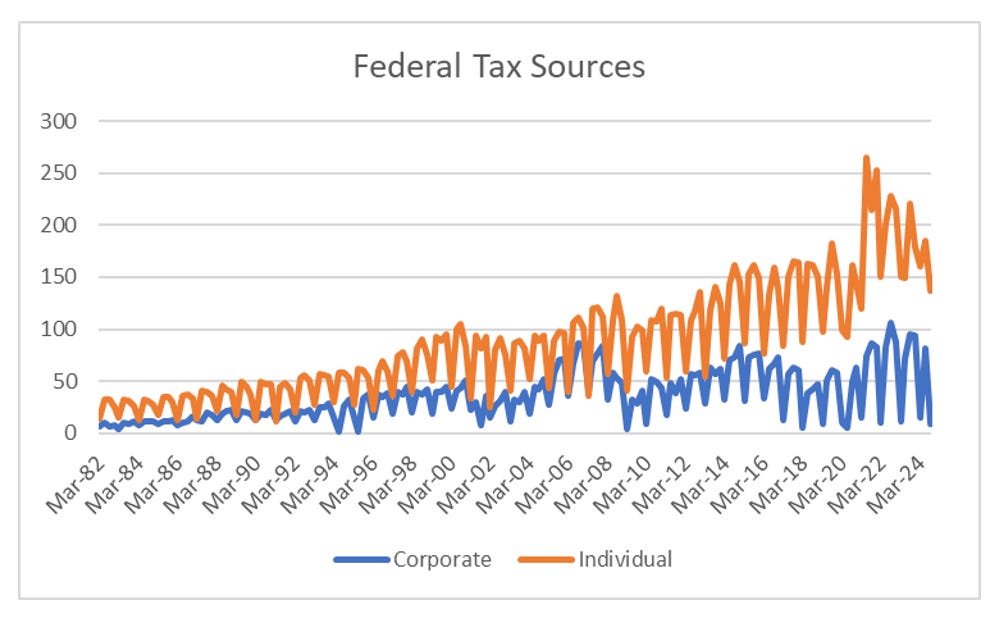

This is mainly, but not entirely, due to falling tax collection. Corporate tax collection is now very low - and at similar levels to 20 years ago.

One of the brutal facts about globalisation was that it was more and more difficult to tax corporates. The temptation for a small nations to cut taxes to attract multinationals that would otherwise invest elsewhere has led to a race to the bottom in corporate tax.

The problem is that US multinationals through various quirks of the tax system pay virtually no tax on foreign earnings - particularly if they run their operations through Ireland. Ireland now runs a fiscal surplus. What is good for Ireland (population 5m), is bad for rest of Europe (population 450m).

Largely driven by corporate tax revenue. Irish corporate tax take in on course to have risen nearly 700% in 10 years. This in stark contrast to everywhere else.

One other factor that disturbs me about US multinational tax arrangements is that it makes it almost impossible for domestic rivals to compete. If you face a competitor that is already larger than you, but they also pay next to zero tax, the chances of competing effectively is virtually zero. This ultimately drives more business to be run and listed in the US. In terms of the flywheel that VC investors are so enamoured with, US tax arrangements drive more and more business to be run out of the US, making it harder and harder for any other country to retain or attract businesses (see ARM in the UK for a recent example). To me, the current political mood of the world is dissatisfaction. Rising income inequality seems to me to be the root cause, and politicians on both the right and left are trying to solve this, or at least appear to do so. This distortion shows up in macro data. One of the biggest macro distortions has been the net international investment position (NIIP) which I have talked about at length. Not only is the size of NIIP deficit of the US without parallel, this should sum to zero across nations, but likely does not due to various structures to shield tax.

The implication is that the bed rock of modern financial theory is probably wrong. Sovereign debt it assumed to be the risk free asset, and US treasuries the ultimate risk free asset. NIIP and tax data would imply US multinationals are the risk free asset (that is the ability of US multinationals to shift revenues and profits as well as globalised production base makes them beyond the control of any government - or in other words, large US corporates are much like bitcoin). The extension of this argument is that the idea of a modern government is broken - as more and more of the economy moves beyond it ability to either tax or regulate. This is the buy case.

The problem with the buy case, for me anyway, is that history is full of examples of a small elite that enrich themselves while ignoring the masses. It always ends with revolution. The idea of modern democracy was to mitigate the risk of revolution by making sure that policy suits the masses. The signs of this revolution is everywhere. Populists are on the rise in the west. China and Russia have broken out of the US orbit, and are replacing US monopolists with their own. US and Western military support is not enough to turn the tide in Ukraine. The Middle East is on fire. And somehow the largest, most profitable organisations to ever exist are happy to continue dig away at the financial supports of western civilisation.

I suspect the best analogy I can make it back to the GFC. Everyone involved in the subprime market knew it was a scam, and that large players like AIG was selling CDS insurance at the wrong price. But it was too profitable for the large investment banks to ignore, so they continued to dance.

Hollowing out the financial support for the West has reduced the political and military power. Everyone assumes someone else should pay, and ultimately the bill will me much larger. This is human nature. Why does GLD/TLT trade so well when US stock market also trades so well? Because both reflect the failure of the US government.

One way or another, governments will reassert their primacy, as that is what voters want, and history shows. My worry is that large US corporations wake up to the risk too late. The movement of GLD/TLT suggests this is the case.