Theft and extortion are both ugly things. But while they may seem the same, they are very different things. Extortion you are buying a service, usually protection, and often protection from the very people you are paying, but it is still a service. Theft, you get nothing back. Some people will tell you that governments give nothing back, but if you live in a rich peaceful nation where the average life expectancy is over 70, this this is plainly not true. And where governments do not work properly, instead of paying taxes you need to pay for security yourself. So I personally like to think of taxes as institutionalised extortion.

In 1970s, it was easy to characterise the US as been bankrupt. The currency was weak, and interest rates were high. But you could not see anything particularly wrong with the Federal government spending. Most of the 1970s, the US fiscal deficit was less than 2% of GDP, and with inflation at 10% would imply a shrinking burden.

That is government debt to GDP ratio in the 1970s was falling, and at very low percentage of GDP.

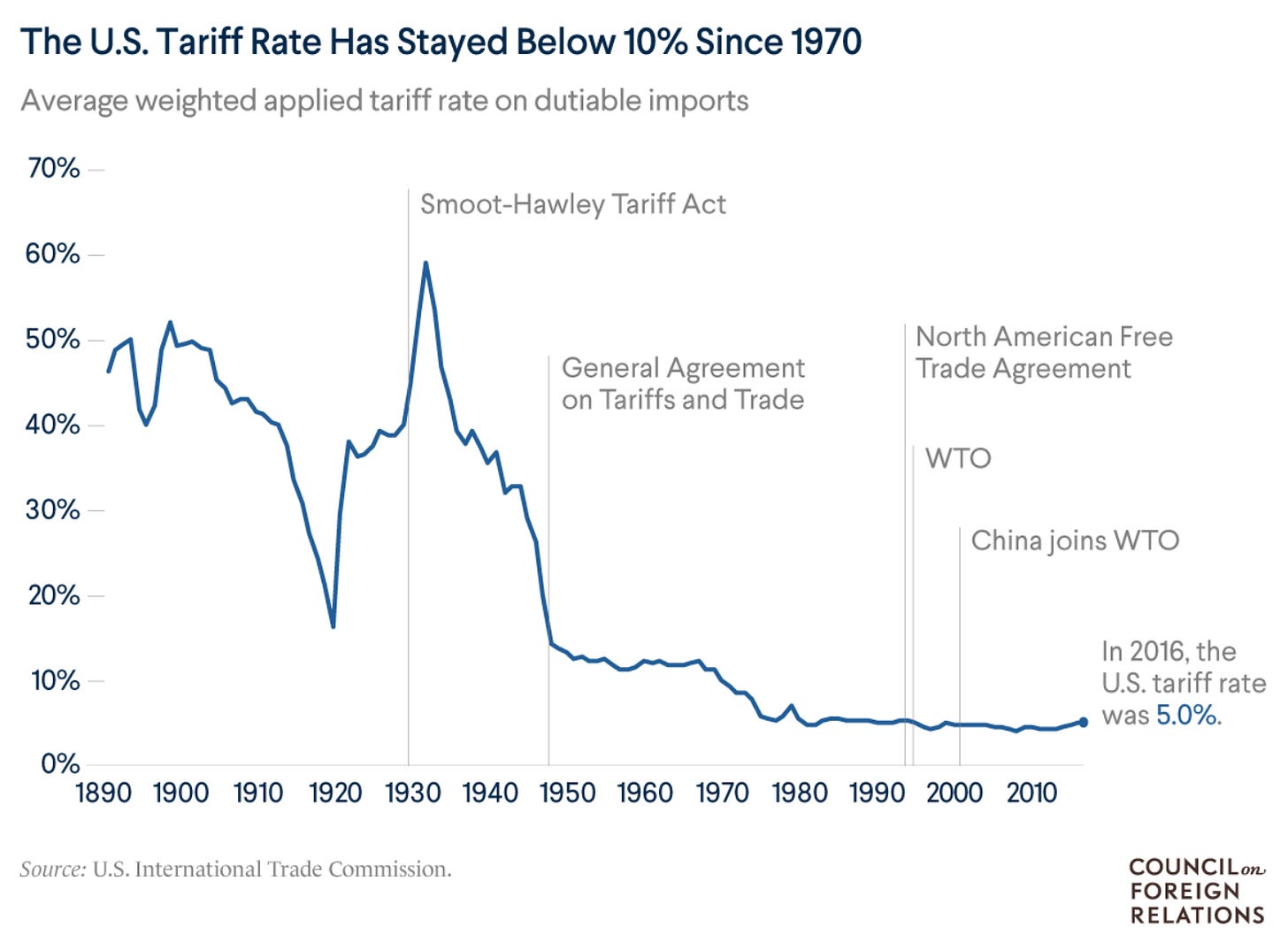

Extortion is an ugly word, but it works, and is the underlying principal under a large amount of market capitalisation. Often when tech types start talk about “monetisation”, you could swap the word “extortion” and you would actually have more clarity on the business model. Google "monetise” their search business by relegating non-payers to the bottom of the first page of search results, or even the second page. Amazon “monetise” their business by putting non-ad paying business at the bottom of their search results. Apple “monetise” their product by making it hard to impossible to use apps that don’t come through their app store (I note when trying to write a Substack note on my iPad is much more difficult for some reason - often freezing. That Apple does not get is usually 30% cut from Substack is probably the reason). FDR, to end deflation offered a deal to US corporates. The government offered legal protection from competition, as long as corporates raised prices and wages. This included tariffs and other regulations. But after World War II, the US began to cut tariffs to help Europe and Japan rebuild.

US corporates were paying high taxes, but without getting any political protection. So in the late 1970s, Reagan and Thatcher offered a new political deal, less tax and less government spending, which is exactly what voters wanted. Over the years, the ability of governments to “extort” tax has been greatly reduced. IRS has been gradually defunded. If anything the type of people that would have worked at the IRS extorting tax revenues have not jumped ship to corporates to avoid paying tax.

When I look at the US, a large number of “extortion” led business models are not heavily reliant on government protection. The US drug industry is particularly reliant on the US not using Medicare to force lower pricing. US tech industry has benefited from government bans on Chinese competition. US tax policy benefits tech and drug companies dramatically. This is not a comprehensive list, but most of the largest market cap companies now rely on very supportive government policy. So we have the reverse of the 1970s, where US corporates benefit from government protection, but pay very little tax. The problem here is that the US government interest bill is starting to go up dramatically.

Extortion only works if people are afraid to not pay. China sent the boys around to its big tech - and I can guarantee you that Chinese tech probably over pay their tax bills.

Personally I think it well over due for a strategic horse head to be place in corporate America’s bed.

Time to sent the boys round to US big tech and pharma in my view. They are not holding up their side of the deal.