Historically, luxury was a bad business. High operating costs, with variable demand meant that luxury stocks tended to act as high beta play on markets. LVMH fell 50% during the Asian Financial Crisis, 60% during the dot com bust, and 50% during the GFC.

However since 2008, LVMH has not really had a sustained fall. In fact it has been a quintessential buy the dip stock, and Bernard Arnault has been the world’s richest person on occasion.

What has changed in luxury? I have tended to use data from the Swiss Watch Federation (SWF) as it seems to match overall luxury data well. We have data on Swiss watch exports going back to 1990, which shows a strong bull market to 2011, and a sideways market since. This makes the more recent bull market harder to understand.

Buried with in the monthly releases from the SWF since 2009 are volume numbers, and we can then separate out volume growth from price growth. Why is this important? Volume growth is much better than price growth. Prices can fall, and if your cost structure has risen with prices, then falling prices will inflict severe losses. I typically look for declining volumes in businesses to short. Seeing falling volumes makes it even harder to understand the success of LVMH.

However, annual data from the SWF points to another trend in luxury. Premiumisation of watches. While watches prices below CHF200 still make up the bulk of the volume, they have become a tiny part of the value. Watches prices over CHF300 have seen their ASP rise by 50% since 2000 and now make up 76% of all value. That is the very top end of the market has seen volume growth and pricing growth, which is ideal condition for any business.

Since 2011, middle to mass market luxury has been very poor, while high end luxury has been phenomenal. Tapestry is the controlling company for Coach, Kate Spade and a few other brands. Hermes is Hermes. Despite US led economic growth, US luxury brands have been poor. Ralph Laruen, Capri (Michael Kors), Prada, Ferragamo, Canada Goose have all been dead money for 10 years or more. That is high end luxury has dominated mass market luxury.

My base view of a pro-labour world would mean I would probably favour mass market over high end luxury. China for me should be the most advanced in this, where the government has taken on pro-capital industries like tech and property development. The problem is there is no sign of a pro-labour move in Kweichow Moutai share price, the most valuable drink firm in the world, with a market cap of over USD 300bn.

Moutai is one of the easiest companies to analyse in the world. It sells Chinese liquor Baiju, and increased volume 7 fold in 20 years, while also raising the price 7 fold in 20 years. USD 200 for a bottle of Kweichou Moutai would seem to be a luxury good in China, but demand remains strong.

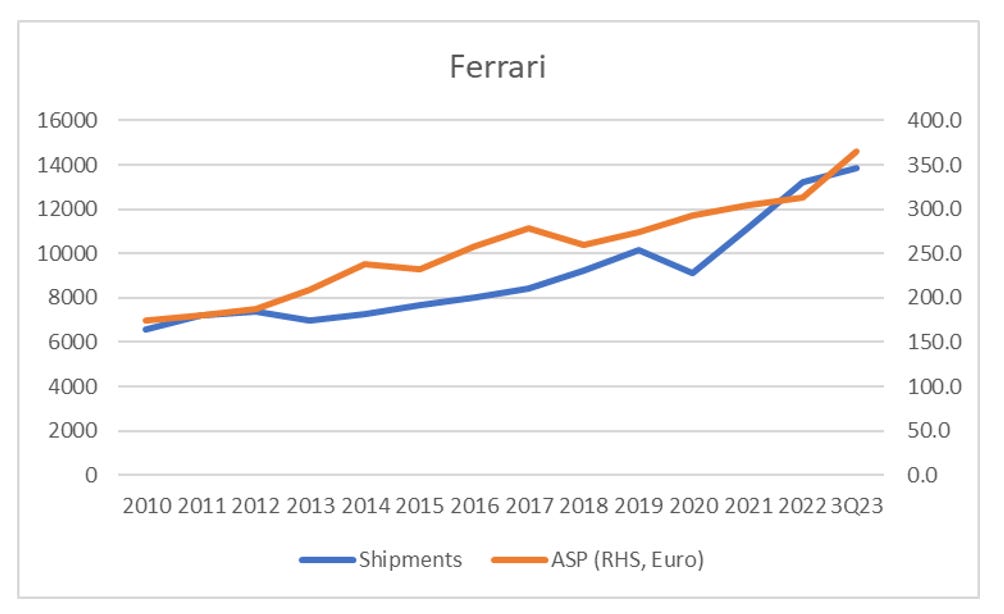

In autos, Ferrari has been the stand out stock, recently touching new all time highs.

Taking reported financial data, and adding some estimates for ASP pre 2016 IPO, we see a similar trend - rising volumes and rising prices. Again, the high end operates in a different market to rest of luxury.

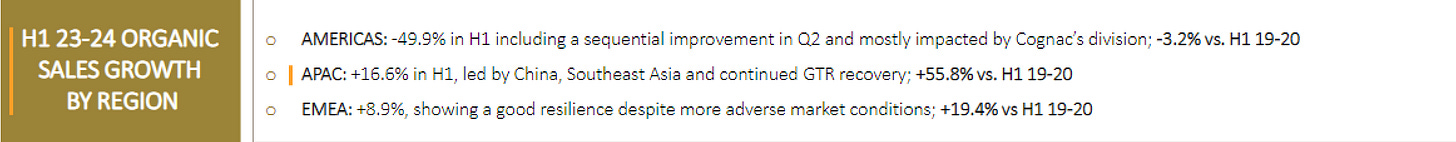

So should I short luxury? Well there seems to be two things we need to look for. One would be high end consumer beginning to trade down. Numbers from LVMH and Remy Cointreau shows a slow down in US consumption, particularly of high end spirits. Where cognac goes, does the rest of luxury follow?

As the numbers from Remy show, it was the Americas that was the problem.

The second thing we would need to see is that owners of high end products begin to sell to raise cash. In discussions with friends I thought this was happening already. My friends has tended to indicate that the top end of the watch, car and wine market has come off the boil, with prices off around 20%. The Liv-ex 100 Benchmark Fine Wine Index would confirm that.

So to answer the question, “should I short luxury?” Well from an industry perspective, the best days were long ago. In the post GFC world we saw a big build out by many brands, Prada, Ferragamo, Coach, Hugo Boss, Kors and the mass market stocks have reflected this build out and the rising competition. At the top end, we have seen pricing and volume do very well, and we have seen LVMH be very successful at consolidating this market, with noticeable acquisitions including, but not limited to Bulgari, Tiffany’s and Christian Dior. Ferrari and Lamborghini has built large premiums over other marques such as Aston Martin and Maserati. For these winner brands, I would suggest shorting when we see consumer’s turn against conspicuous consumption. When would that happen? Well with conflict now in Europe and the Middle East - can we be far from “we are all in it together moment”? Luxury strikes me as good area to short. I will take a closer look at the winner stocks.