The most dangerous place to be long invested is a cartel that is about to get disrupted. Payments, and fintech more broadly, seems a good place to look. Typically, a cartel member will have fantastic financial positions, and will generally be considered as either a “quality” or “compounder” stock. One recurring feature of investors in broken cartels is that they tend to buy all the way down as think they are buying at a discounted price. Payments strikes me as area full of competition and ready for disruption.

As mentioned in my post “Is the US taking on the Credit Card Cartel?” there are changes afoot at the FTC in how they regulate the payment system. What we have also seen in China is the forcible opening up of the Alipay and Wepay payment systems to the detriment of their owners, Alibaba and Tencent.

While Tencent and Alibaba fell for a variety of reason to do with increased government regulation, the fact that they were forced to open their payment ecosystems is very interesting. With the imminent launch of the eRMB, China’s payment system should be fully digital, and fully backed by the state. The cost of transactions in China, which is already low, should fall even further. Looking at Visa financial data, it has been losing competitive position in Asia Pacific market for the last few years.

In the “olden days" (think pre GFC), the combination of weakness in competitors share price and declining competitive position would lead to a derating of a stock. This has not happened with the US payment sector, in fact it has rerated higher. This in particular has been driven by Visa and Mastercard. Like many large cash flow generative US corporates has taken to issuing bonds and buying back shares.

A company like Visa does not need to issue debt, as it has minimal capex. But by having a bond outstanding, it can have a fixed income security to help justify its equity valuation and share buybacks as “value creating”. That is large cap US corporates use the price insensitive bond buying of central banks to help rerate equities higher.

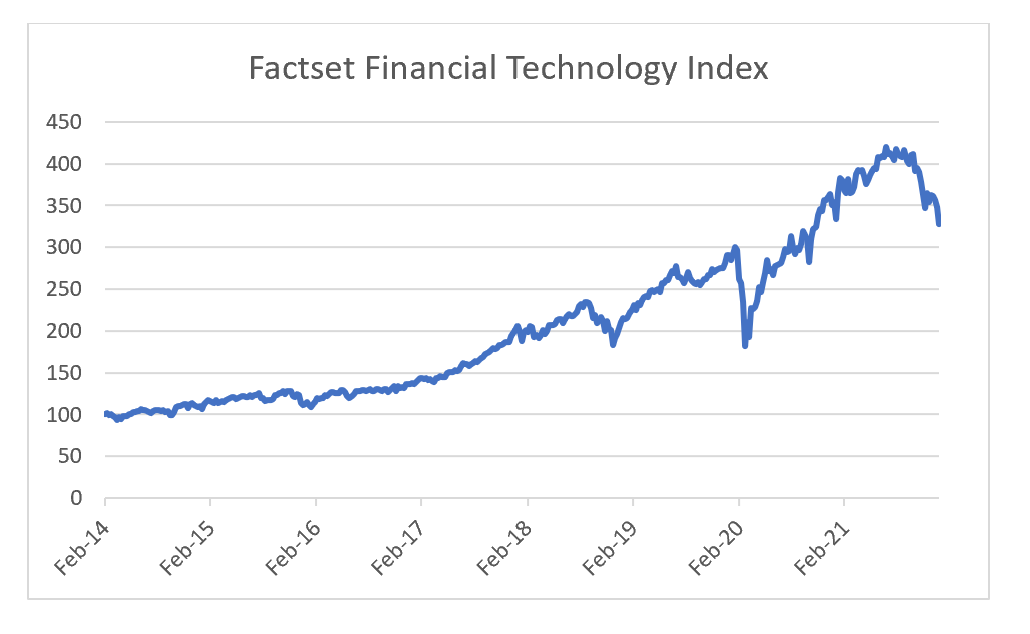

Both Visa and Mastercard trade on close to 20 times EV/sales - but as pointed out above, this is a valuation driven by share buyback and bonds that currently yield 5% below US inflation rates. However the very high valuation of Visa and Mastercard has pulled the entire financial technology sector higher. The Factset Financial Technology Index has been an excellent performer in recent years, but is beginning to face some significant weakness.

Visa and Mastercard make up a significant part of this index, but among many of the smaller names, there has been significant weakness. I find usually small cap weakness precedes large cap problems.

From experience, when a company has three different negative angles that could play out, it is very unlikely to prosper. Payments in the US fit that criteria. Competition from blockchain, rising inflation and bond yields, and increasing regulation from the government. Given the large amount of VC money in fintech, is the above comes true, then I imagine VC are will also be troubled. Payments look a place to avoid or sell.