I had been fairly relaxed about markets. Nothing much looked like it was unwinding, and yet we saw Nikkei VIX touch 70 this week, a level seen during the GFC and Covid. Current levels have tended to be associated with crises of some sort.

The move in VIX is even more surprising to me as leading indicators like Japanese banks and JGBs were pointing to continued wage growth and inflation in my mind. When Japanese banks roll over, then problems are more likely, and they rolled over in 1999, 2006, 2015, and potentially now. That is historically, Japanese banks roll over - AND then VIX spikes.

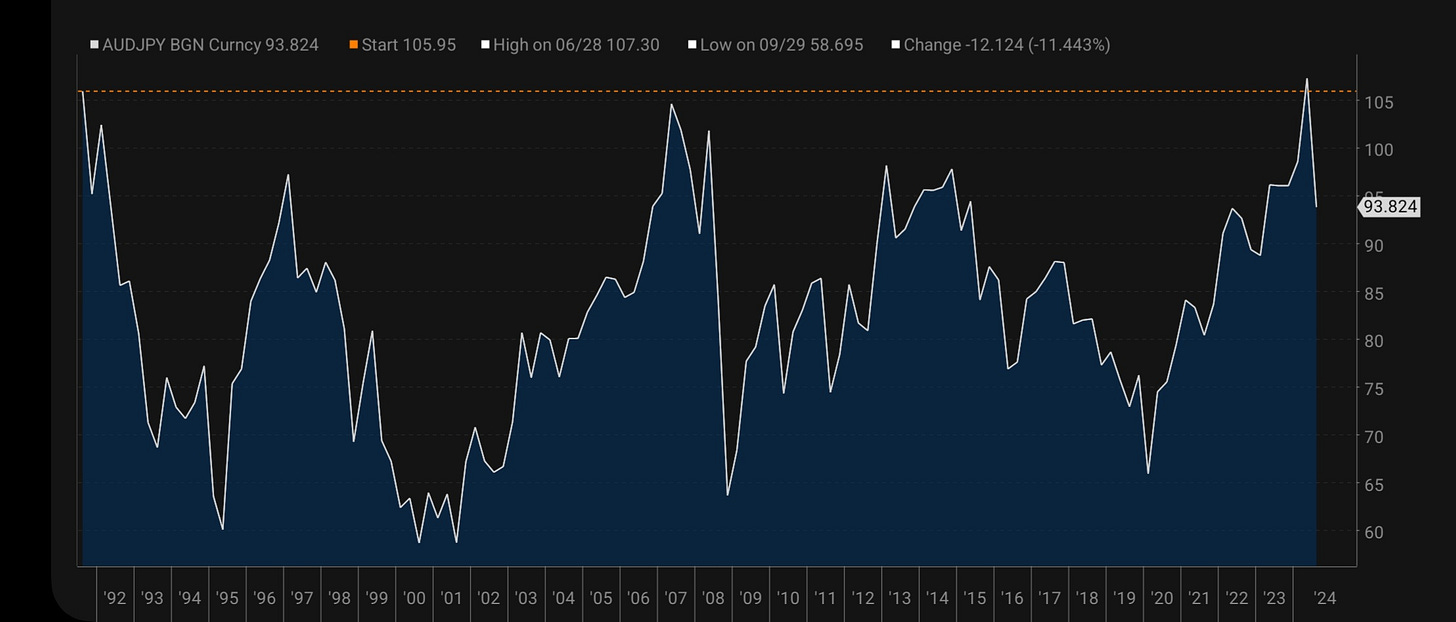

A lot of the spike in volatility has been ascribed to the unwinding of the carry trades. Classic carry trade pair such as AUD/JPY looks to have rolled over. Again historically speaking, carry trades tend to start unwinding BEFORE the spike in VIX.

Looking at JGBS, they also tended to see yields fall BEFORE a spike in volatility, and then see yields collapse as volatility spikes. So the behaviour of markets is very different this time.

So what happened? For me, historically Japanese market has led the US. In bonds, JGBS correctly called the treasury bull market, and the beginning of the treasury bear market in 2020.

This has also been true in equities, with the MSCI Japan in USD leading the S&P 500. Why could this be true? I suspect that as Japan has a strong manufacturing sector, they tend to pick up order slowdowns earlier.

So the big surprise in markets has been the US bond market signalling recession before either the Nikkei or the JGB market, driven largely by the NFP number last week.

The US bond market is the real surprise here. A second Trump presidency promises more Tariffs and more tax cuts - which are bond bearish. My gut feeling is that the JGBs are right here, and treasuries are wrong. So why have markets reacted so violently. I suspect the answer is clearinghouses. They have no forward pricing ability, and price everything backward looking. There is another problem with clearinghouses. Before clearinghouses became the central party to all trades, when there was a big move in markets, you would have winners and losers. So lets say a tail hedge fund was long Nikkei volatility in July and August. They would see a 40 print - say job well done, and cover their position. These days, when volatility spikes, the clearinghouse goes - “oh volatility is higher now - everyone needs to pay more margin” - so winners and losers have to stump up more collateral, starving the market of liquidity, and causing it to fall more. Clearinghouses are volatility creating structures. Despite all these shenanigans, GLD/TLT continues to trade fine.

When I look at US politics, and UK riots, and geopolitical situation, my best guess is that governments will keep spending, and they will be working very hard to maintain rising wages and full employment. I think we are in red pill territory - that is no recession, and more inflation. I will change my mind when JGBs tell me to.