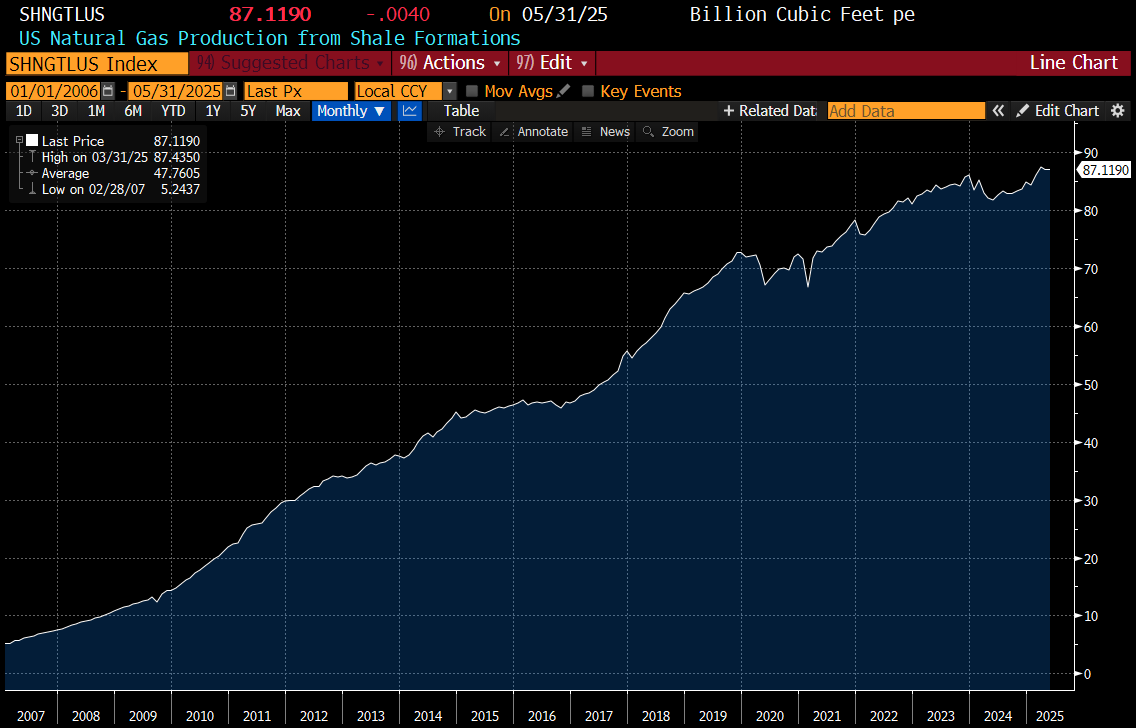

Ever since shale production was commercialised, US natural gas production has surged.

The US produces so much natural gas, that the Permian region can see negative prices for natural gas from time to time. This happens as Permian oil producers also produce natural gas as a by product - so will produce natural gas almost by accident.

Just these two graphs alone make the idea of the US suffering from a natural gas shortage seems crazy. And yet, I see two other graphs that seem to suggest something is up. First of all, Henry Hub natural gas futures are inflecting higher. January 2028 natural gas futures seem to be moving back to a bull trend after a two year consolidation.

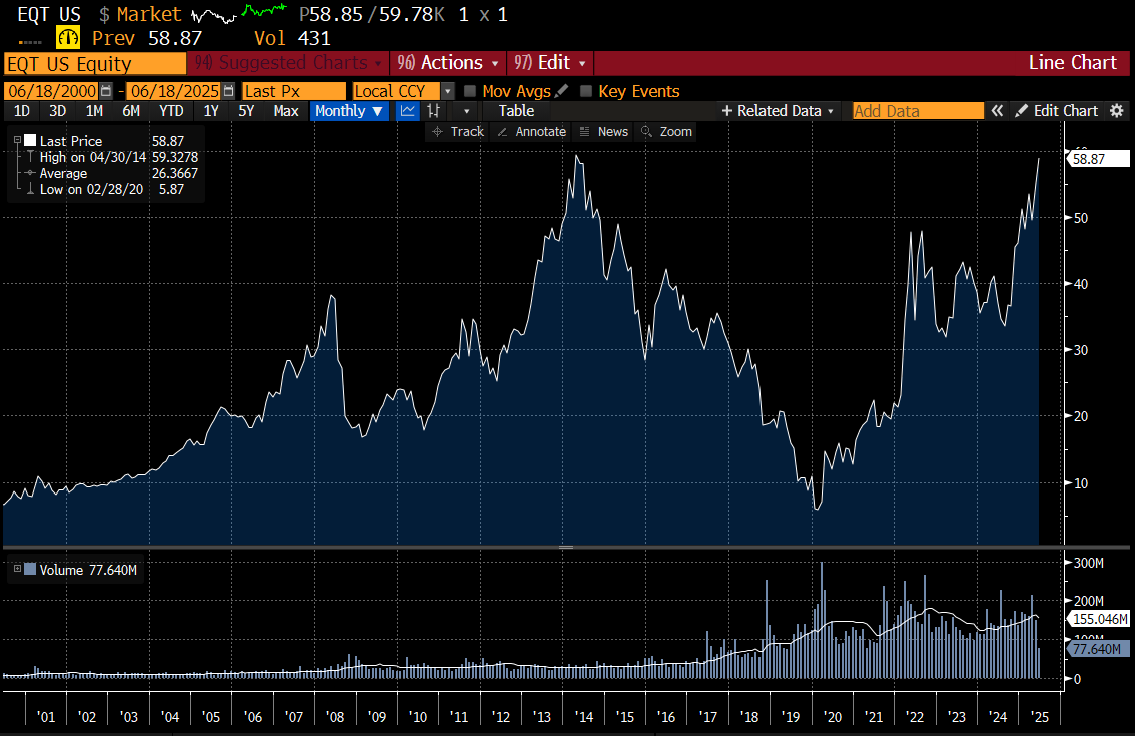

And natural gas pure play - EQT Corp, is nearly at new all time highs.

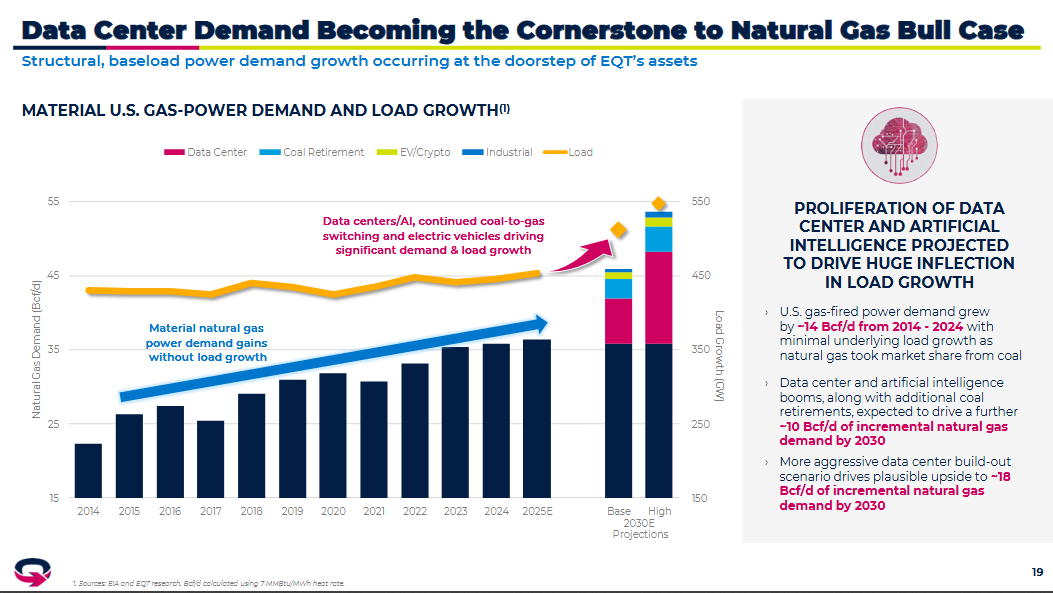

EQT has an arresting presentation - where they are suggesting 25% growth in natural gas demand by 2030.

They also highlight that LNG capacity is going to increase substantially.

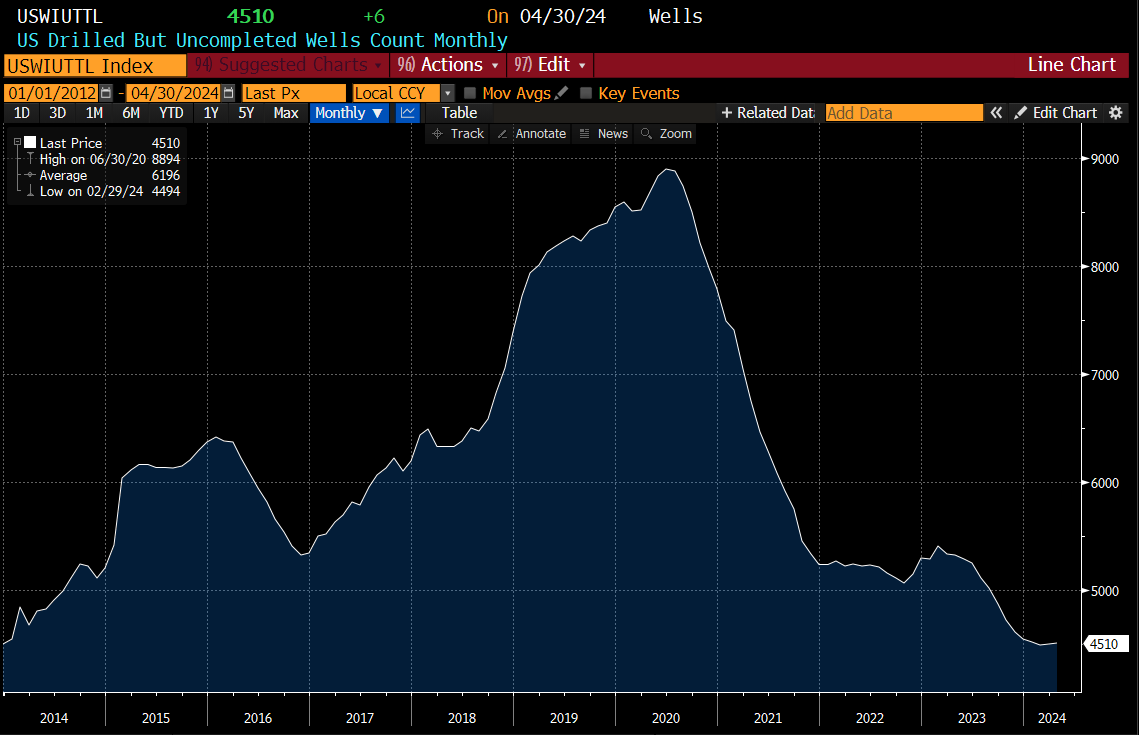

Personally, I am not sure about the data centre demand - I thought the DeepSeek news earlier this year would put a dampener on demand - but with Nvidia back at close to all time highs, we can assume those data centres will get built (whether they will make any money - we will leave aside for the moment). In essence, EQT is saying the US will see demand for natural gas rise by 25 bcf/d - with 10bn rise needed in the Appalachian region where EQT operates, and 15bn in the Permian region, where most of the LNG capacity is being built. The problem is that the inventory of wells that can be used to boost production has fallen dramatically.

The growth in US natural gas production has also slowed.

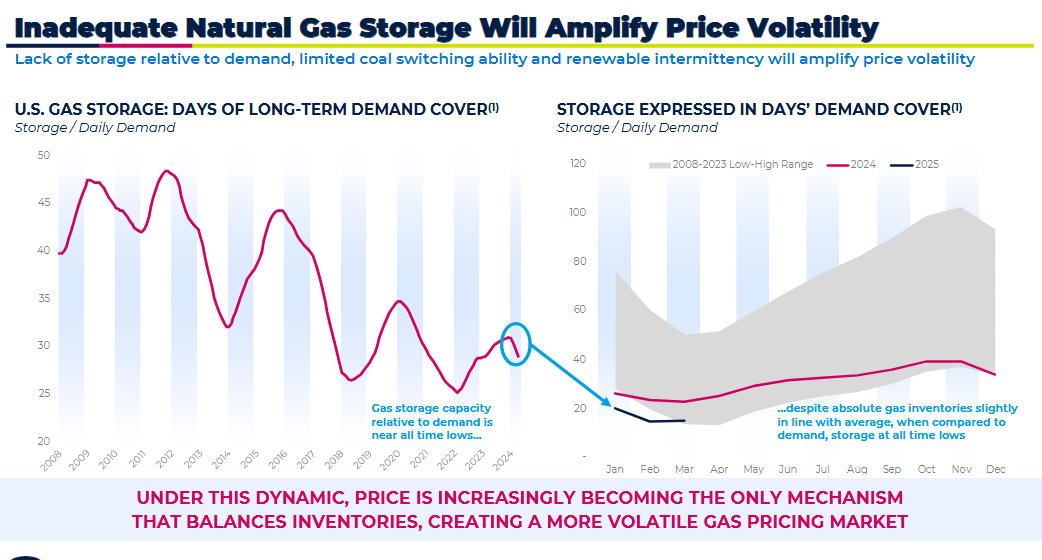

EQT make a couple more interesting points. As natural gas production and demand has increased, there has been no investment into storage. This also has to do with reduced seasonality making storage less profitable.

I think the market is recognising the tightness of the US natural gas market. For old people, I am beginning to get visions of the dot com bust - where surging natural gas prices in California in 2000 led to money being pulled from speculative ventures, and collapsing tech pricing.

Of course this is all just a story - but it is starting to look like a good story to me. And just like in 2000, gold is beginning to inflect against the S&P 500.

The other thing about this story is that I hope it is true. A good bear market would be very good for me - as I love to short sell. This makes me slightly cautious, when people want something to be true, they will convince themselves is true. The one thing that is problematic to this argument would be the rise of renewable energy - but renewable energy really is not suited to data centre usage. I think the best we can say is that it looks likely true, and if it is true, I am positioned to do well.