When I started to add political analysis into my market analysis, I was given some very good advice by someone who shall remain nameless. Politicians are simple - they will do whatever they need to do to be elected. The corollary of this is that in true democratic nations, like the UK, US or Australia, there are never really “populists or extremists” - they are just politicians that are just responding to what voters want. However, I think you can take this analysis one step further, and politicians will do their best to ensure their political success going forward. Thinking about this allows for a deeper and better analysis of markets and politics since World War II, and perhaps give a better method to understand where we are going.

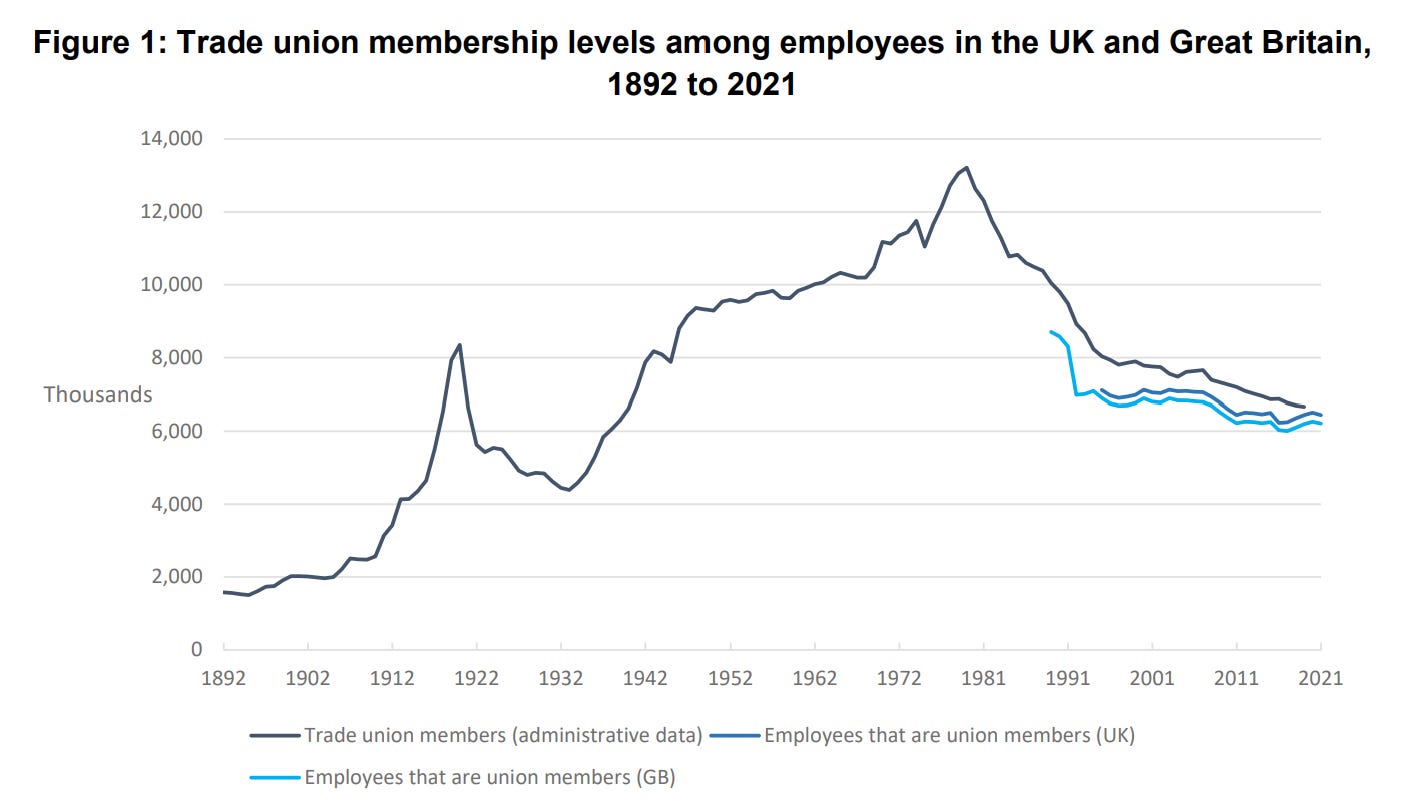

I am going to use the UK as politics here is very clear cut - the party in power tends to have almost unlimited power to enact policies, without the countervailing influence of state government or a supreme court. One of the defining features of the post World War II era was the surge in union membership. The Labour government that came to power after World War II probably noticed that union members tended to voter Labour, so encouraging unions AND the nationalisation of major industries would put an overwhelming number of voters as natural Labour voters.

With the staglfationary 1970s, voters were fed up with these “pro-labour” polices, and opted for Thatchernomics. As can be seen above, a combination of anti-union laws, AND privatisations greatly reduced the number of union members, and natural Labour voters. The Conservatives no doubt noticed that shareholders, homeowners and business people tend to Conservative voters. So many Thatcher era policies where aimed at creating exactly these type of voters. One of the key policies of Thatcher was the transfer of state owned housing to private ownership. The Thatcher government gave the right of tenants in social housing to right to buy the properties they were living in.

Other policies pursued in the Thatcher agenda was the privatisation of key businesses. This served the dual benefit of moving move workers from public to private sector, which reduced the chances of them being unionised, while also encouraging the public to become shareholders, both greatly increasing their chances of voting Conservative in the future. British Telecom was one of the most successful nationalisation, and was directly marketed to the public, greatly increasing participation in the stock market.

Finally, a policy of reducing corporate tax rate to encourage business growth and investment was the final policy. Corporate tax rate in the UK fell form 51% in 1981 to 19% in 2023, but in the most recent budget rose to 25%.

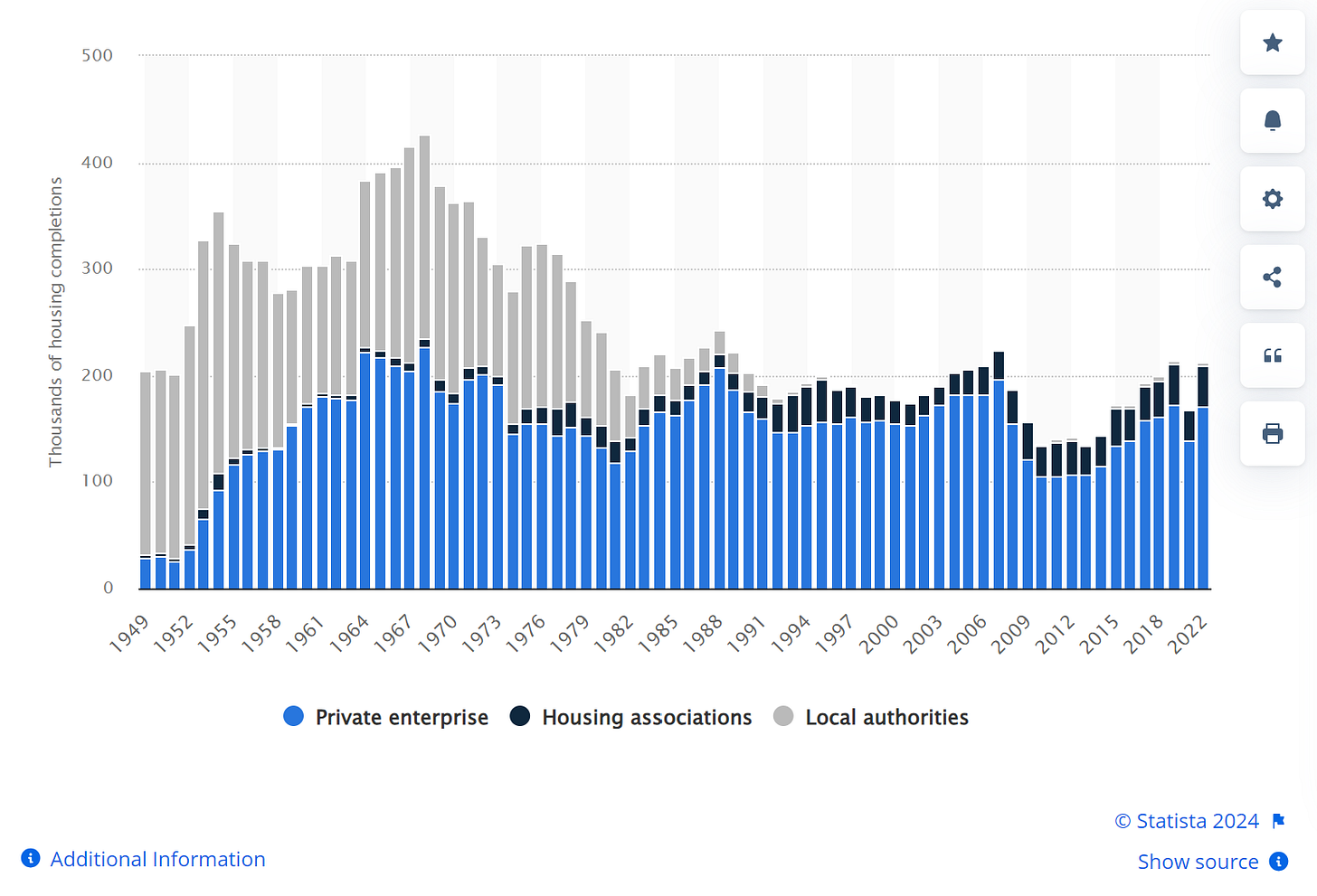

From 1980 to 2007, these policy measures would have been seen as both economically sensible and politically popular. That is they almost worked as a poltical “flywheel”. The more voters liked these policies, the more voters that were likely to like these policies were created. So much so, that Tony Blair, Labours most successful politician, is seen as an heir to Margaret Thatcher by many political commentators. The problem is that many of the core Thatcher policies now alienate more voters rather than create new supporters. Housing is probably the most key one. The housing associations were key builders of homes in the UK. Together with the right to buy, which saw the transfer of homes from the state to private hands, also saw the state reduce its role in building homes. Home completions were around 300,000 homes a year in 1970s, have been running at 200,000 homes a year since the 1980s.

This has led to the obvious problem of house prices in the UK becoming expensive. This is dual aspects of a policy that weaken unions, keeping wages low, and policies that limited supply of housing, both core policies of the Conservatives. Voting intentions of the young to Conservatives are at the lowest levels ever.

While this benefits older voters that own homes, it has completely alienated younger voters.

Finally, privatisation was combined with rising share ownership, and increase competition. This allowed the public to participate and gain in the improved efficiency gains of better private sector management. IPOs and share offerings were a way to bind the public to the ideals of free market capitalism. But in the current world of private equity, venture capital, unicorns and share buybacks, the capitalist system tends to favour the few rather than the many.

The falling allure of right wing economic policies means that there is an increasing focus on cultural issues, rather than economic issues. It explains why Boris Johnson was and remains a far more popular politician than Rishi Sunak. The obvious response to the above trends is to raise taxation on corporates, which has begun. Build more homes, which Labour is proposing, raise wages, which is also happening, and to raise interest rates. Another policy, which would make sense in a Labour policy dominated world would be to raise the birth rate. An aging population tends to be more conservative, so I expect to see numerous policies to promote increasing fertility. The most important one will be to get housing costs down, but I suspect other policies will also be implemented.