I cannot make my mind up between the bear case or the bull case for the world - the blue pill or the red pill. I will lay out both cases, and see which makes sense.

BEAR CASE - BLUE PILL

The bear case is almost analogous with the experience of the GFC. Back then, and urged on by regulators and rating agencies, financial markets considered mortgages to be almost risk free. Investment banks, being profited motivated, realised that rating agencies, and large insurance companies like AIG were completely mispricing these assets, so embarked on arbitrage spree. The problem was that the implicit guarantees, were not actually real guarantees, and when the market realised, the value of businesses like Fannie Mae evaporated.

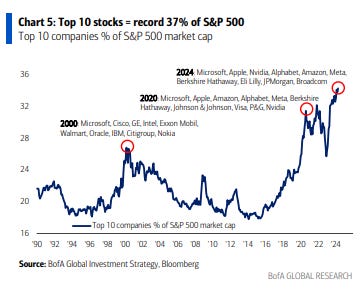

But at the heart of the GFC was regulators setting rules that mispriced assets, and financial markets reacting to that. Fast forward to 2024, and for me, we have a similar set up, where sovereign debt, and Treasuries in particular, are seen as a risk free asset. Deficit spending by the US government, as well as the Federal Reserve committing to buying corporate debt during Covid has made corporate debt similar to treasuries. Corporate spreads are at all time lows. This reflects the government debasing its credit to the benefit of corporates in my view.

The bear case is obvious. The market is mispricing treasury risk, and when this is priced correctly, then a new bear market will begin. When I look a the long term chart of gold versus treasuries, it seems to have begun.

BULL CASE - RED PILL

A new digital age has dawned, that is causing a fundamental change not in how we work, but in the idea of government, and what it can or should do. The large multinational that are driving the bull market work largely outside of a single nation. Their customer base is often bigger than the population of any single nation.

With more and more activity moving digital, GDP is becoming less measurable precisely (how exactly do you account for crypto currencies, or when an influencer in Brazil is watched in Japan via Instagram and generates advertising revenue - where exactly is that activity happening?). Could GDP be grossly undermeasured? Is that why government expenditure to GDP ratios and financial assets to GDP ration looks so stretched?

I can’t make up my mind which is the correct case - but what I do know is that the re-election of Trump makes BOTH cases more likely to be realised in 2025.