The Trump election has radically changed the fortunes of crypto, and bitcoin in particular. The US government is now fully supportive of the crypto project, and the prospect of it being fully integrated into the US financial system is now very high. Memories of the jailing of Sam Bankman-Fried and the collapse of FTX are now very much in the rear view mirror.

One of the more interesting things about bitcoin is that the volume traded of bitcoin (in bitcoin terms) has declined from a peak level in 2017. In the Covid trading boom, bitcoin was trading almost its entire future supply of 21 million coins. On average since then, daily trading volume is closer to 500,000.

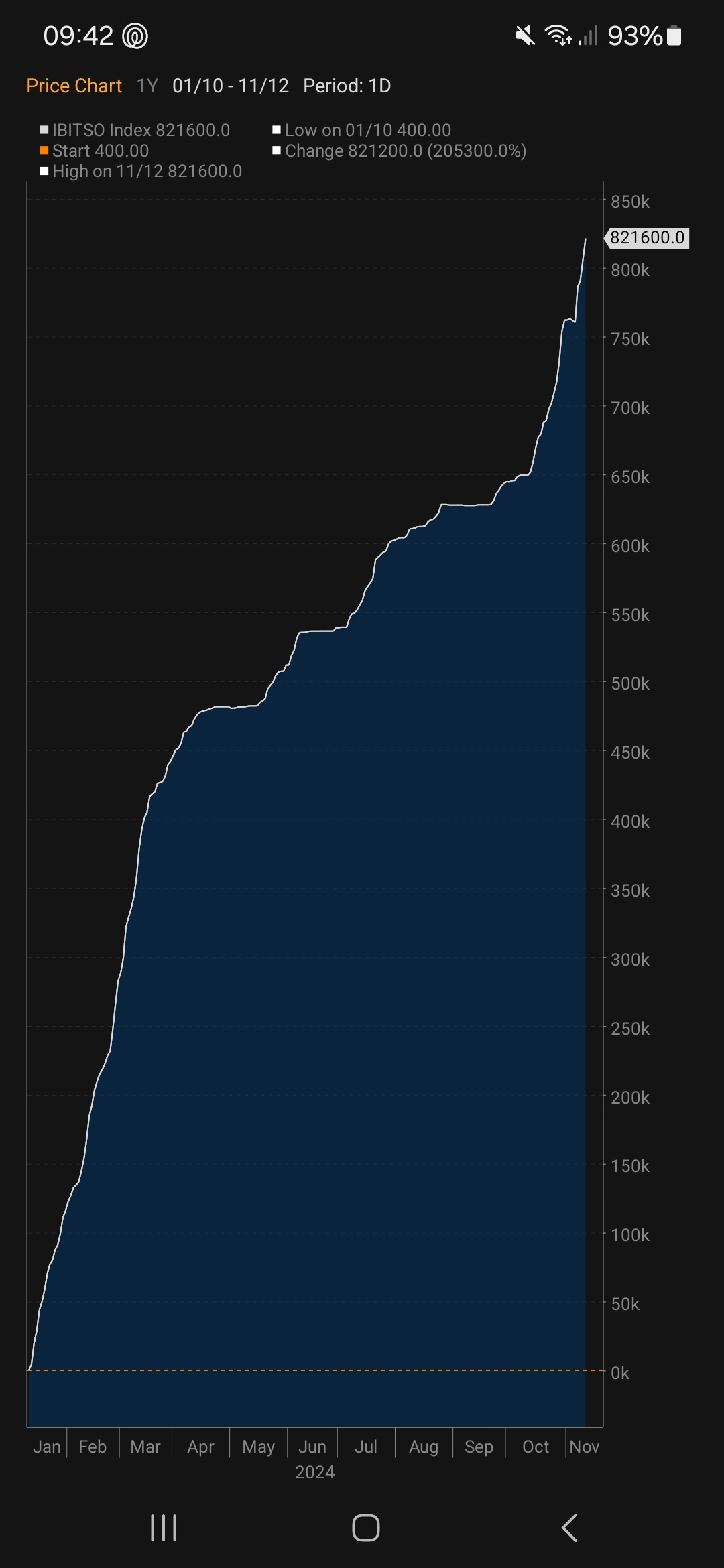

Microstrategy holds 279,420 bitcoin, which at about 0.5 days of trading and slightly more than 1% of total theoretical supply still had a long way to go - but he has signalled his intent to continue to issue debt and equity to keep buying bitcoin. Shares outstanding in bitcoin ETF is surging (IBIT US)

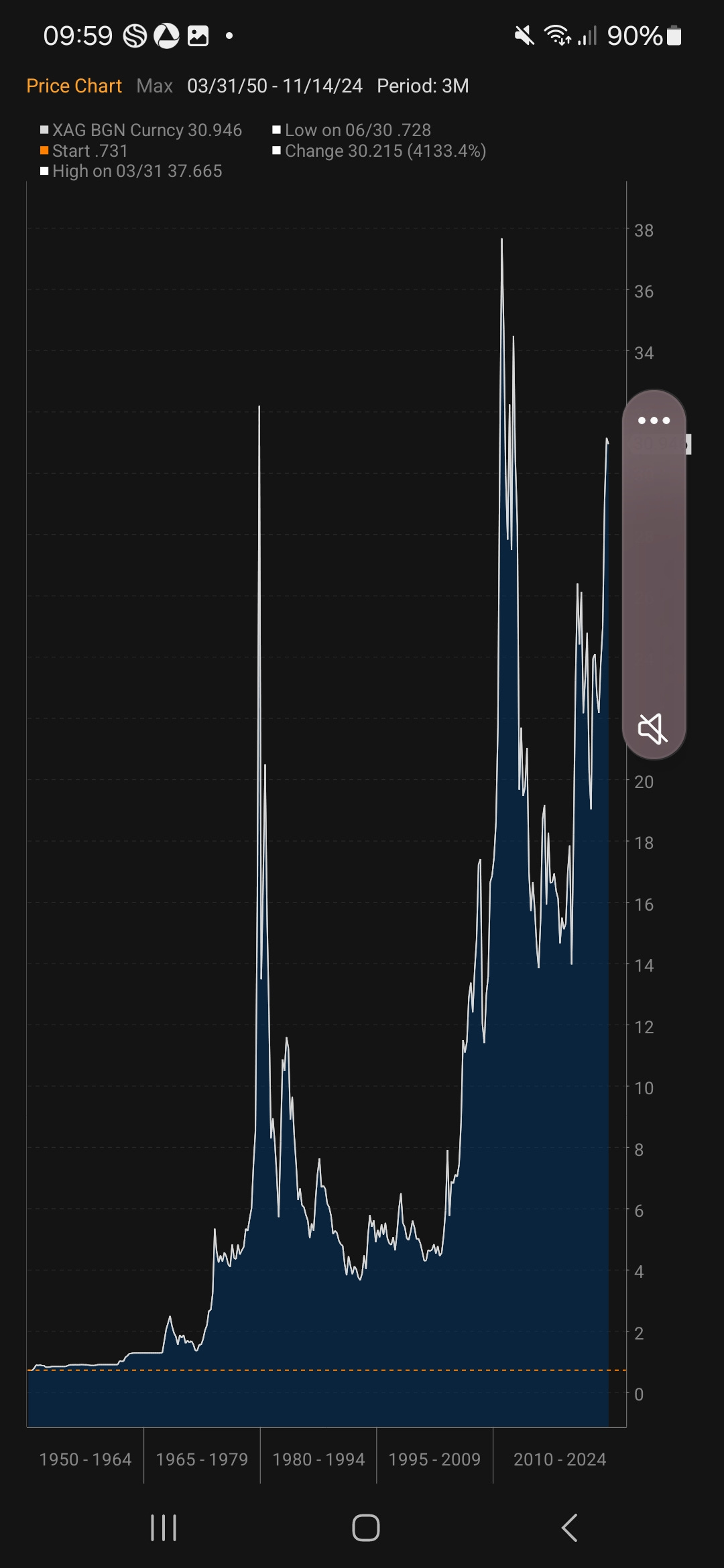

With a market cap of USD 42 in- it holds the same number of bitcoin at Michael Saylor's Microstrategy. As we have seen with gold - ETF ownership does rise and fall, but let's assume Microstrategy and IBIT gives us a read on 2% ownership of outstanding. Satoshi Nakamoto is estimated to hold a bit less than 5% of total supply at 1 million bitcoin (this is subject to debate - like all things crypto). So how much supply would Michael Saylor need to control to cause a squeeze? Well we have have a good precedent. Back in 1979, the Hunt Brothers managed to gain control of 10% of the silver supply (and back them you could consider silver money - like bitcoin). Believe it or not silver is still below the peak price the Hunt squeeze achieved.

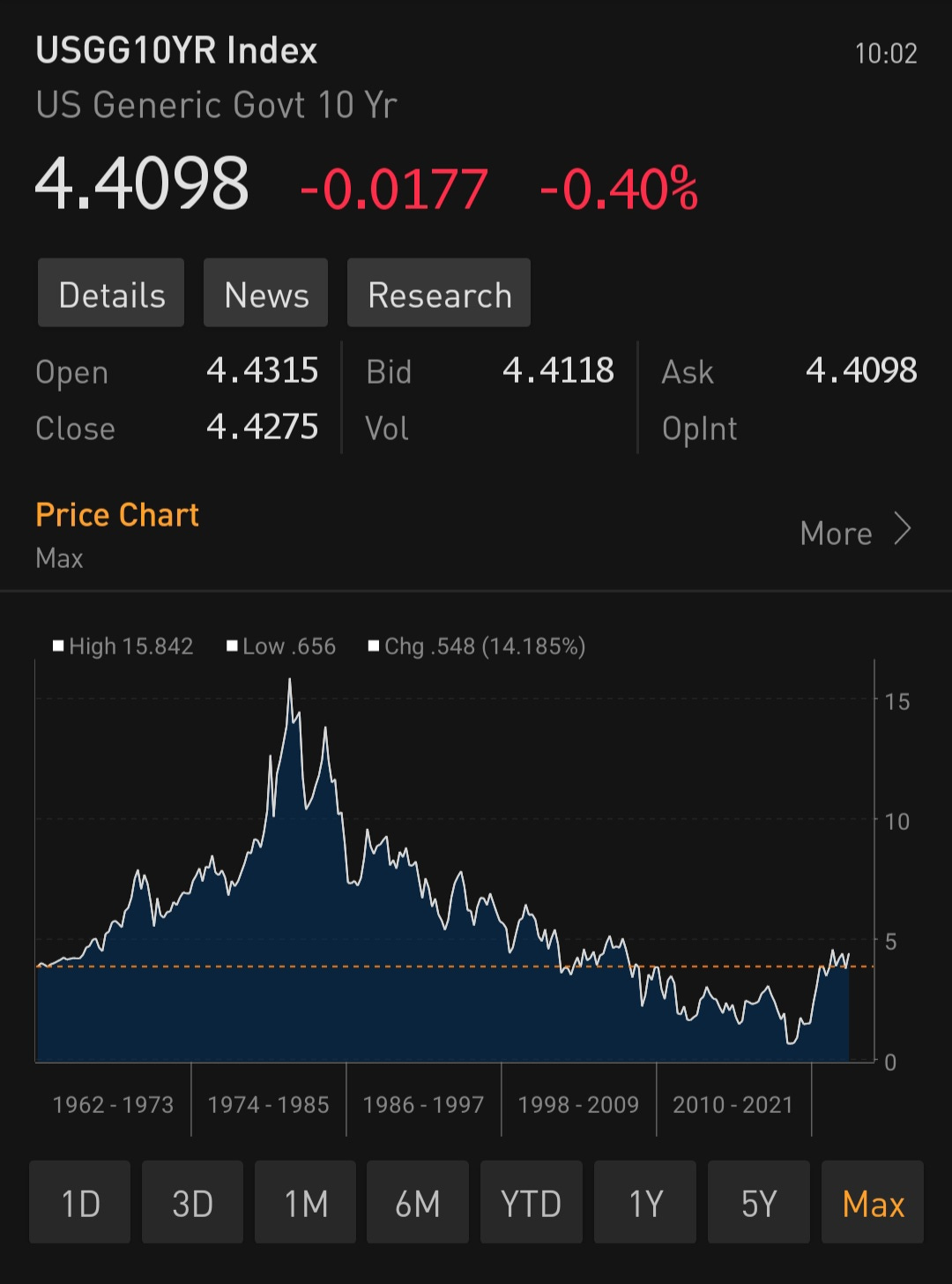

Unlike the Hunt Brother's Saylor seems pretty open and transparent about getting financing to achieve this aim. As can be seen above Hunt Brothers squeeze failed and eventually saddled them with losses. But what was more extraordinary was they were able to raise financing at all. Ten year treasury rates were 15% back then, against 5% today.

One of the questions I always wondered with Bitcoin was whether at some point Satoshi Nakamoto with his 5% supply could come out and dump his Bitcoins. With a value now of USD 90bn - and now what looks like US government endorsement- selling this bitcoin seems unlikely. Like equity owners - Satoshi should be able to borrow against this asset value, if not now soon. There is also a risk that the key to this bitcoin wallet has been lost. Either way with 5% at Satoshi, 1% and rising at Microstrategy and 1% and rising at IBIT - the threshold for a squeeze is rapidly coming into view. This view is enforced by the surge in Tether market cap - implying money is coming to the crypto space.

All very squeezy, squeezy Japanesesy. If participating in a short squeeze is too much for you, unlike others who see bitcoin as an inflation hedge - I see it as source of inflation. Bitcoin squeeze implies higher interest rates to me. My target remains at least 10% bond yields in the US. Don't like crypto? Short bonds.