2024 was an intriguing year. I feel like I was right about things macro, but that macro and markets are not longer connected in the same ways.

2024 Review

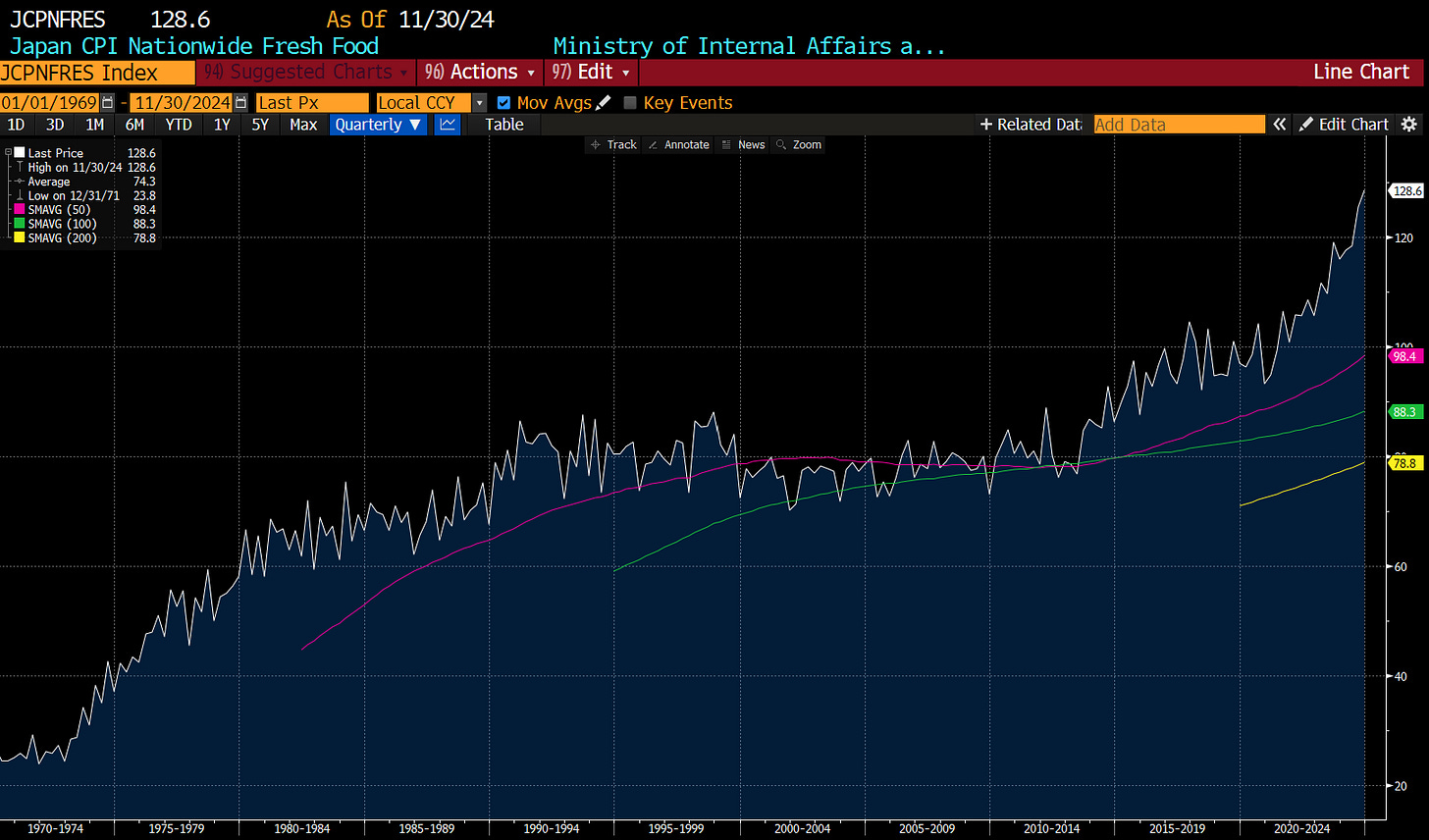

So lets go over the bits that have been right. Broadly, speaking I saw inflation inflecting higher in a “pro-labour” world. When I look at measure of food inflation, they have indeed inflected back to the 1960s and 1970s era. Perhaps the most stunning inflection is in Japan. Decades of flat food prices have been replaced with ever rising food inflation.

On the back of this, I have stayed relentless bearish on bonds - both JGBs and Treasuries. This has been broadly correct. Japanese 10 year at 1% still looks a short to me.

So far so good, but I also assumed that we would see a broad-based break out in commodity prices. While gold has touched new all time highs recently, if we look at the Commodity Research Bureau Raw Industrial Index, it has had a lacklustre time, and remains at levels first seen in 2010.

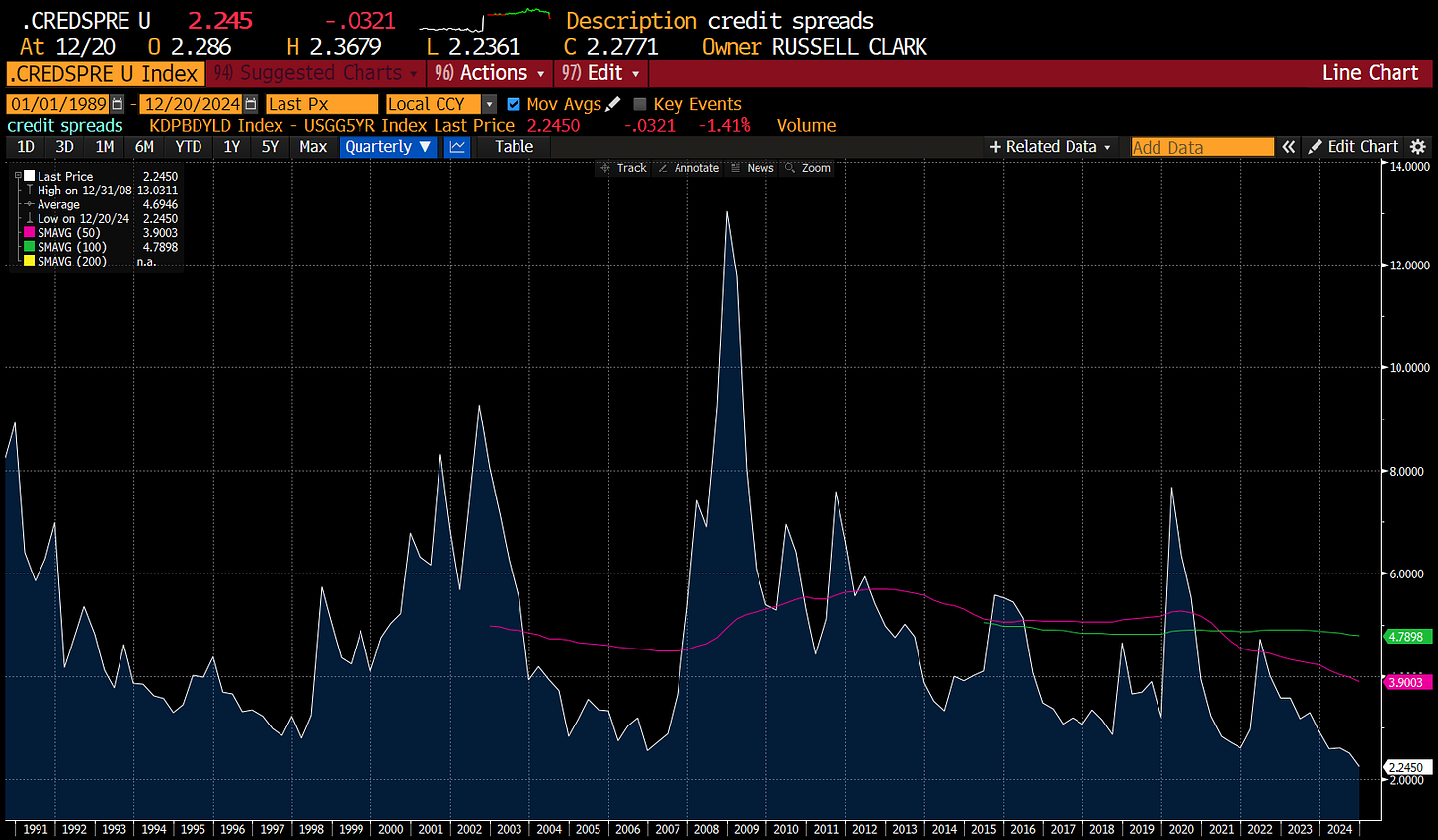

I had assumed the move higher in food inflation, and higher yields would cap asset prices - at least in nominal terms. In some ways that has worked. If you look at anything that is “old technology” it has struggled this year. It has actually been a year where shorting could have made you money. A mixture of oil and gas names, and ICE auto names would have worked reasonably well, but I won’t lie, it would have been a struggle. My pro-labour view would have assumed some widening in credit spreads - instead we see all time lows. Assets markets have been much stronger than expected.

I had also assumed a focus on full employment and rising wages, combined with advances in artificial reproductive technology (ART) and a bi-partisan pro-natal move globally would lead to a change in fertility and birth rates. In UK and Australian data, we have definitely seen more women freeze eggs. But in the most relaxed regime for ART - Denmark - new births have fallen back to lows. This is an area to be re-examined.

2025 Target Areas

Below are the areas I am going to focus on. If you think they are interesting, become a paid subscriber, so I know to spend more time on them.

Tech and Quantum Computing

One thing that has become clear is that tech and trade flows are what drives macro, not the other way around. Focusing on US domination of not only cloud computing, but also electric vehicles would have been a better lead on the relative weakness of oil, as well as the Euro and the Yen. With that lesson in mind, I think the recently announced breakthrough by Google in quantum computing could have huge effects.

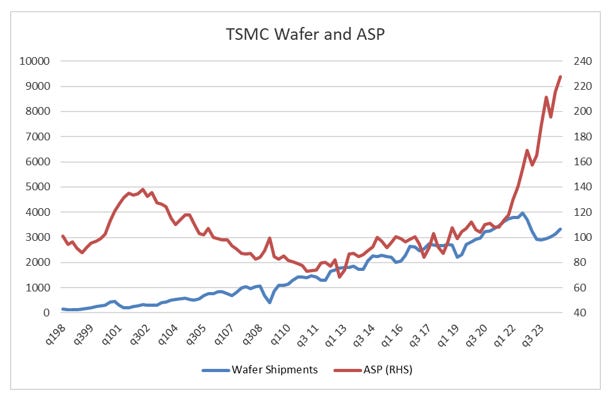

One thing I had gotten wrong about markets was that surging pricing in the tech space would lead to move entrants - and then falling prices. This is a typical capitalist system. When I track TSMC quarterly pricing, I had assumed investment by other semiconductor producers would also pricing to inflect lower at some point. At the moment, there is no indication of that.

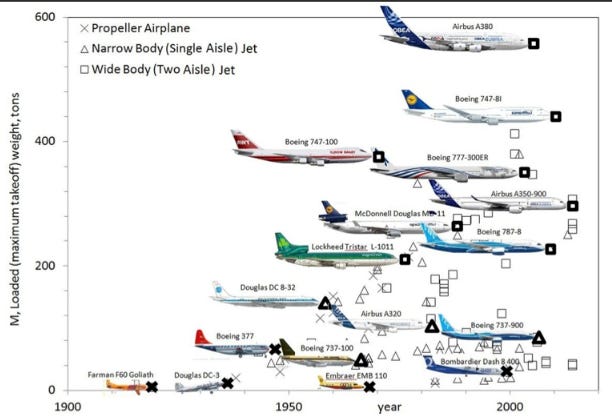

The pricing of semiconductors has been a huge driver in the performance not only of TSMC, but also Broadcom and Nvidia. All have been great stocks. But if you believe in capitalism, then this surge in pricing should drive either new entrants, or new technology. New entrants, particularly in China, have been kneecapped. But I wonder if Google and a new technology with quantum computing changes that? I am always reminded how propeller driven flight was the dominant engine type, driving larger and more complicated designs, until near the end of World War II, the jet engine was perfected, and within a few short years, the jet engine was everywhere. Quantum computing potentially offers such a shift.

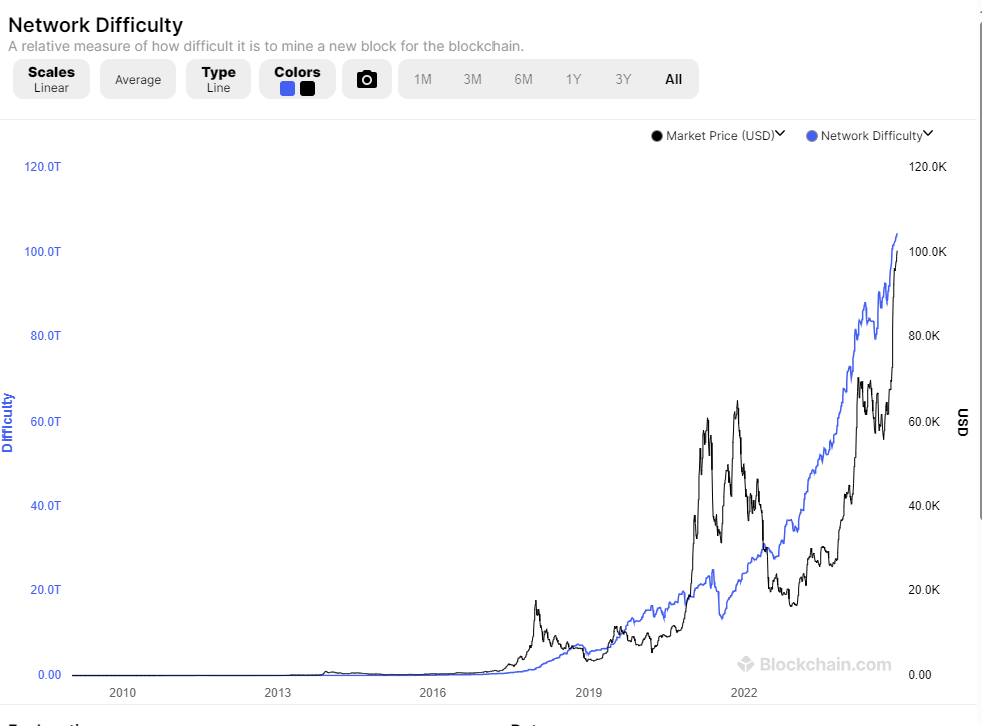

One interesting area is where break through in quantum computing destroys bitcoin. If mining bitcoin with quantum computers becomes much easier, does this take away cost support for bitcoin? And does this matter anymore? Another area for more work.

Fertility

There are some uncomfortable aspects to the failure of fertility rates to show an upward shift. Firstly, we have to consider that perhaps that urbanisation naturally reduces fertility rates - mainly just how difficult it is to afford having a family in a city. And the baby boom of the post World War II period was just a catch up period to repopulated war torn regions.

Secondly, it has been suggested to me that male testosterone levels are falling globally, through lifestyle and other choices. Is this possible? I know in Japan there has been a recent phenomenon where boys have stopped being taller. After a long period where average height in Japan for students rose almost every year, there have been signs of this stagnating. I have to admit, I find this all circumstantial, but maybe modern life is not creating enough men who want to become fathers? Certainly the rise of “incel” culture points to a problem of some sort. Anyway, I plan to continue my work on fertility.

Is China Smart Or Stupid?

I can’t work this out to be honest. In contrast to the US, China has regulated its tech sector relentlessly. This has led to falling prices and intense competition. Alibaba, which used to be one of the must own stocks, along with the Fang stocks, has languished for years now. At USD200bn market capitalisation, it hugely trails US mega tech.

Is this a smart play by the Chinese? To reduce income inequality, and improve Chinese competitiveness? The US focus on America first has certainly been good for the stock market - but Chinese focus on free trade has seen it come to dominate trade with countries in Asean.

Is China just allowing an image of stagnation to be projected as its gain more power and market share? Or has the move away from capitalism, and more state control really dulled the entrepreneurial spirit, that China is headed for a crisis of some sort? While Chinese trade data is good, Chinese bond yields are pointing to crisis. Working out whether China is failing or not makes a huge difference to all assets.

Do We Need Government?

Part market, part philosophical question - but does society need government anymore? Big government grew with the needs of the industrial world and industrialisation of war. But as even Eric Hobsbawm in the 1990s recognised, modern corporations can now do many of the functions that governments were originally charged with - postal service, healthcare, utilities, road building, space exploration for example. On top of that, it is likely that the databases of big tech have more data on citizens than governments do. Crypto currencies could take over the issue of currency. Are we moving from nation state democracies to corporate led techno anarchic states?

The gap between Chinese tech valuations, and US tech valuations would seemingly imply that US has already embraced the corporate led nation state. And we have the example of the East India Company to draw from, and the current Trump re-election and cabinet definitely echoes in some respects.

The Implications Of Drone Warfare

Recently the war in Ukraine has relied on drones to attack and harry the enemy. Due to signal jamming, it has already embraced AI in drones to target and attack. What does this mean for modern warfare? Could China launch a 100,000 drones to effective shutdown Taiwan, or harry it into submission? What if any countermeasures exist? Does the computing power needed mean that big tech are already a military force?

Conclusion

Macro based investing worked in one shape of form for 50 to 60 years. But the last few has been not so good. My view is that we were in a long period of stagnating technology, where market share and profitability was determined by relative costs. But in a new era of rapid technological change, and geo-political confrontation, technological prowess is the major determinant of returns. Its an area of focus, be it ART or Quantum Computing. If that is interesting, then please become a subscriber, if you are not already.