Early October saw a big spike in GLD/TLT which moved it a long way from its moving averages. Over the last week or so, it has come back to a degree, mainly through a rally in TLT.

Just looking at TLT US, a technical minded trader may see TLT rallying back to it 200 moving day average (MDA), which would be around 99. That would another 13% from here and 20% from its low.

What are the bond bulls looking at? Well the rally in TLT is easy to understand. The 2 year treasury yield is indicating that the Federal Reserve is done with raising rates. This makes investors nervous that interest rates are going to fall, and keen to “lock” in the higher yields of 30 year treasury.

I also suspect the bond bulls are looking at lead indicators like the Senior Loan office Survey showing the percentage of loan officers tightening credit standards at levels typical of a recession.

It is interesting for me to see that the professional forecasters for the first time in 20 years think bond yields are too high. They seem to have learnt the lesson of the GFC and its aftermath too late! This is taken from an Apollo presentation, but you can find similar charts at most investment banks. What this says to me, is that economist and forecasters completely missed the bond bull market, and now that rates are higher, they are not going to miss it again. Its this type of mentality shift that tends to lead to sustained bear markets.

I have little faith in Wall Street’s view of bond yields. But I do have faith in the Japanese bond market. The 30 year JGB has been right on inflation and yields for over 30 years (note that until recently, Wall Street was also always bearish on JGBs - so much so that being short JGBs was called the “widowmaker” trade.) JGB market sold off before the treasury market in 2020, and so has good forecasting pedigree. They don’t see a recession coming. What are they looking at?

So what do the Japanese see that Wall Street doesn’t? Well two things I suspect. First neither Biden or Trump have much plans to cut US federal government spending. Federal Government net outlays remain elevated.

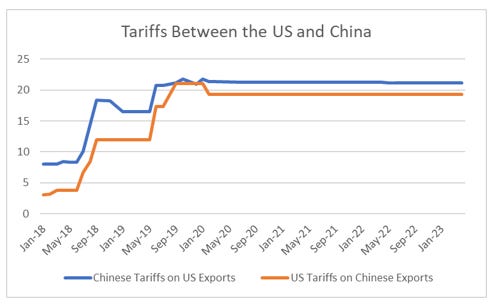

And that we are transitioning from a low tariff to a high tariff world.

More and more of the foreign holdings of treasuries are flowing from official holders (read central banks) to private sector holders. To me this implies that pricing should become more important. Central banks are price insensitive. Private sector is price sensitive.

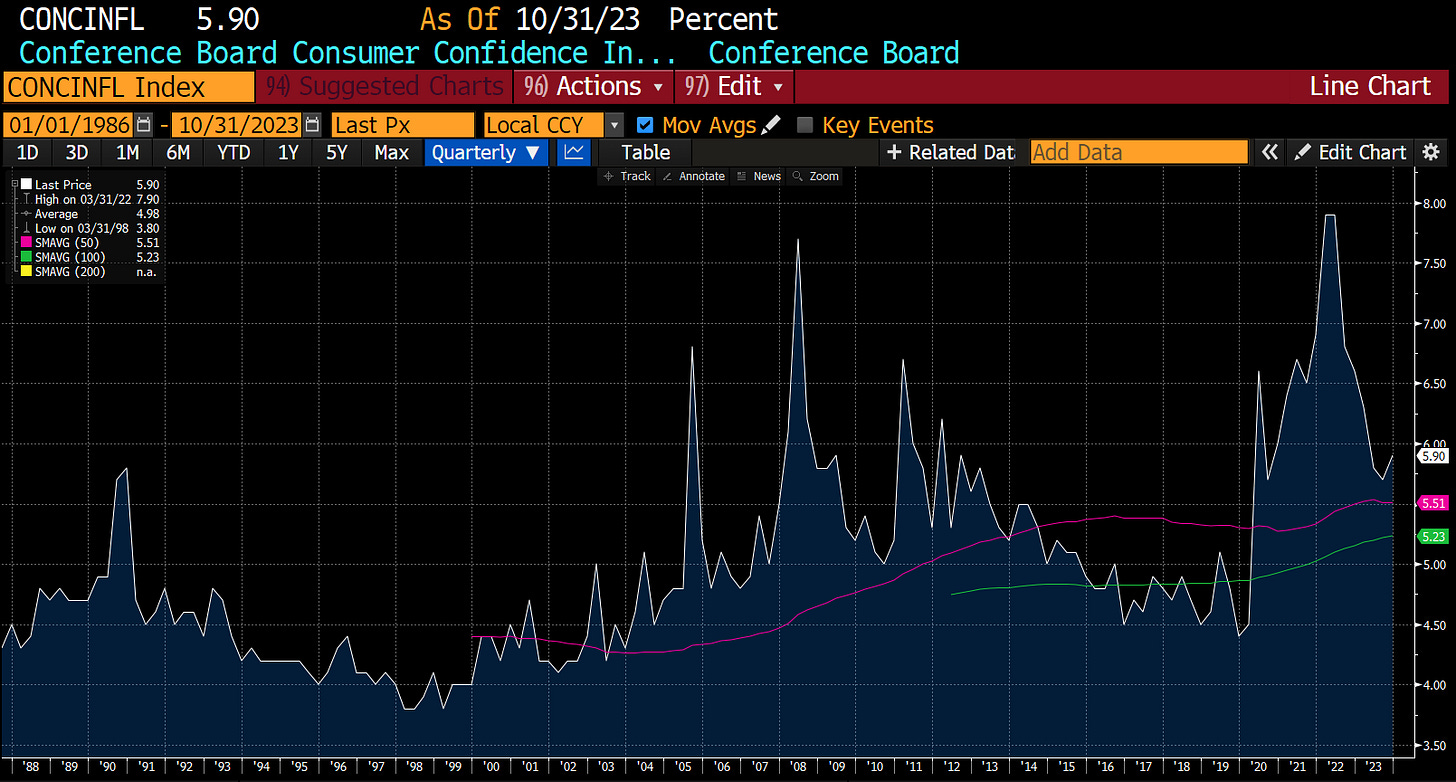

While market forecasters see low inflation or even deflation, the Conference Board is still reporting consumer inflation expectations are very elevated. I have a feeling the consumer has a better feel for this than the economists.

Despite this, flows to GLD and TLT show that market participants are betting on deflation.

For me, with the dividend yield on TLT still well below Fed Funds Rate, short TLT still makes sense to me.

I understand the bond bulls arguments from a macro perspective. But politically what I see is that wage inflation is a political imperative, so the only way to control overall inflation is reducing credit flow. This is the exact opposite of how things have been runs for the last 40 years or so, where wage growth was kept in check, so credit flow was imperative. Investors should expect to see credit indicators flash recession, as this is necessary to get real wages to rise.