One thing I struggle with is the market’s view of Chinese policy. The almost universal view of the world is that the Chinese communist party is exerting more and more influence over the economy, and that this makes China almost uninvestible. If you believe that China is turning communist, then it’s only a matter of time before the landlords are rounded up and shot, and the Chinese army starts invading its neighbours to spread the communist gospel. This is where the logic of current thinking in the West on China naturally leads. This seems wrong to me.

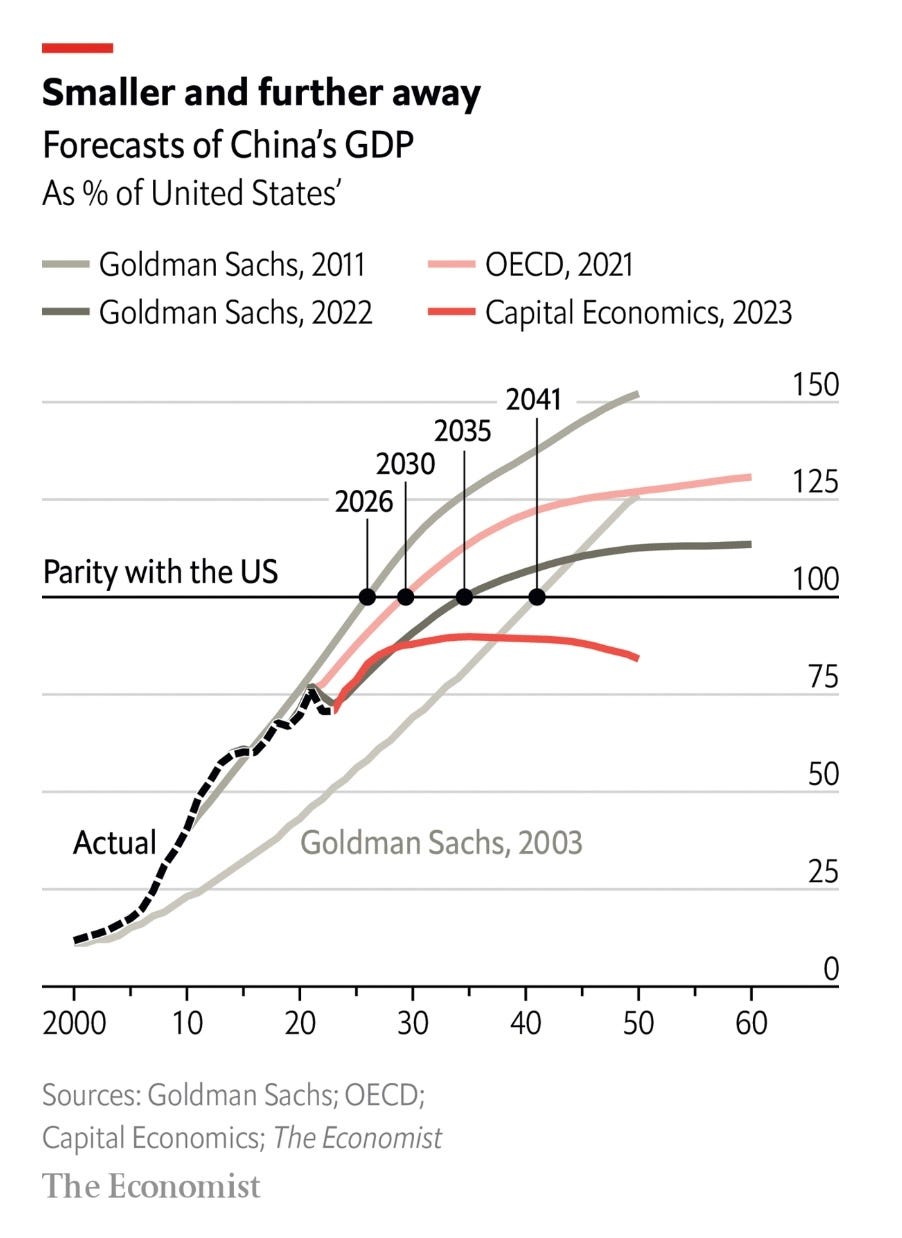

What seems far more likely is that the China and US disagree over who should have the largest economy in the world. The US has been the number one economy for over a century, and politically and culturally is very much of the belief that this should continue. China, as far as it has a policy, targets China becoming a middle income nation. The issue is of course, with a population four times larger than the US, means that the US needs to ensure that the average Chinese person remains only one quarter wealthy as the average American. 2011 was when fears of China overtaking the US probably peaked. As the Economist shows, Goldman Sachs thought China would overtake the US in 2026 in 2011. This has been pushed back to 2035 by Goldmans, while Capital Economics predicts this will never happen. I think China is accepting short term econmic pain to help conjure a non-US dollar financial system into existance.

The issue is that like Japan in 1980s, even if China suddenly became democratic, it is hard to see how Americans could ever accept China having a larger economy. If you look at US-Japanese relations in the 1980s it was all about how to restrain Japanese economic might, even with Japan being democratic and staunch US ally. Given the history of China relations with the West, relative economic decline is not political acceptable in China. This leaves China with only one option, to replace the US financial system with it own system. Strangely, China seems to me to be making enormous progress in this aim.

First of all, with Russia’s invasion of Ukraine, the West looked to isolate and destroy the Russian economy. This policy has signally failed, with Russian exports of energy to the rest of the world remaining stable. This trade is largely conducted outside of the US dollar financial system, not only for energy products, but for the shipping of these assets too. Russia exports 10% of total oil exports, all of which now needs to be outside of the US financial system. The recipients of this oil, must also have the financial system in place to handle this trade, meaning that the non-US dollar financial infrastructure is now in place in major nations such as India, China and Brazil to name a few.

Secondly, to reduce Chinese influence in the global economy, you would need to see Chinese imports shrinking. Despite nearly 7 years of tariffs and other political pressures on China, including a collapsing property market, Chinese imports still remain well above 2016 lows.

I also like the GLD/TLT trade as natural consequence of setting up an alternative financial system to the US should see natural flows away from treasuries to gold or alternative reserve assets. It continues to perform well.

I think the swing factor for a future financial system is India. With the largest population in the world, it faces the same long term issues with the US as China. Does India wish to retain strategic autonomy to grow as it wishes? If so, then its national interest more closely align with China, and the building of an alternative financial system to the current US centric system. It has been a keen buyer of Russian energy, so by extension is supporting this proto financial system.

The US also does itself no favours by showing no political will or ability to control fiscal deficits. Why are you buying treasuries when the US government shows no ability to collect the revenues to service it?

A study of history finds that the establishment (read the West) always underestimates the ability of contenders. The American Revolutionary Army, Napoleon, the Red Army, the PLA were all seen as unsophisticated weak contenders until they were not. And almost all were driven by the conviction they were fighting an unfair system. To me, the US takes its financial position for granted. Without some change, this proto alternative financial system will keep growing until at some point change will be forced on the US. Given the entrenched interest in the US corporate sector to avoid taxation, and the support this has in the Republican Party, crisis seem inevitable to me.