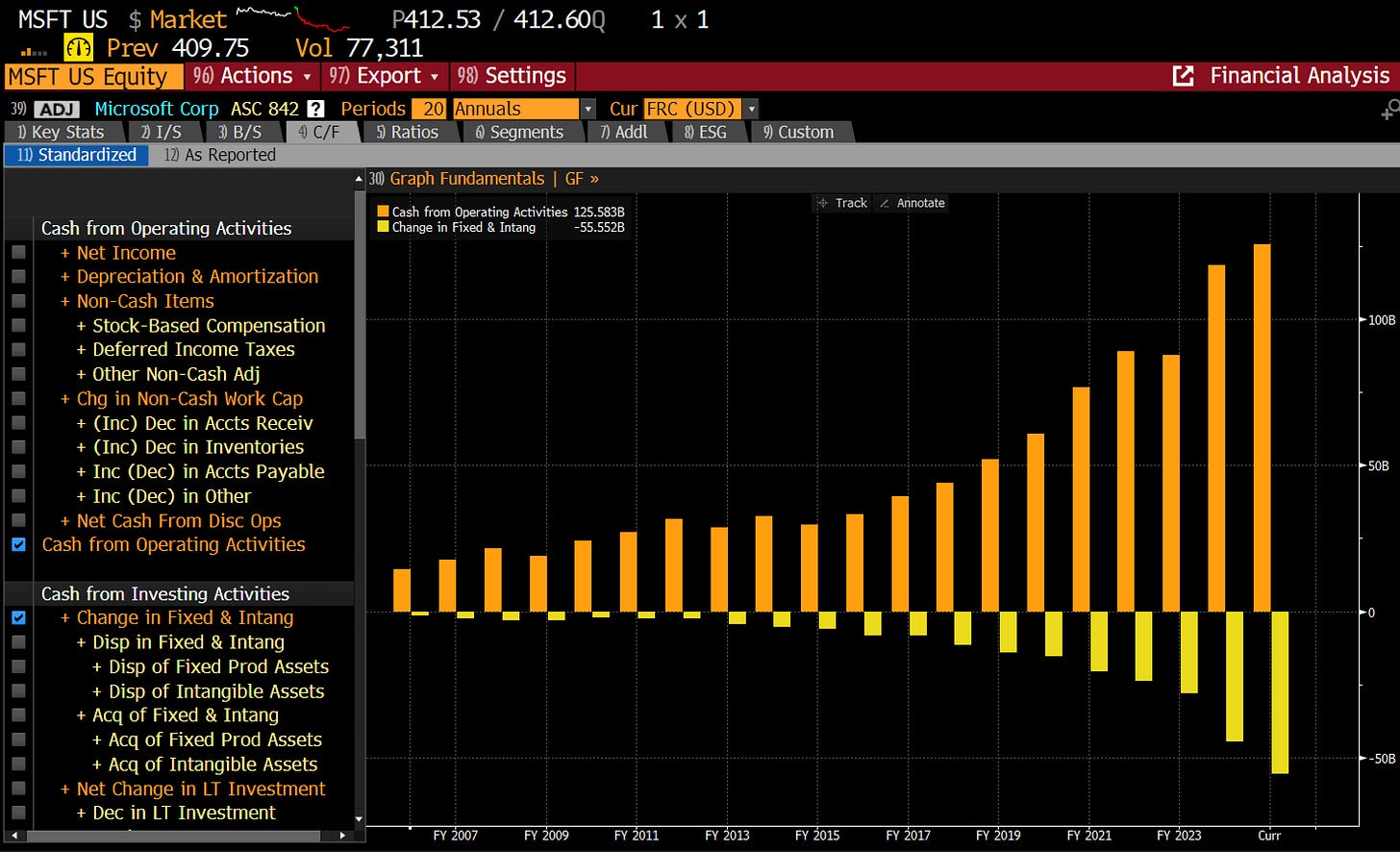

The US tech sector - particularly the mega caps - are the only sector in the world you “HAVE” to have a view on. When I look at US tech, I see the following (please feel free to abuse me in the comments). Most of the tech space is exactly as you would imagine it to be - volatile and competitive. However big tech - Microsoft, Meta, Google, Apple and Amazon have managed to carve out profitable areas (I will come to Nvidia later). Microsoft has managed to become the “go to” corporate software name. A huge installed base, and large switching costs, allows it to generate significant cash flow. The shift to cloud has helped to reduce sales on original software, and expansion into other areas. While growth is good, it has had to invest to grow.

Google has a dominant position in search. This has allowed it to generate huge growth in cashflow with far less capex than Microsoft until recently.

Meta another advertising giant has been able to growth cashflow with little resort to Capex.

Apple barely bothers with Capex at all.

And then there is Amazon, who basically spends everything its makes to grow.

Each has a monopoly in various area - Google in search, Meta in social media, Apple in handsets, Microsoft in corporate software, and Amazon in online retail. By far the best business is search (social media is good too - but as Tiktok shows, can be either disrupted, or banned). Its such a good market, Google paid Apple USD 20bn a year just not to launch their own search engine. The arrival of AI - Open AI and now DeepSeek - has thrown open the search market. Rather than just asking Google - asking your selected AI program is the default. For Google this is an existential threat, and hence Google is investing USD 75bn. Microsoft, Meta and Amazon are not far behind leading to a USD265bn capex in total on AI. For me, the amount of spending is not just to defend existing market positions, but also to discourage start ups from entering the space entirely. If you set AI bar at USD 50bn to compete - then most of your competition disappears. One way to do that is to bid up the value of Nvidia GPUs - and Nvidia has surged due to this tactic.

In simple terms, Google is trying to defend its position in search, and everyone is else is trying to get in. With limited number of Nvidia chips available, this makes perfect sense. This is why DeepSeek is such a problem - as it seems to imply this tactic is broken. That a competitive AI model can be built much more cheaply, and without cutting edge chips. The question is whether the big tech companies decide that spending on AI makes sense or not. Assuming AI will be a advertising led model (DeepSeek makes that more likely), we can estimate profitability. We can see at how much Meta makes per subscriber. In the most recent quarter than was USD 14.25 on its 3.35bn subscribers or about USD 50 per sub a year.

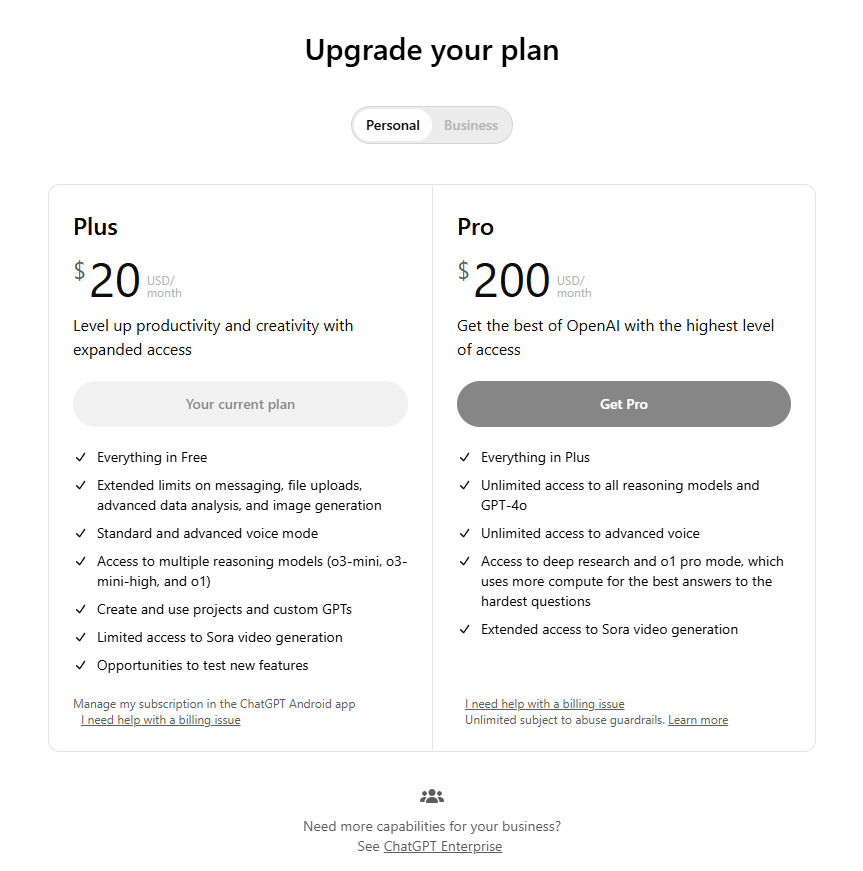

With USD 265bn Capex from the big 4, and lets assume that they get USD 50 per sub - would mean 5.3bn users (i.e the whole internet connected world) just to get the capex back in sales - and that is ignoring running costs - which are substantial. ChatGPT obviously thinks it can charge directly - it wants USD 20 a month from average punters, and USD 200 a month from corporates. A month ago, I was prepared to pay this - no longer.

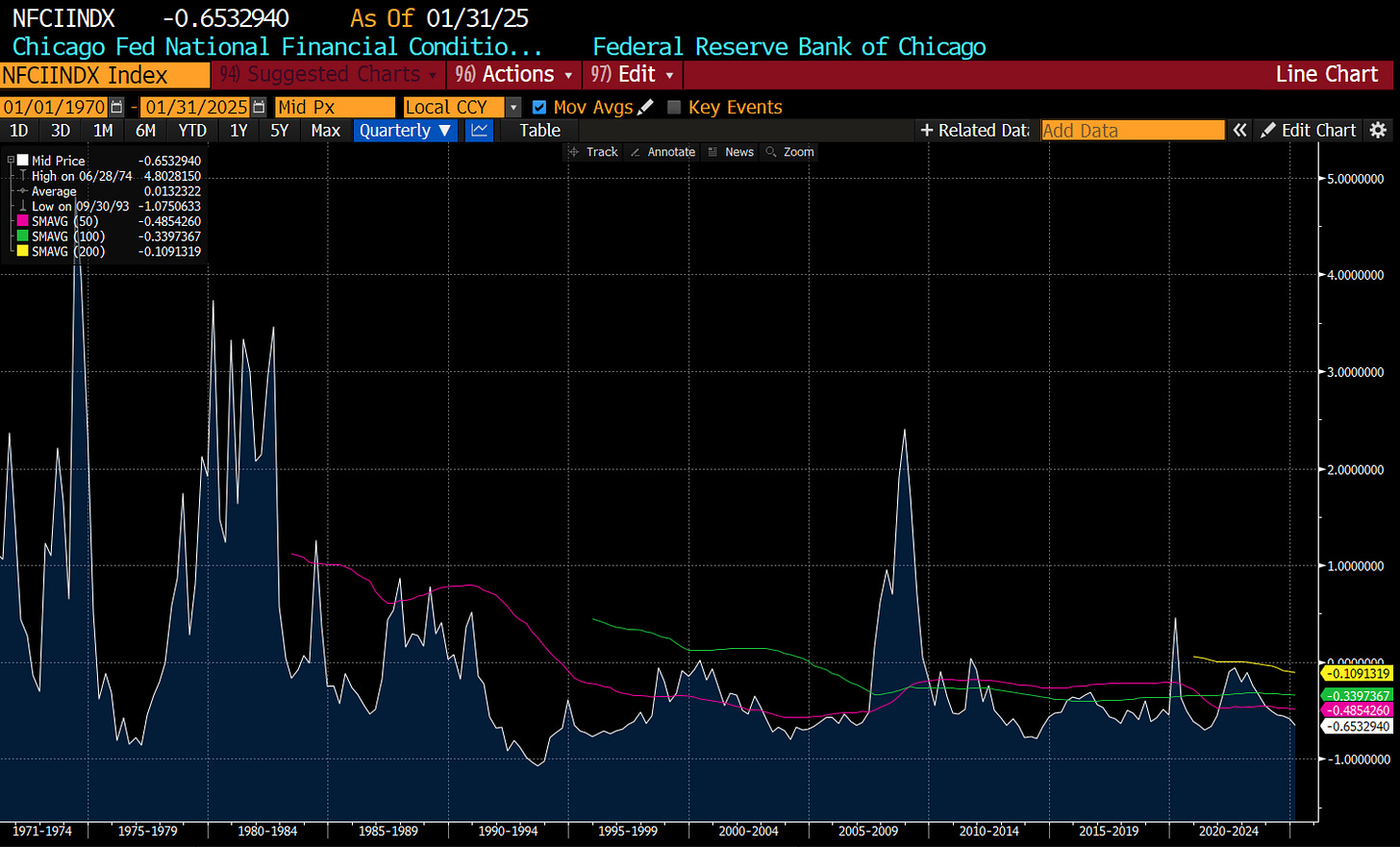

If AI is going to be free - and DeepSeek makes this more likely - then something has to give. My guess is that should a rally in commodity prices, or a sell off in bonds tighten financial conditions - AI budgets will be the first to get cut. For the moment, financial conditions remain benign.

The risk to this view is that DeepSeek is a fraud, or the AI market changes again - but given the Capex numbers we are talking, and the availability of DeepSeek as a free option in the AI space - a cut in AI capex seem inevitable to me.