Boeing was a frustrating short for me back in the day. In many ways its a very transparent company. Together with Airbus it has a duopoly on the commercial aircraft, enjoying good pricing and margins. The only real driver has tended to be orders from airlines, which tends to ebb and flow with the economy. Airlines may go bust, but Boeing and Airbus would always be there, ready to make more planes.

Around 2017, I thought Boeing looked an interesting short. A third of its order book was estimated to from Chinese airlines. With Trump coming in and the investment climate between the US and China deteriorating, the outlook for Boeing was deteriorating in my view. China was also spending large amounts of money to develop its own aircraft, which would at the very least take some of the Chinese market. From an order book perspective, order backlog did decline over this period. However the stock soared.

The main reason was that management focuses heavily on share buybacks. Shares outstanding fell nearly 20% in this period.

In essence, all operating cashflow was diverted to shareholders. In 2018 and 2019, USD 20bn was used to buyback shares at around USD 350 a share.

While Covid was not particularly predictable, lack of investment into product has indeed comeback to haunt them, as the other side of the duopoly, Airbus has continued to prosper.

For Boeing managers the short term gain of share buybacks was too difficult to resist. For US politicians, the same calculation has taken place, where the gain from spending has outweighed longer term concerns. The most obvious is the inability to raise taxation. 6% of GDP budget deficit with full employment is hard to understand.

Even more mysterious is why the Fed began to cut rates when the stock market and property markets are at all time highs.

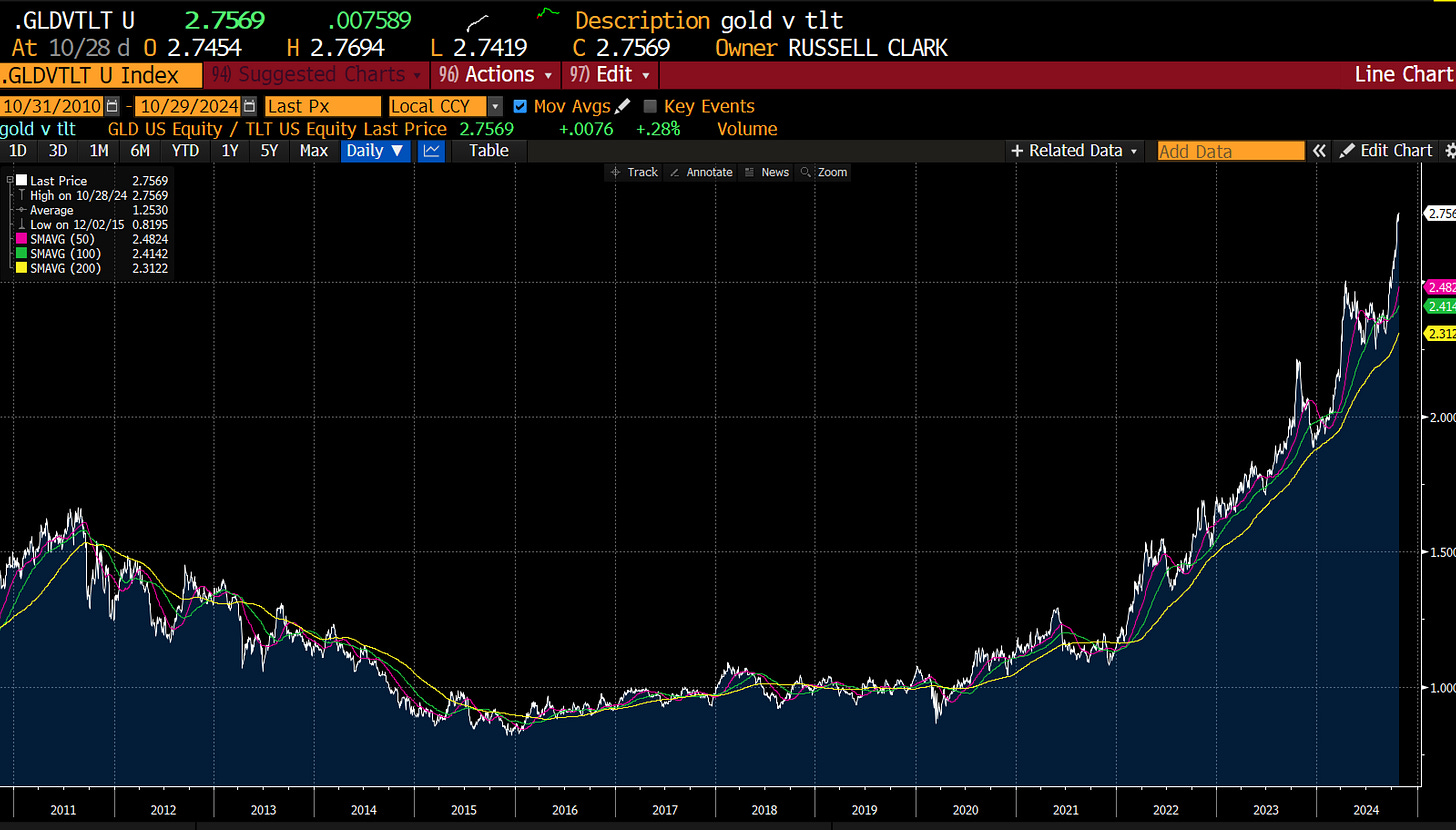

The Federal Reserve also cut rates while Boeing workers are asking for a 40% pay increase, and the longshoreman union just won 60% pay increases. The US is flying high at the moment, using its own money to boost growth, but just like Boeing, management seem to be overly focused on short term gains. For me, GLD/TLT points towards the bill coming due.

The question is whether the US government can find it within itself to return budget balance, or like Boeing it waits until crisis before acting?