The strength of the dollar has generally been a surprise to macro investors (in my view). It did not weaken materially during the surge in commodity prices in 2021, and the old theory of twin deficits (the addition of current account and fiscal deficits) has also broken down in recent years.

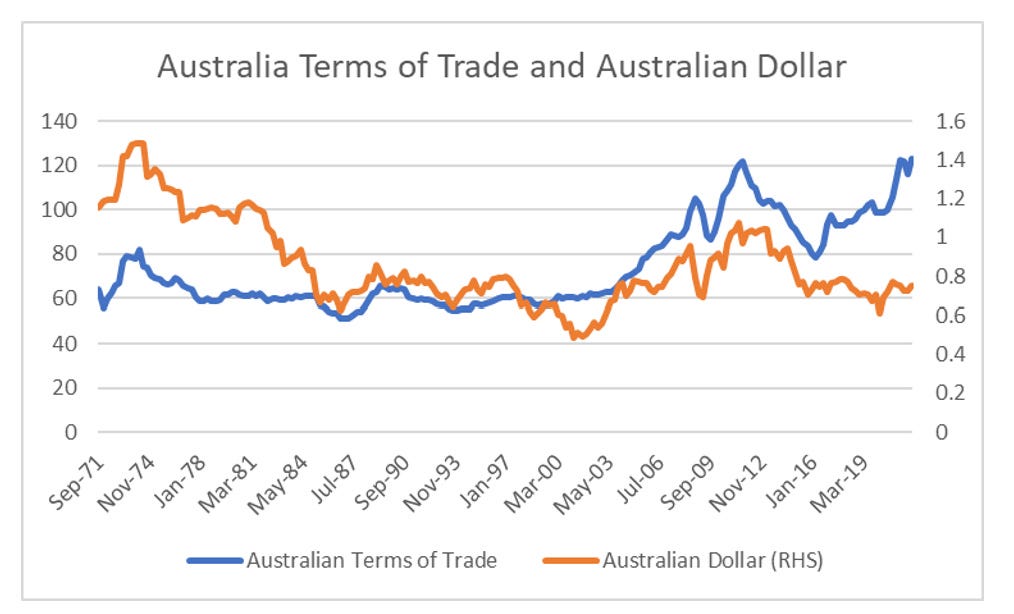

I have also pointed out that terms of trade changes also used to move currencies has broken down.

I was a heavy user of Net International Investment Position (NIIP), which worked well for Japanese bubble, the Asian Financial Crisis, Eurocrisis, the problems in EM since 2011 onwards (please see my other NIIP posts). In recent years, the NIIP model has been saying both the US dollar and US equities were problems.

How can we explain the failure of these macro indicators? Recently, I have been thinking about the concept of an American Empire. When we say Empire, we typically think of an invasion of some sort, followed by direct political control. But almost all Empires had some sort of financial aspect. The East India Company was definitely focused on profitable trading. Post World War II independence, and anti-imperialism has been the norm, which has seen the number of independent nations bloom. 1945 there were 50 members of the United Nations, now there are 193. But if the idea of invading a nation to control it is largely gone (assuming Russia’s invasion of Ukraine fails), how else could we think of an empire? Could we use the idea of wallet share? I look at my current life and compare it to twenty years ago. Today is essentially impossible for me to operate without using and paying US owned corporations. Substack is based in the US, as is Stripe that handles the payments. All of the software I use is US owned, and even though I use a Samsung mobile phone, it uses Google software. I do most of my banking with a US bank, and my credit cards are all US payment systems. I watch the majority of my TV through either Netflix, Disney+ or Amazon. Even my favourite football team is majority owned by Americans. American corporations control a large amount of the food and beverage companies I use.

Is there some sort of historical comparison to corporate domination leading to currency strength? The best I can come up with, in the globalisation period which began in 1980, is Japan. For people of a certain age, corporate Japan basically dominated the auto sector, the gaming sector, the semiconductor business, medical and photography business, music (think Walkman and TDK), and basically destroyed incumbents everywhere. What was also very noticeable again Japan was the almost total lack of success that foreign brands had in penetrating Japan, with perhaps the exceptions of Coke Cola and McDonalds, but even there they faced strong domestic competition (I highly recommend Pokari Sweat and MosBurger if you ever make it to Japan). There were two big differences between Japan in the 1980s and the US today. First of all, Japan exports were goods heavy, and Japanese corporates tended to pay tax. So, as Japanese corporates dominated global trade and took market share, this turned up in a very healthy trade surplus, and in a budget surplus. So corporate domination appeared in a twin surplus and drove a stong yen.

When we look at the US today, we see similar domination, but much of the domination are in what would be called service based indices. US multinationals also make heavy use of tax arbitrage to reduce tax bills substantially. There is a reason so many pharmaceutical and technology companies are based out of Ireland. If we think about US corporate domination and the profits it brings, but they are only visible in the stock market, not in trade data, or even in tax receipts, does the record NIIP deficit make more sense? Probably.

It probably also explains the relative strength of the Chinese Yuan, as China would be the one market where US corporates face competition in all areas from payment to hardware. Also China is far more in control of tax than the US (you are tempting jail or worse in China by attempting tax avoidance). China has also been very good at taking market share in other emerging markets against US corporates, threatening long term dominance. The financial commentary is constantly talking about how Chinese innovation is probably done. And yet, TikTok destroyed Instragam by being both better and cheaper. Same with Hauwei and Cisco. Alipay and Wepay offered far better and cheaper payment systems than Mastercard and Visa. Huawei and other mobile phone operators in China also dominated in emerging markets by offering better foreign language technology and cheaper take rates on their app stores (15% compared to 30%). I always thought the security angle of attacking Chinese business was a smoke screen to protecting profits, but this analysis suggests that profits and security are flip sides of the same coin.

This analysis points to a better way to think about macro. Macro is actually driven my corporate profitability and market share. This would certainly explain some of the unusual weakness we have seen in oil exporting nations relative to the oil price. They are using old technology, while the US is developing the short cycle shale oil cycle.

Does this mean in a capitalist free market world, there is is no macro or credit cycle? Just corporate profitability and market share, which probably explains when nations with weak innovation such as Mexico or Philippines continue to have weak currencies. It certainly makes understanding the macro world easier. An area for further research.