Currencies do not trade the way they used to. In many posts I have pointed out the collapse in old correlations between macro data and currency movements. I have even put forward and new strong dollar model in an old post . It was a step in the right direction, but it still feels somehow lacking. In general most macro analysts also feel like the US dollar is a short, but Brett Johnson of Santiago Capital has been pushing a strong dollar theory, the “Dollar Milkshake” for quite some time. You should have heard of him as he has 260,000 followers on Twitter and RealVision have a video explaining his theory here.

So credit to where it is due, Brett saw divergent monetary policy leading to a strong dollar. And this has been true. The Bank of Japan has keep short term rates negative, and the Japanese Yen has duly collapsed. The question left unanswered in my mind, is that Japan has had extreme monetary policy since 1990, and the Yen was much more overvalued back then than it is today, so why has the monetary policy divergence worked now, and not in the previous 30 years of divergent policy?

As RealVision and presumably Brett point out, US dollar strength is typically associated with financial crises, particularly in emerging markets. Usually tighter monetary policy in the US and a stronger dollar causes financing conditions in emerging markets to tighten considerably. Historically speaking, movements in the Dollar Index and Emerging Market Bond Spreads have been highly correlated. This has not been the case recently, with the dollar trading strongly, and EMBI bond spreads trading at very tight levels.

But there are plenty of other oddities in the currency market. For me, currencies used to be very predictable. When thinking about currencies I almost always started with a hypothetical question. Lets say you needed to keep all your savings in either Canadian Dollars or Mexican Peso for 10 years. Which would you choose? The obvious answer to me would be Canadian Dollars. Why? Political and market history make Canada seem a safer option. Below I provide a long term log scale performance of Canadian Dollar Vs Mexican Peso. I chose Canada and Mexico for very specific reasons. Both border the US, and do the majority of their trade with the US. Both are also major commodity exporters. With all these features netted off, productivity, innovation and sensible fiscal management should determine the relative values of this currency pair. Or to put it simply, no trader has ever gone bust shorting the Mexican Peso.

However over the last three years, the Mexican Peso has been very strong even against the US dollar. This is probably the strongest period of currency strength for the peso is over 50 years.

Japanese Yen/Mexican Peso is even more extreme, with the current exchange rates back at 2008 levels. My observation is that the Dollar Milkshake Theory does little to explain the strength of the Mexican Peso. Historically, tight US monetary policy has destroyed the Peso.

For me I used to short Mexican Peso has an expression of the mismanagement of Pemex (among other sins). This strategy used to work extremely well, with the Peso following Pemex CDS very closely. No longer.

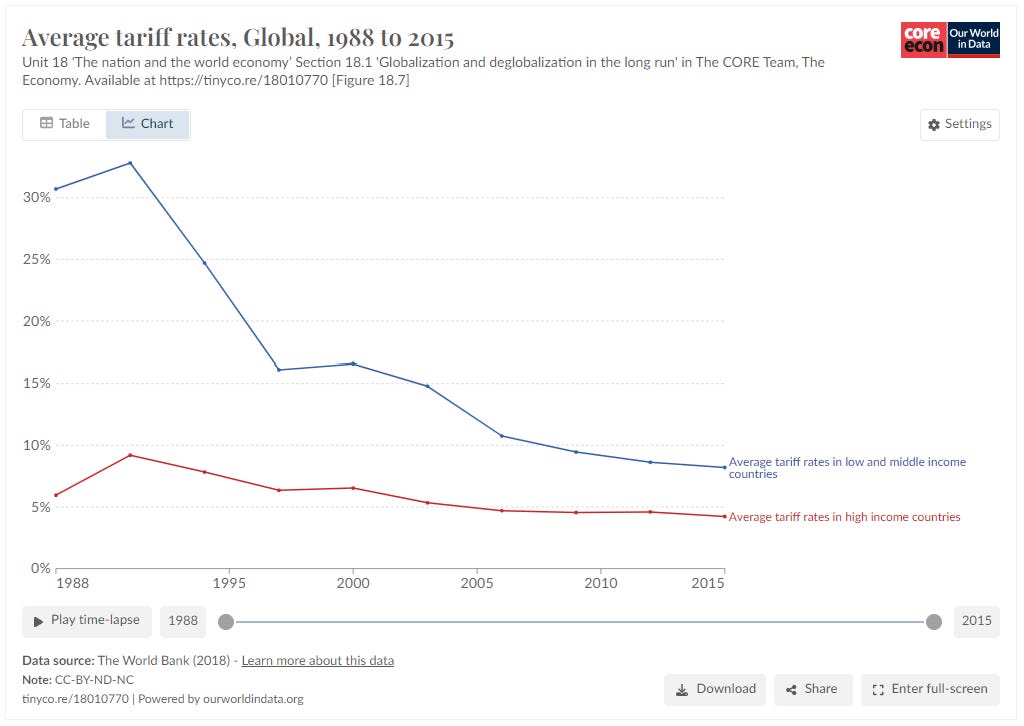

What this says to me is that currency movements no longer reflect movements in macro economics. So why has it become easier for the Mexican Peso to strengthen? And why has it suddenly become easier for the Japanese Yen to devalue? One reason that it used to be hard for the Yen to devalue was that the weak yen would then exert deflationary pressure on other currencies, including the US dollar. That was the Japanese were using a “beggar-thy-neighbour” policy, that continually failed. This was particularly true during the Asian Financial Crisis, in the late 1990s, and during the GFC. Politically, the US was leading the world in opening up to trade and to cut tariffs. A quid pro quo of this was to allow market forces to control exchange rates. Another way to think about this was that Japan has world beating exporters, and falling tariffs would put “upward” pressure on the Yen. The idea was that the currency market would balance out any competitive advantage.

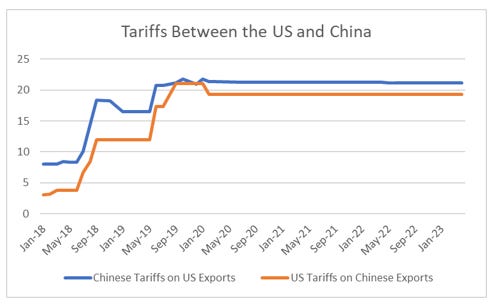

Of course tariffs between the two largest economies in the world are no longer less than 10%. Both have risen to 20%, and probably to the surprise of the Chinese, tariffs have stayed in place even though Biden won the 2020 Presidential election. It should be noted that candidate Trump is mulling a 10% across the board tariff, probably to cut down on the reexport of Chinese goods via third party nations. The logic of falling tariffs being good for Japan, and rising tariffs being bad for Japan is pretty compelling.

Also the idea of friendshoring to Mexico supporting the Mexican Peso is also compelling. I made a lot of money shorting the Mexican Peso from 2011 to 2016, on the principal view that the creditworthiness (or lack thereof) of Pemex was a good guide to the currency. But if Mexico is the preferred export partner to the US (it benefits from being much closer to the US than Japan, and less at risk from disruption), then the strength of the Peso makes sense. As pointed out many times before, macro is really politics, and politics implies a weak Yen and a strong Peso. Currency analysis without political analysis is now worthless.