Since 2016, it has generally made sense to buy the dip. For dip buyers, a VIX around 30 has proved to be a good dip buying opportunity, which is roughly where VIX is today.

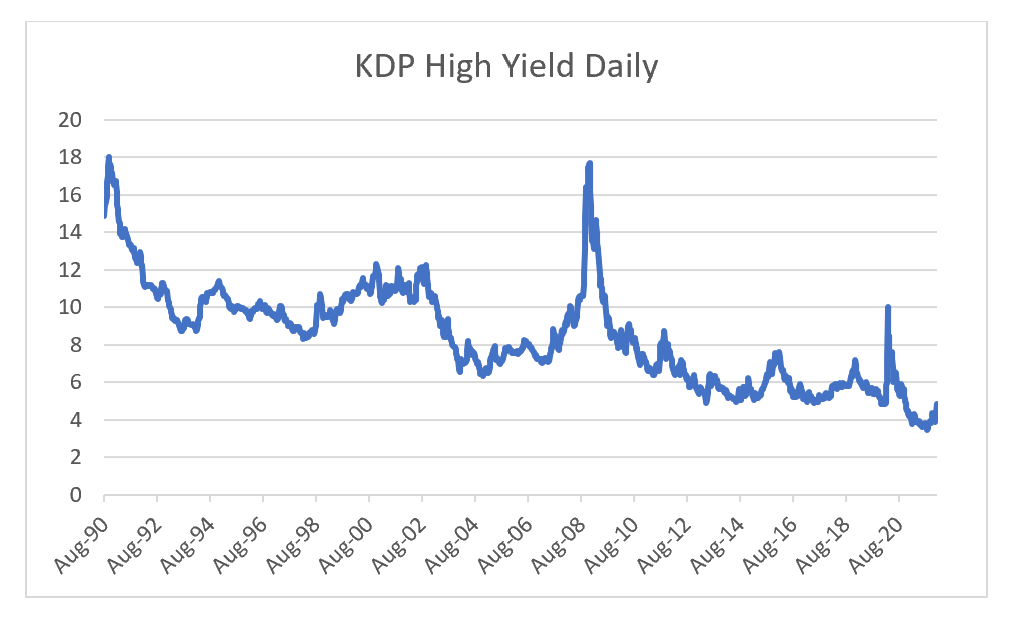

However, it has also tend to make sense to buy equities when the high yield (junk bond) market is distressed. Even with the recent sell off in high yield, it is still at levels far lower than seen in previous sell offs.

One reason why the VIX and high yield are saying different things, is that long dated volatility has become much more expensive over the last year. Below I show a rolling generic 6mth VIX future. Pre Covid, it traded between 15 and 20, post Covid it has usually been above 25.

Why this is important is that the level of the VIX is a better buy signal when it trades well above the 6mth curve, typically a premium of 10, as seen in 2009, 2012, 2018 and 2020. Currently we are well short of that level, mainly due to the elevated long dated future.

Finally, the weakness in US equities seen in 2022 is the first time since 2016 when equity weakness has not coincided with weakness in the oil price. 2008 was the last time we saw rising oil prices and falling equity markets.

Risk reward would suggest to still sell the rip in equities.