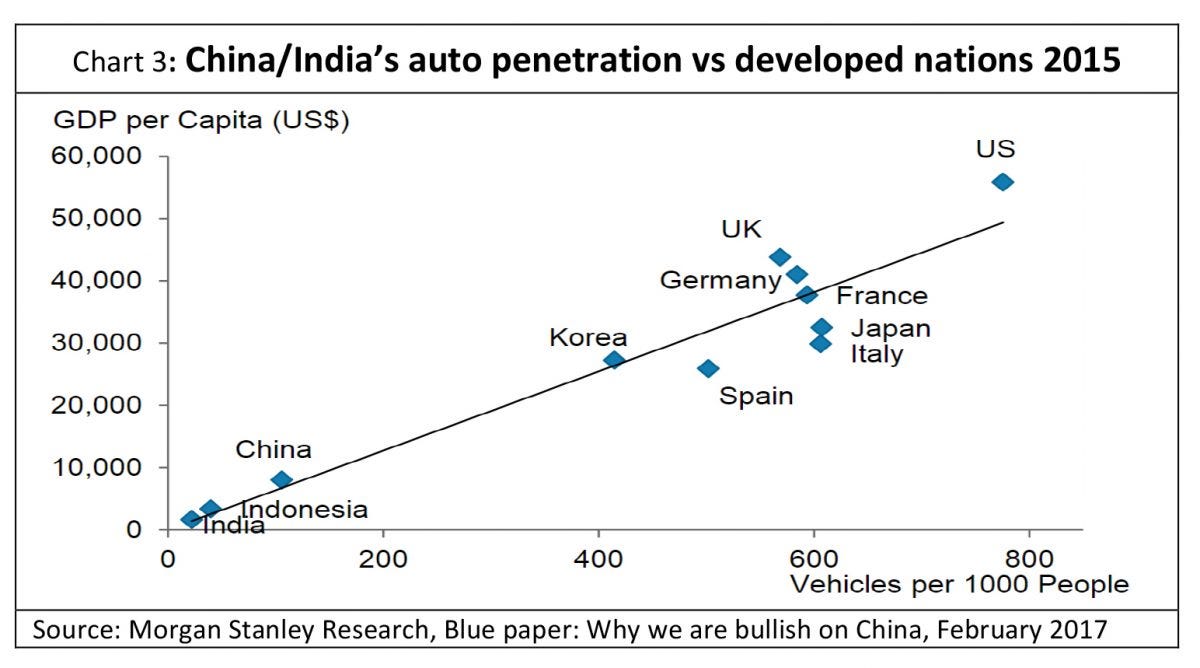

Emerging market investing (at least on the long side) always seems pretty easy. It almost always centres on some sort of “catch up” trade. A classic example is the auto market, where developed markets will have somewhere between 400 to 800 cars per thousand people, and an analysis will look at an emerging market an assume that it will catch up in 20 years, and then model a likely growth potential. A chart like below would be a classic starting point - showing auto ownership per 1000 people and comparing to GDP per capita.

The premise behind this is that Emerging Markets like China, Indonesia and India will catch up to developed world standards. This is standard template for pretty much all emerging market bull stories, and features heavily in any long bias emerging market fund. The implication is that you should always be bullish emerging markets. Despite this, emerging market have been a sideways markets since 2007.

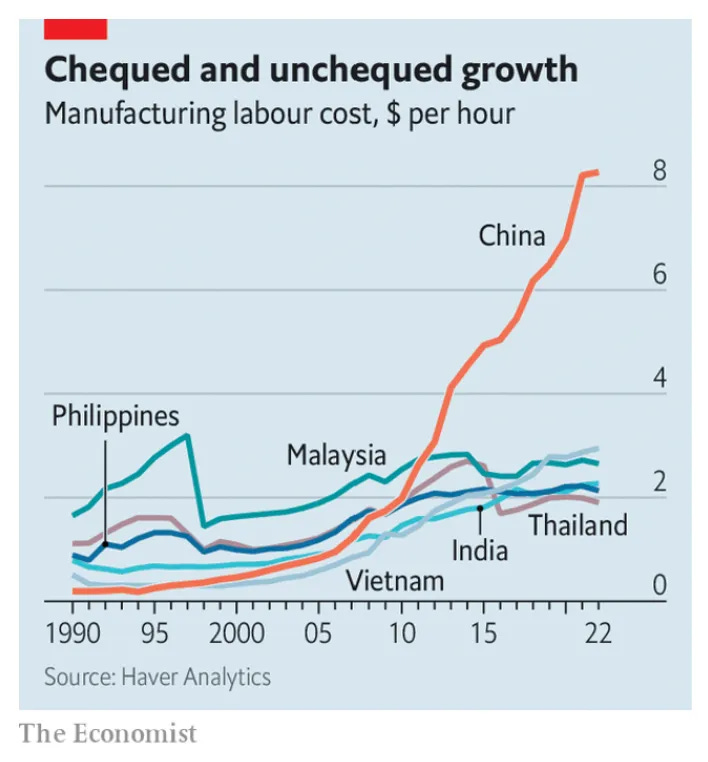

Despite the many emerging market crises over the years, most fund managers are very unwilling to short emerging markets. The reason is that there is a belief that there will always be underlying growth. The problem with this is that it assumes poor countries will become rich (convergence). As we can see from manufacturing labour cost (read as wages). The former Tiger Economies such as Philippine, Malaysia and Thailand all saw their best growth in 1990s, and since then it been pretty poor - but with the glaring exception of China.

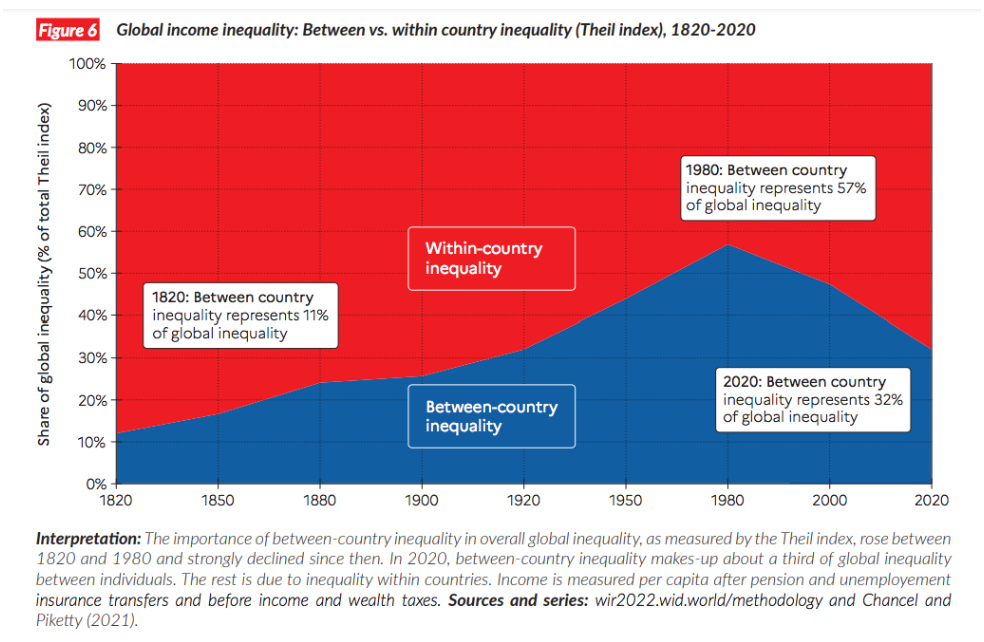

My observation with emerging markets was it was not the stocks that gets you (although frauds in emerging markets are pretty common) its the currency that gets you. Or to be put it another way, wages always rise nominally in market like Malaysia, Thailand or India, but then currency weakness pushes the wages back in US dollar terms. In a “pro-capital” world this meant that you basically needed to buy emerging markets when their relative wages looked cheap against the US. The best way to measure relative cheapness (and adjusting for productivity etc) was to look at the trade and current account balances. One way to think of pro-capital policies is that they actually REDUCE income inequality BETWEEN countries. Or to put it another way, there used to be no billionaires in China in 1980, and now there are plenty. Or all Chinese were poor in 1980, but now the majority of Chinese (or any other emerging market) are only relatively poor.

From 1900 onwards, WWI and the collapse of various Empires saw policy focus on reducing “within-country inequality”.