Ronnie O’Sullivan may or may not be the greatest snooker player of all time - but he is probably the most naturally gifted. Snooker is a very slow game - and achieving a perfect score is vanishingly rare. Ronnie has the distinction of the fastest ever perfect score. If you wanted to carry on the Ronnie analogy, like Ronnie, I burst on to the scene, did great things, then suffered a form slump, retired from the game, and then returned once my technique was corrected. I like that.

In a game lacking superstars - Ronnie is the only true superstar. But despite that, he has claimed snooker is a bad sport, and would try and stop his kids from taking it up. I would probably concur with macro investing. I find the whole macro world very reactive. Now that bond yields are rising, there are whole sea of commentators writing long and dense theories on what it means, and how it might be “part of a plan”. Like Ronne - I am a fan of quick and direct (no comment!). Bond yields are going higher because politicians need to get wages higher. Trump is imposing tariffs, because he needs to get wages higher. Why do politicians want wages to be higher? Because the voters are telling them that they “want wages to be higher”. Why make things more complicated?

One problem I really have with the macro community is that they focus on consequences, rather than the driver. A good example is this comment forwarded to me by a subscriber.

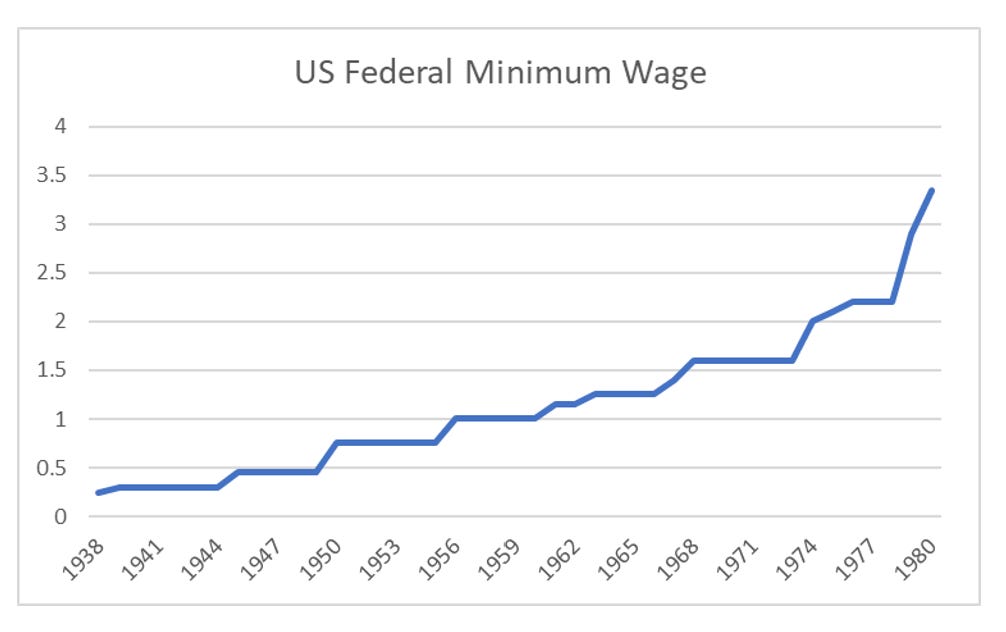

That clown was not me - as I don’t go on exchange floors. But Marko is focused on consequences rather than drivers. The driver is that the US government is working hard to get wages to rise. For context, from 1939 to 1980, the US Federal Minimum wage rose 1000%.

1980 to 2025, we have seen slightly more than a 100% increase. Guess which era was focused on raising wages, and which era was focused on raising profits and asset values. (Sorry - no prizes for this pop quiz).

My base case assumption is that the US government wants wages to double over 10 years - which translates to around 7% a year. I also assume they want to keep house prices in check, and the dollar strongish (7% pay increase with 10% inflation would defeat the purpose) - so a real rate of 3% or so would be necessary. This gives you 10%. In a world of free movement of capital and no tariffs - our friend Marko here would be correct - the US would be toast. But in a world, where the US has onshored all auto, steel and iPhone(?!?) manufacturing, through the use of tariffs, would there be no jobs? I doubt it. Rather the government would be desperately looking at ways to keep cheap imports out (just like now - for example).

10% does not look that wild to me. It was where we got to in 70s.

Brazil, which has always maintained tariffs to protect domestic workers, already has overnight rates at 14%.

Mexico, which the US still has a trade agreement with of sorts, is already at the 10% rate, even if recent cuts have pulled it lower.

If calling current US policy Latin American-like, leading to Latin American interest rates is too much of a step for you, then we can look at US ally, Japan. Japan is very closely tied to US financial system. Japan is suffering from rising yields, as its workers also need pay increases.

For me the macro world is in denial. In essence, they are saying rates cannot go up, because it would destroy asset prices. This is true - but in many ways is the actual point of rising rates - to get asset prices to fall in nominal terms - to make them more affordable. It’s that simple. Deal with it.

Perhaps the most laughable thing about the macro world is being surprised about bond yields selling off. It was inevitable at some point, but with an obsession with back testing and algorithms, the macro world would not accept it until it happened. On this, I feel a bit like Ronnie O’Sullivan when talking about younger snooker players:

“Yeah, they need to get their act together because I am going blind, I have a dodgy arm and bad knees. And they still can’t beat me!”