One of the reasons for an “independent” central bank was the idea that they would not juice up the economy or the stock market to the benefit of incumbent politicians. The reason for this was from the 1970s, when Nixon put huge pressure on the Federal Reserve to make sure the economy was firing. Under the first Trump administration between various other tweets on tariffs and wall building, President Trump was never shy about crowing about the performance of the stock market under his watch. Despite a very good stock market, President Trump lost his re-election bid.

To be fair, President Biden, faces a tough re-election bid as well and he has presided over a pretty good stock market, if not volatile.

Of course, the stock market and the economy is not always the same thing. But unemployment has been at remarkably low levels in the US for the last decade, and yet neither Trump or Biden have ever basked in high popularity. George Bush Senior lost his re-election bid in 1991 with unemployment at 7%, while George Bush Junior won hi re-election bid with unemployment at 5.5%. Obama won re-election with a rate around 7%.

This disconnect between stock market, unemployment and electoral popularity is not just an American phenomenon. In the UK, the Tories are headed for electoral Armageddon with UK unemployment a the lowest level since 1970s.

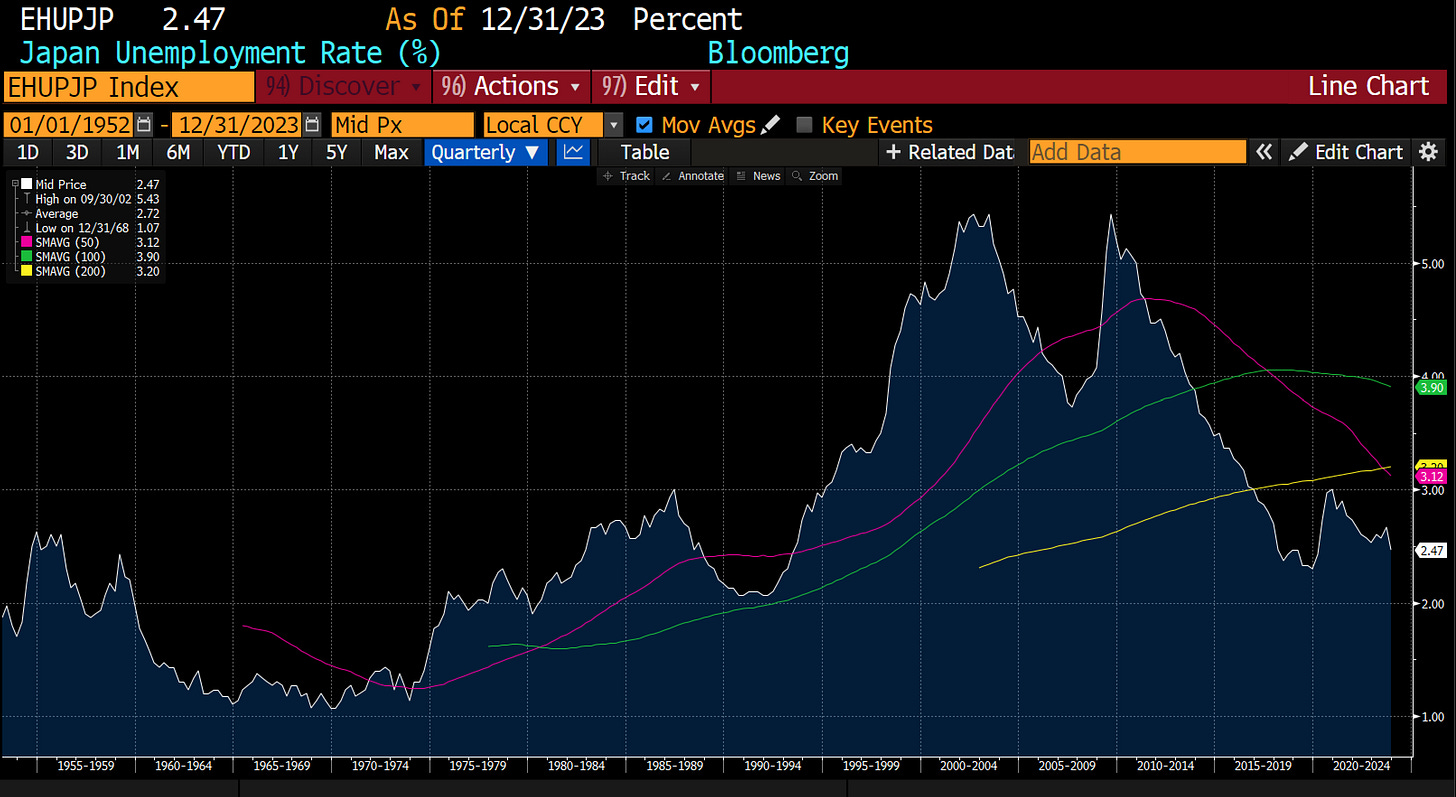

In Japan, the Prime Minister Fumio Kishida faces a electoral crisis, and very low popularity numbers, despite the Nikkei threatening to break out to new all time highs.

And by recent standards, very low levels of unemployment.

So are there any very popular politicians in the world at the moment? Modi in India is one option, although one wonders what if any lessons could be applied from Indian politics to elsewhere. Another option is President Obrador, who is likely to leave office as the most popular Mexican president ever. As mentioned before, Orbador has been able to raise real wages significantly in Mexico.

Coincidentally, or not, Mexico has done a good job in regulating America Movil (AMX US), which was the source of wealth for Mexico’s wealthiest man, Carlos Slim.

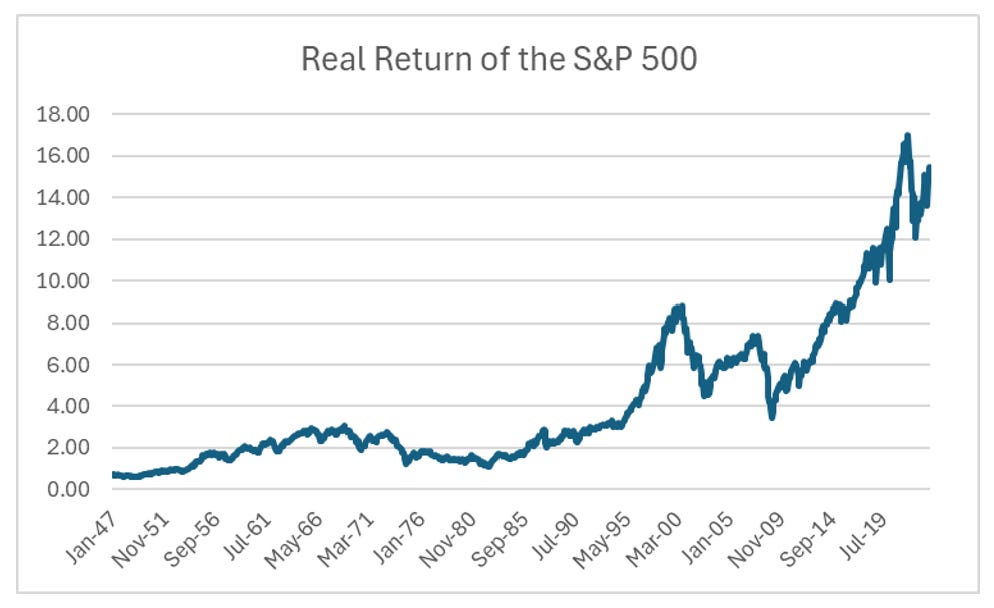

My best guess is that worker’s in the US and UK are not happy with the rate at which wages are rising. Real wages have maybe risen 20% since 1980s, with most of that increase in the last 10 years.

Real return to the S&P 500 since 2008 lows has been close to 500%, which makes the efforts to raise wages seems pointless in comparison.

The road to electoral success lies in raising real wages. Who will grasp the nettle first?