We are living in times of profound change. What I am trying to do with Brumby Capital is capture the opportunity of those changes. I have set up a website - www.brumbycapital.com - that includes a beta version of AI Persona for the fund. You can speak to it, and it answers in an Australian accent. Please give it a go and give me feedback on where we can improve it. At some point I hope to train it on my own voice. The AI Persona has been set up by a company that I am invested in and if you would like to know more please reach out.

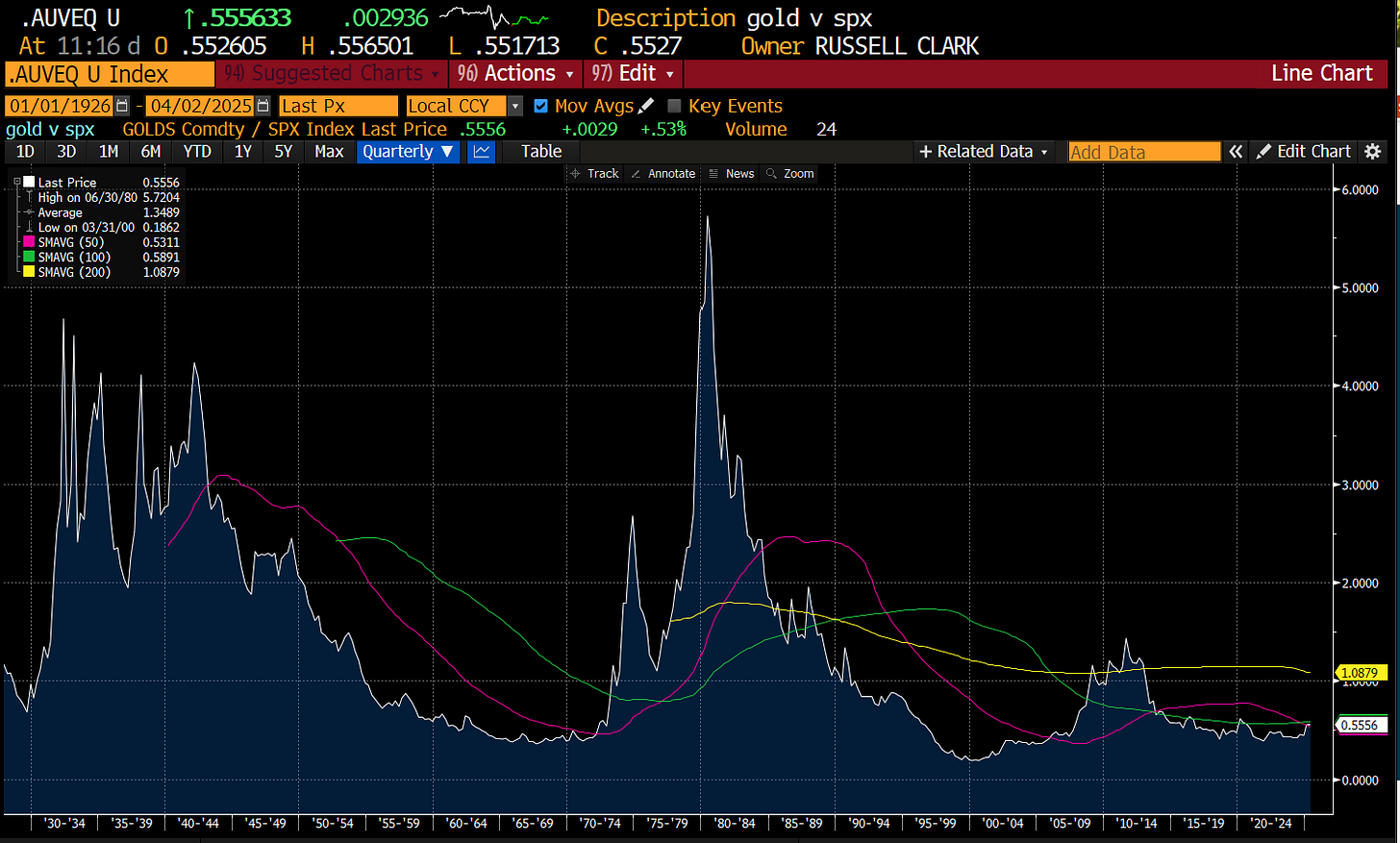

For me, there were two profound moves in the market last month. First gold broke out again the S&P 500. It does not do this often - and it can have fake out moves from time to time - but when it does move, it tends to be a powerful signal of change.

The other move was the break higher in JGB yields. From 1999 onwards (the beginning of my investment career), buying JGBs when US equities fell was a money good trade. For the first time I can remember JGBs were not a safe haven during US equity weakness.

Having been in NY last month to meet various investors, I can say that I think the average American is in deep denial over how the world has changed. The reason that the US spends so much more than other countries militarily was that was exactly the system the US wanted until recently. After World War II, Japan and German were explicitly guided away from having any offensive capacity. When the Soviet Union collapsed, the US offered security assurances to Ukraine to get them to give up nuclear weapons. And because of this security blanket, the US received reserve currency status, and a primary voice in how western economies should be structured. Betraying Ukraine has shattered this system. Europe and Japan now know they need to remilitarise, and that following the US line on China is now optional. No major nation will be looking to use Treasuries or even other government bonds as reserve currencies anymore. The movement in gold tells you this. The unending bid for government bonds is gone in my view.

There are now two big political drivers to markets - firstly Europe and Japan need to remilitarise. This will require hiring more military personnel at a time of record low unemployment, and to build out there own secure military supply chain. Both of these things will require money. The good news is that nations like Europe and Japan actually have a great deal of money salted away, either in foreign reserves, or savings. The problem is that almost all of that savings has ended up in the US, one way or another. We can see this using the Net International Investment Position (NIIP) data. They will need to bring that money back. This data is also picking up foreign reserves. But the second big driver is that no nation can really perceive the US treasury as a safe reserve asset anymore.

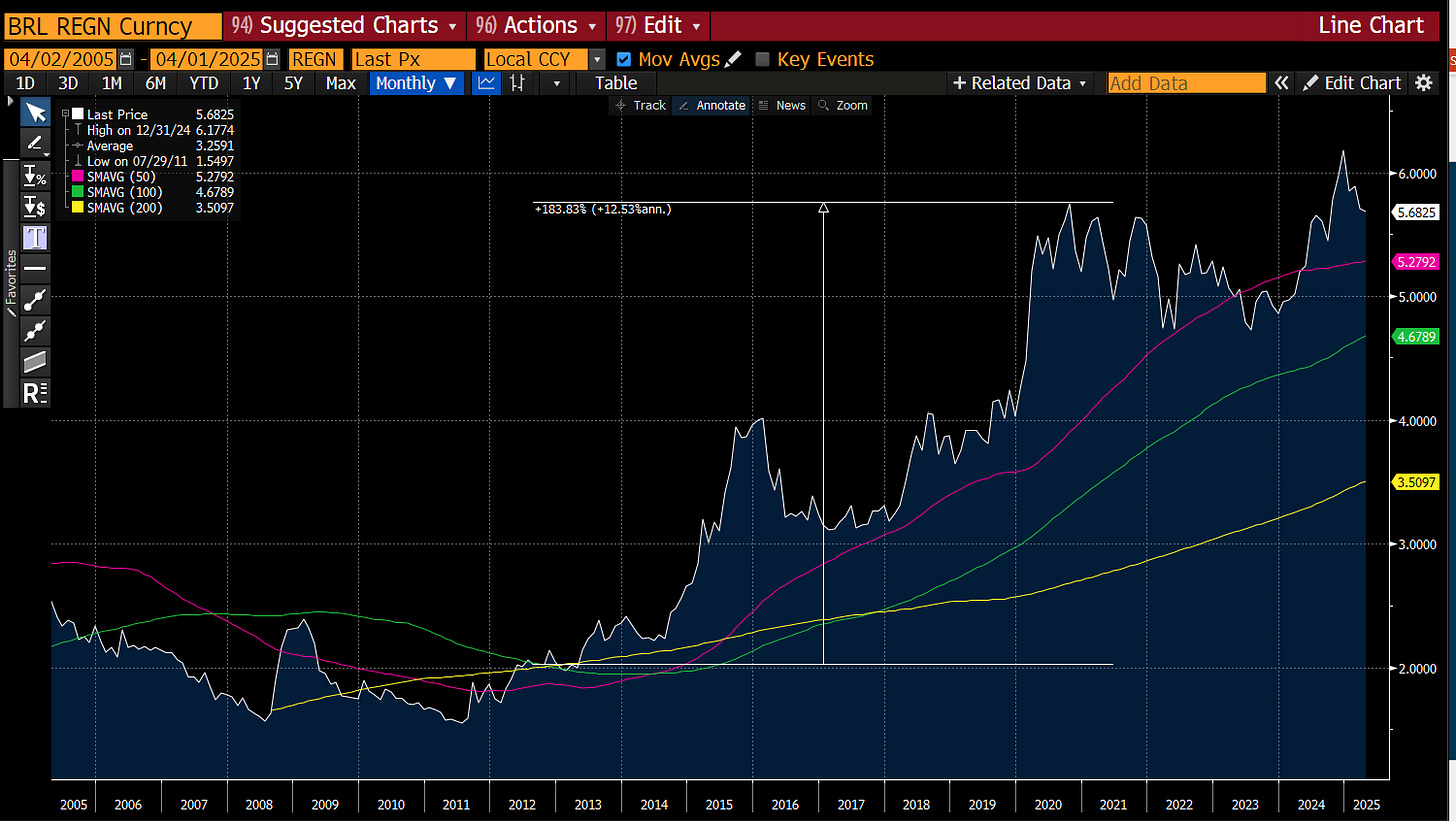

When I was in New York as made this argument, I was often told the US would remain the reserve currency forever, and that it was still the best option. Maybe this is true - but for me it feels like the genie is out of the bottle. This trip reminded me of of capital raising trip I did to Brazil in 2012. At the time, I was heavily short Brazilian assets, as the Brazilian Real was expensive, and the Chinese construction bubble, and associated steel and iron ore bubble looked ready to burst. I had found US investors that agreed with me, but when I suggested this in Brazil to Brazilians, they could not bring themselves to sell the Brazilian real to buy US dollars. The currency has weakened ever since, and Brazilian assets have been very poor in US dollar terms.

I suspect President Trump, just like Prime Minister Boris Johnson, is pro-cake and pro-eating. In this case I think President Trump wants to have all the manufacturing AND capital flows into the US. For me, its hard to see how that is possible - foreign credit flows into the US are a consequence of the flow of manufacturing jobs overseas. Putting all of this together, and I see capital flows across borders slowing and reversing, and I see the cost of capital rising across the board. I suspect this is going to put downward pressure on all asset markets. Take emerging markets for example. During the dot com bust, and due to the Asian Financial Crisis and the Argentinian and Brazilian devaluation crisis, spreads over US treasuries were 9%. Today, they are barely 3%. How do they perform well when spreads are so tight and US yields are rising? Same is true of corporate debt.

The bigger earthquake for financial markets is dealing with the fact that US Treasury is no longer a credit worthy asset. The market is already beginning to trade this way. Back in the 1970s the US also became uninvestable, with a number of non-free market policies, we started to see a huge gap open up between Swiss and US bond yields. In recent years, this spread has begun to appear again. At its peak the spread was 10%, and I think we are headed back to those levels.

If the GFC was about discovering that mortgage back securities were not safe assets - how does the market deal with discovering that US treasuries are not a safe asset? In simple terms, I see long term US interest rates going to 10%. Current valuations for most assets will struggle in that world.