I have liked the long gold, short treasury trade for a few years now. But recently, I have seen a lot of chatter about bonds being a buy again, and gold having topped out. It has had a good move - but has been moving sideways of late.

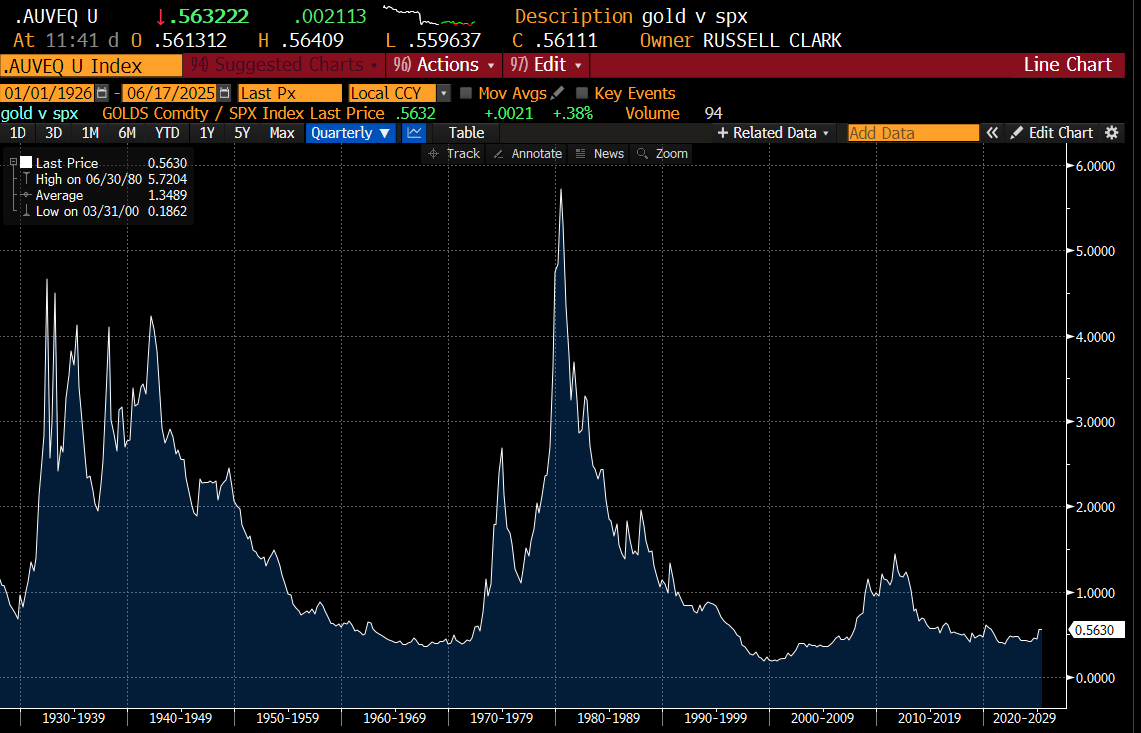

If we are going back to the craziness of the 1970s, then we have plenty of upside left in the tank!

Why anyone thinks 5% on the 30 year treasury is a buy is a mystery to me. During the 1990s and 2000s, governments worked hard to balance the budget. These days they have all but given up. Only much higher interest rates would force any unpopular fiscal policies these days. 10% on the long end still seems likely to me.

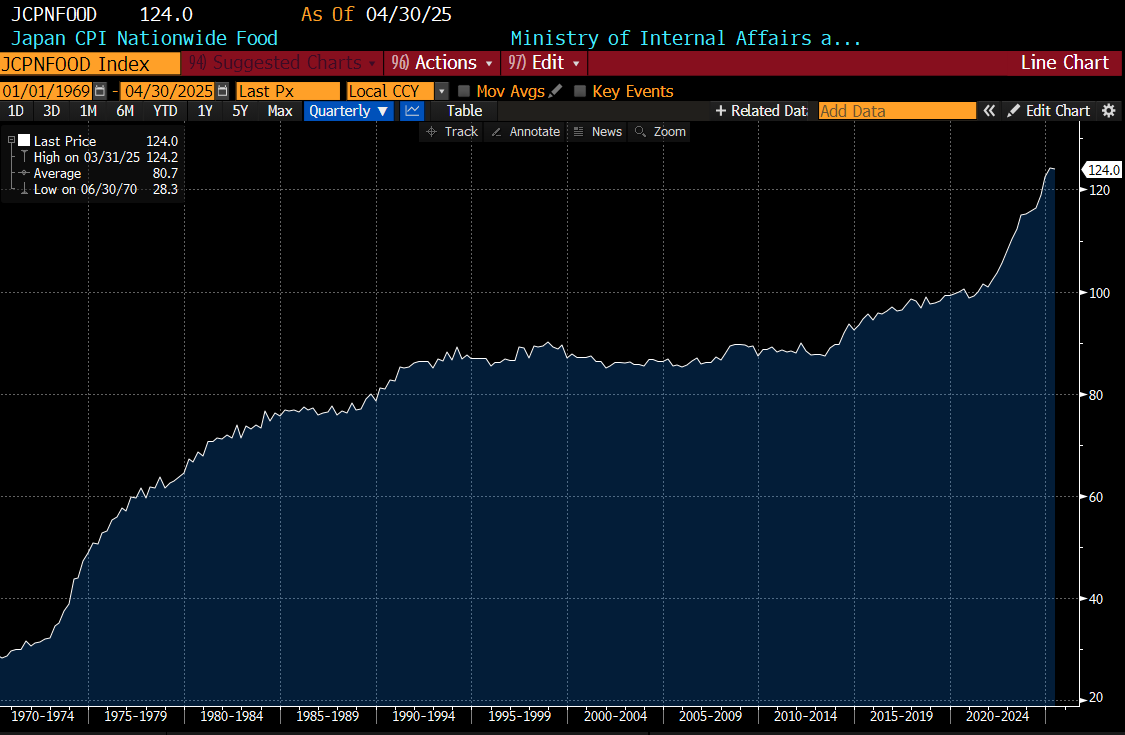

What about gold? I think of gold as a hedge on wage and food inflation (I see these two things as interchangable). If I use Japanese food inflation as a guide (its useful because it was flat from 1990 to 2012 - you don’t need to use a log scale), in 1970s, food prices went up 200 to 300%. We have broken higher recently - and I can easily see Japanese wages rising 200 to 300% from here.

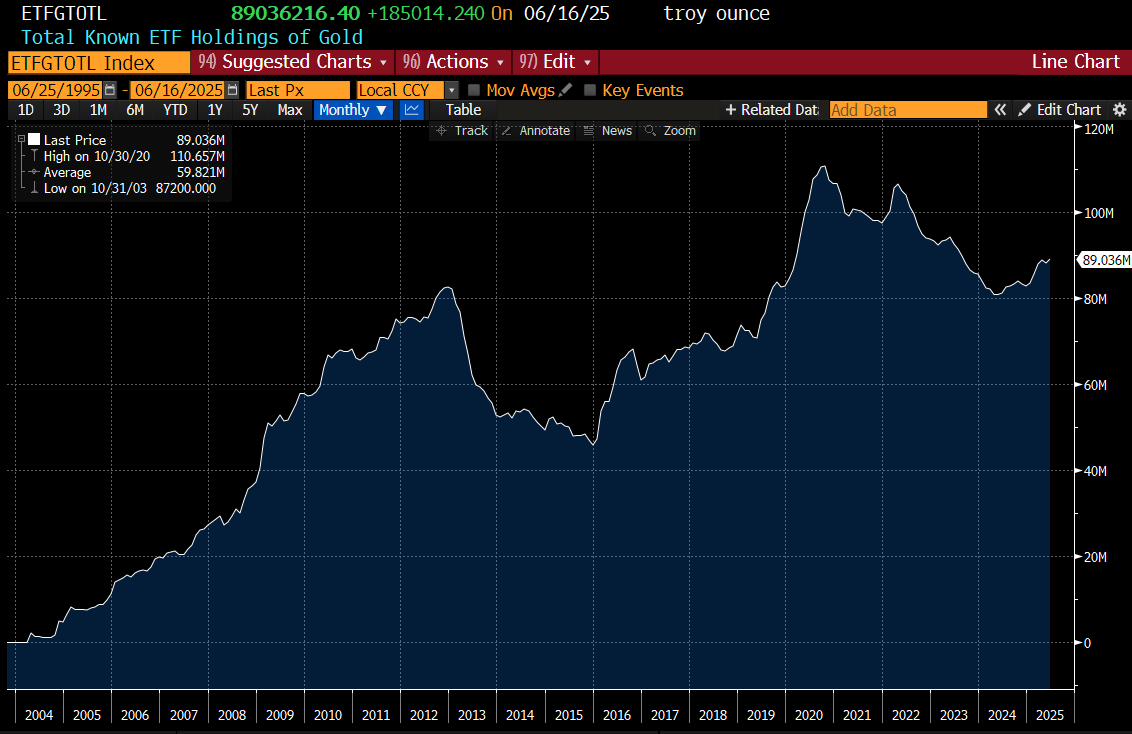

Some people say that gold is over owned - but ETF holdings still look low to me.

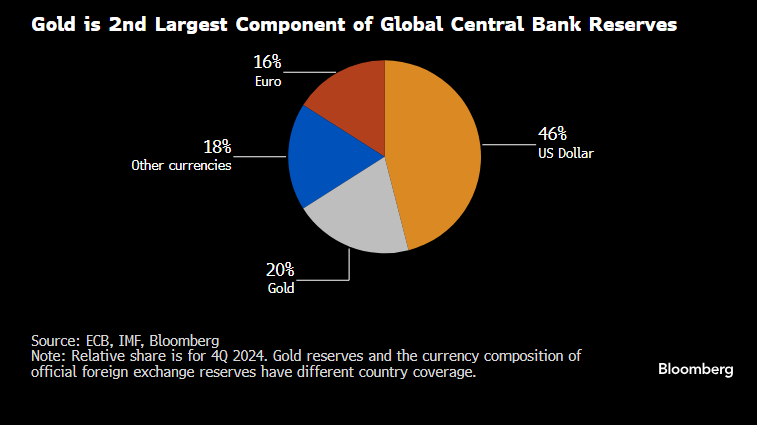

You could argue that gold has been driven by central bank buying. I would agree with this. But as Section 899, as well as the treatment of Russia foreign reserves should highlight - only an idiot would be buying another countries bonds as a foreign reserve. Gold is now 20% of central bank reserves. For some that feels like enough, but for me, on current political trends - a number closer to 80% seems likely to me.

Much of the current bull market in the US has been built on the Trump and Biden administrations abusing the reserve currency position of the US. The recent break out in gold versus the S&P 500 only just looks like the beginning to me.

So I can understand why people might think GLD/TLT are done - and there are very rational economic reasons to think this. But politically, we are only just getting started I think.