Macro analysis, much like movies about the future, has a natural dystopian bias. Why? Because people like to hear about doom and gloom - it sells well. This is a fact. In my investment career - I have made more money being long, but raised far more money when I am net short. The logic of it is easy to understand. If something does go wrong, having a hedge to ease the pain helps - and if you can be net short and make money even better - something I have been able to do for long stretches of my career. What I began to focus on was capital flow and asset markets (and hence the title of the substack). I originally used BIS data - but started to notice that a newly reported economic metric - net international investment position (NIIP) - also seemed to do the trick. I mention this, as almost every bearish article on the US now seems to mention NIIP. This chart from the Economist would be pretty standard.

The thing is that NIIP worked well in predicting the Eurocrisis, showing that German investment was pouring into Spain, so that at some point when the Germans asked for their money back - there would be a problem.

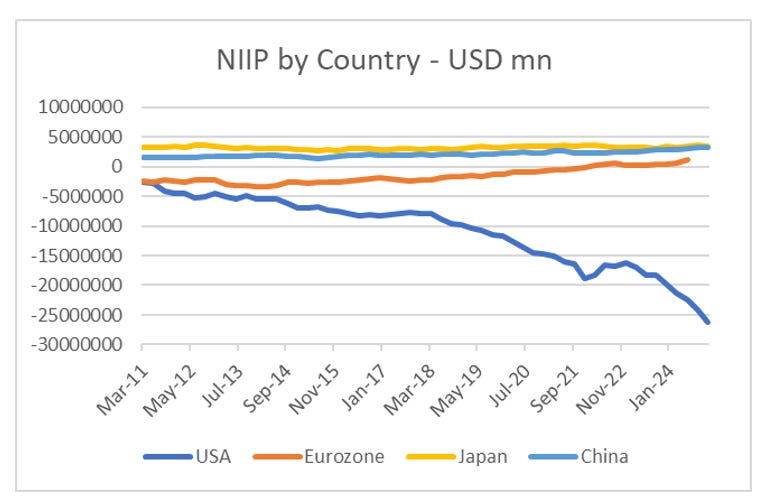

The first problem with a bearish view on S&P 500 is that from 2016 onward, the US NIIP has blown out - but there has been no equivalent increase in NIIP elsewhere. Or in other words, the US seems to be booming WITHOUT any inflows from other countries.

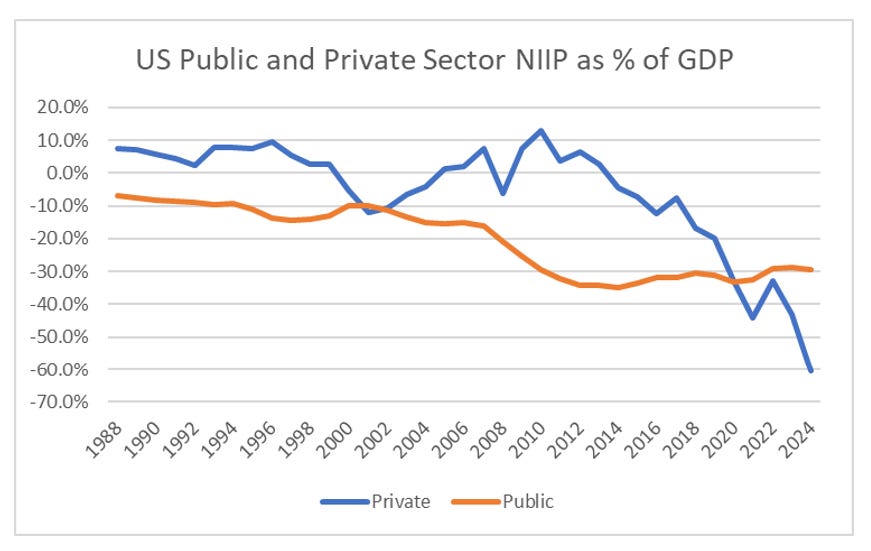

Taking the analysis a bit further, I try to strip out any NIIP that comes from the US dollar being the reserve currency - so separate the NIIP into a private sector and public sector measure. Using the dot com bubble as a comparison, I thought the US looked overvalued in 2016.

What I am trying to say, is that the NIIP backtested well - and I then used it to time being bearish on China successfully, but since 2016, it has totally failed as a macro economic indicator. I suspect that the US NIIP data does not work anymore, because of two interrelated factors - one is massive offshore profit shifting, which NIIP is picking up, and share buybacks, which has shifted returns from income focused to capital gain focused. So if NIIP is a bust, is there any other reason to be bearish on the US? As mentioned, I used to use a different data set to gauge asset flows.