I have been contemplating the nature of American capitalism for a while now. To my mind, “the rules” that market used to work with have changed. Industrial policy, capital controls, and big government are all okay, after being verboten for many years. But the thing is, that even though all these rules have now being broken, as long as American capitalism is creating wealth, then all is good. S&P 500 at all time highs suggests to me that these policies will continue.

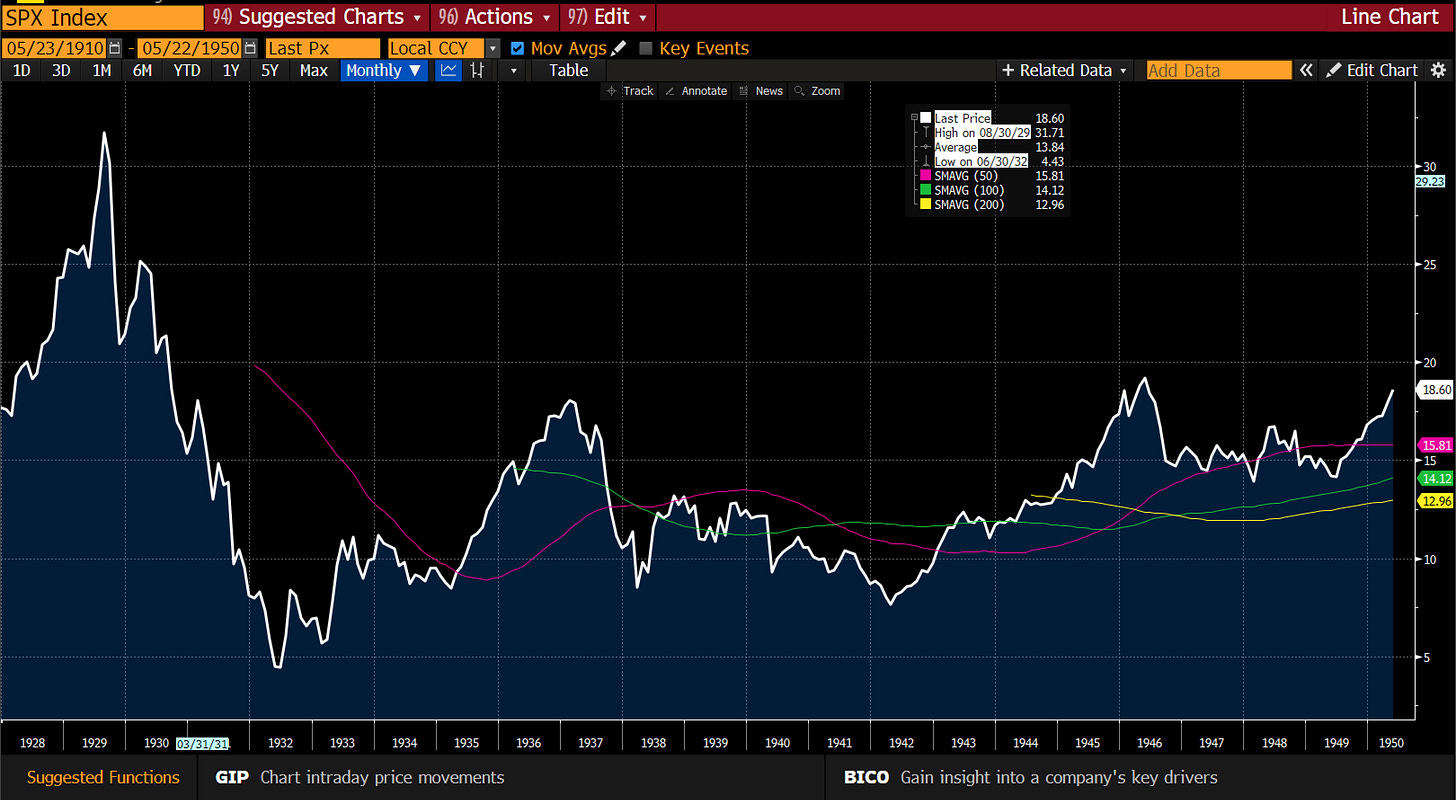

When I look at the great policy shifts in the US, they have always happened after a period of lacklustre market returns. Or when American capitalism is not able to “create wealth”. The long period of sideways markets during the Great Depression gave way to pro-labour, and full employment policy changes in the 1940s to 1960s.

The stagnation of the 1960s and 1970s gave way to pro-capital policies of the 1980s, and the upturn in markets again.

The lesson from above is that whatever the barrier to wealth creation that has existed in the US, American capitalism will find a way to overcome it. So Warren Buffett style, always long the market has been a super successful strategy. But my interest is in understanding what causes American capitalism to fail in the first place. What goes wrong so that policy needs to change? First of all, what American capitalism always needs is a schmuck.