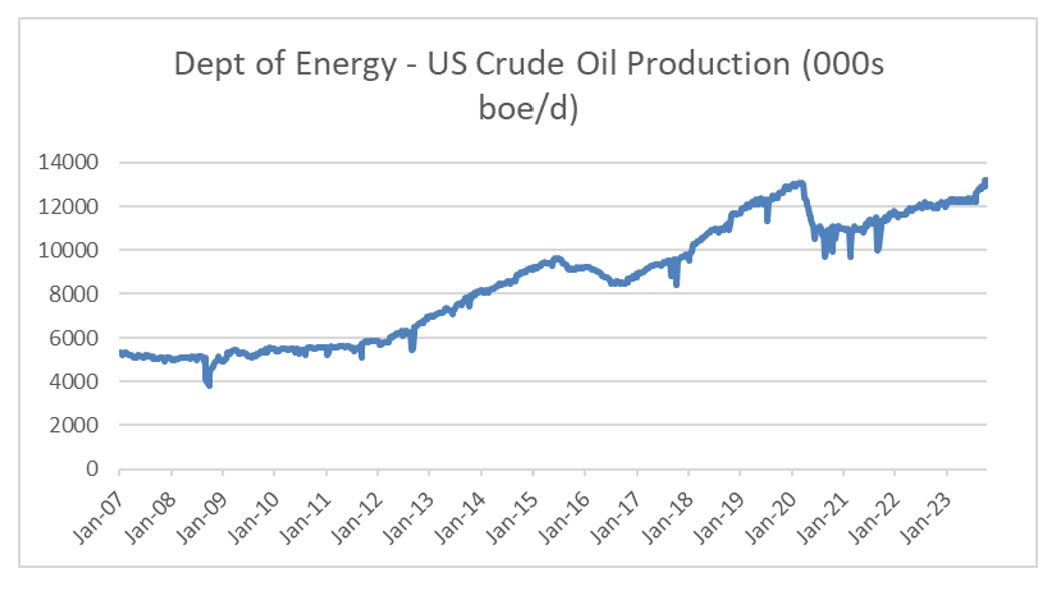

The energy markets have been undergoing huge changes. Starting with the shale revolution that saw the US go from producing 6mn barrels a day of oil in 2012, to over 13mn barrels a day today.

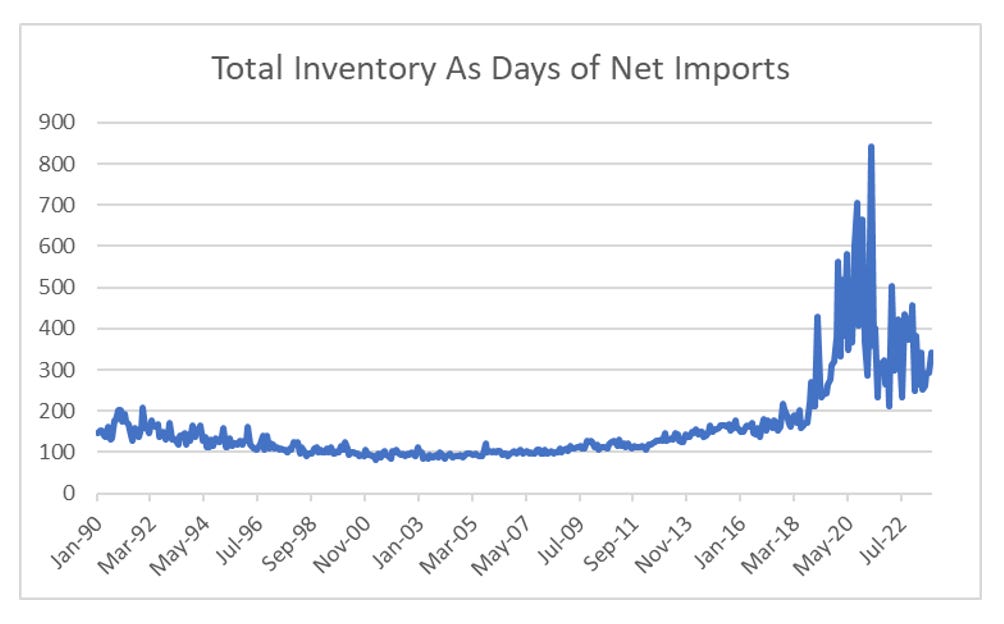

A knock on effect is that the US does not need its Strategic Petroleum Reserve (SPR) anymore. In fact much of the stored oil under the SPR was in the wrong place. The Biden administration has taken advantage of the high energy prices since the Russian invasion of Ukraine to run down the SPR.

Some “analysts” claim that this is a one off policy to keep oil prices down, and when the SPR is refilled again, oil prices will surge. US oil inventories are kept as a hedge against supply blockades. IEA recommends keeping 90 days of imports as a minimum. As commercial operators would not hold that much inventory, the US government had to set up the SPR. With the growth in US production, and the fall in imports, US has excess inventory now. The SPR is not necessary. It is very unlikely the SPR will ever be refilled.

US shale oil production has been increasingly dominated by Permian production in recent years. Production in other shale areas has been stagnant.

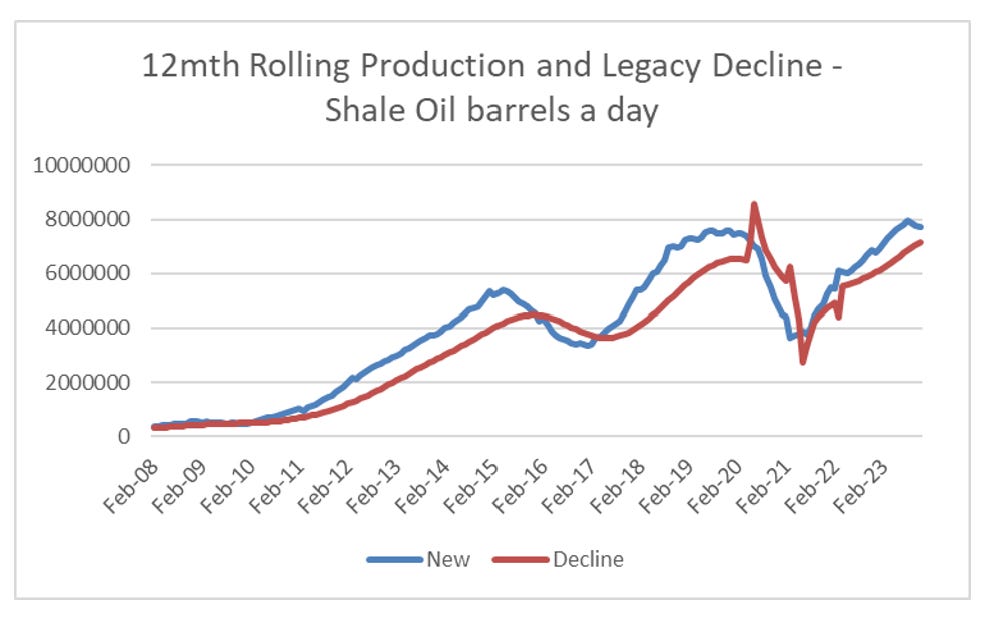

What is unusual about this is that Permian drillers have been running down the stock of Drilled Uncompleted (DUC) wells. That is they have been completing more wells than they have been drilling.

Why is this a big deal? Well shale oil is a short run method of production. New wells produce 50% of their output in the first year, and then go into decline. To grow production, new wells need to be outpacing the decline in production at older wells, and using data from EIA, we can estimate both. New production looks as if it stalling, while legacy decline is still rising. The chance of US oil production falling is increasing.

I look at January 2028 natural gas future prices to get an idea of whether the industry is still over producing or not. From a low of USD 2.6 in 2020, this rallied to USD 5.5 in 2022, before correcting to USD 4.8 today. If this started to fall again, I would need to change my mind about US supply of energy.

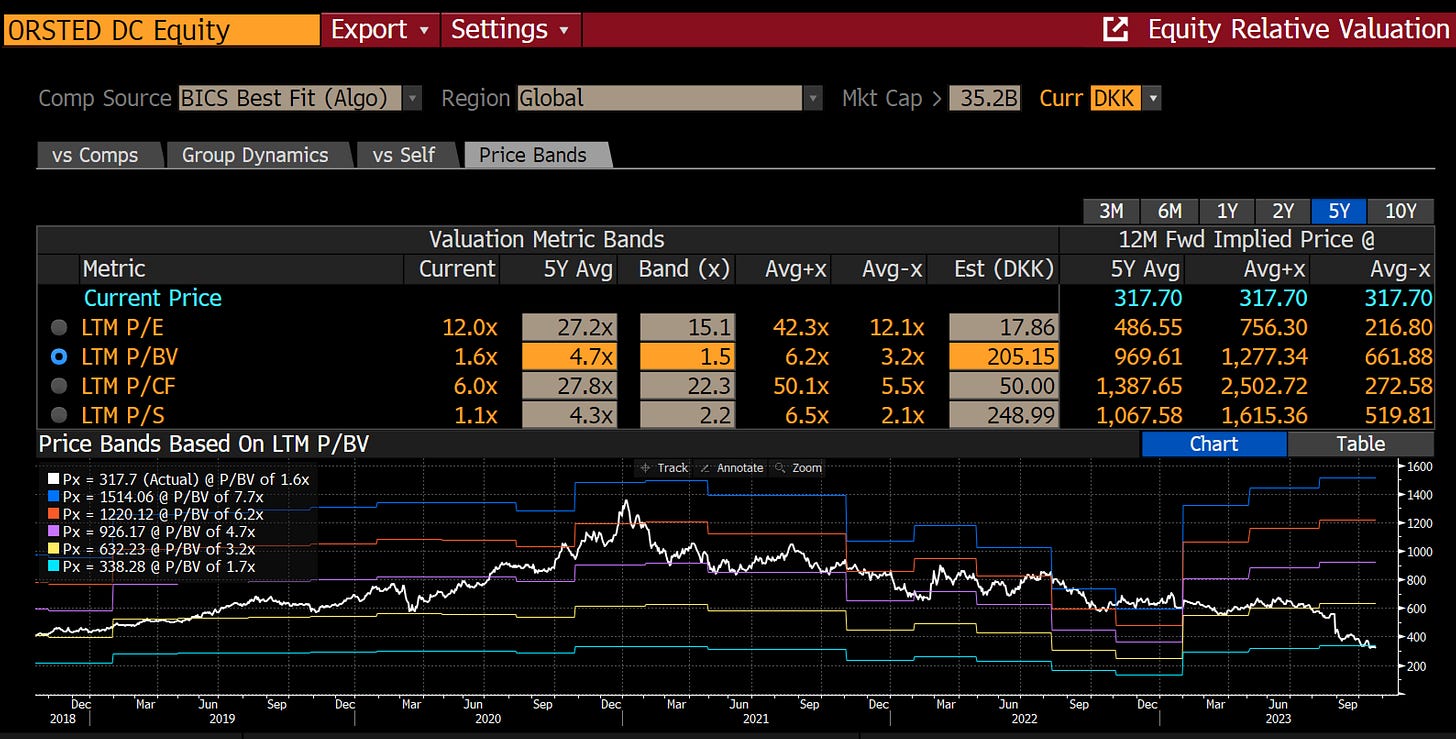

In the renewable space, we have seen problems emerge in the offshore wind industry. This is most visibly seen in the share prices of leading offshore wind producer - Orsted. Orsted has fallen 50% this year, and 77% from its peak in early 2021.

For the more “excitable” analysts out there, this is taken as proof that the offshore wind market is broken, and that government policy to go green is a failure. However, Orsted itself sees no problem in the offshore wind business. It’s most recent capital day still forecasts tremendous growth in the wind industry.

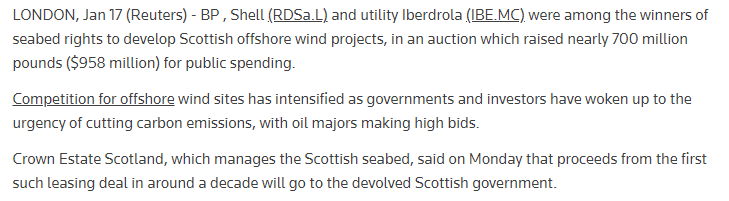

The problems of Orsted and other wind producers are not a failure of government policy but the success. As this Reuters article points out, the auction of rights to seabed in early 2022 saw record amounts raised, as BP, Shell and other big oil names entered the market. The problem for Orsted and other existing wind energy names is that new deep pocketed investors have entered in the industy, increasing competition for offshore wind assets.

Offshore wind suffers some of the same problems US shale suffered. Increasing competition bid up the value of the land, which diminished returns. This has led to reassessment of the returns available, and Orsted to go from being valued at 6 times book value to 1.7. The question is now one of policy. Does the government raise the price paid for offshore wind, so that big oil can earn a return on its investment in seabed rights? Or does it allow market forces to work, and force the value of sea beds lower?

As tradable carbon prices have remained very strong, my best bet is that at some sort of compromise will be reached, and offshore wind generation will continue to grow.

The green energy revolution continues unabated in my view. With investment in fossil energy falling, we should see firm to rising energy prices, and with growing competition for green assets, we will need to see rising prices to keep supply growing. Energy inflation looks set to return.