They say experience is good, but personally if I could trade experience for youthful dynamism, I would take that trade everyday. Sadly, its not, so we are going to have to settle for experience. And one thing experience has taught me, is that when your subconscious is not settled, then you need to take a beat and try and work out what is wrong. This also works the other way too. I think my subconscious knew that my friend, Michelle, would make a great wife, but it took a long time for my conscious self to catch up.

Working out what the subconscious it trying to say is definitely something that gets easier as you get older. And that’s not even just for myself. Whenever people say one thing, but then do another, its what they are doing that tells you what they really want subconsciously. Working out why they want that subconsciously can be hard to work out, but at least you know what they want.

Lets start with the areas where the conscious and subconscious parts of me are in agreement. It felt to me that political power was flowing back to labour and away from capital. For me this meant that inflation would be higher than expected, and that gold would likely outperform bonds. And the GLD/TLT trade has worked a treat.

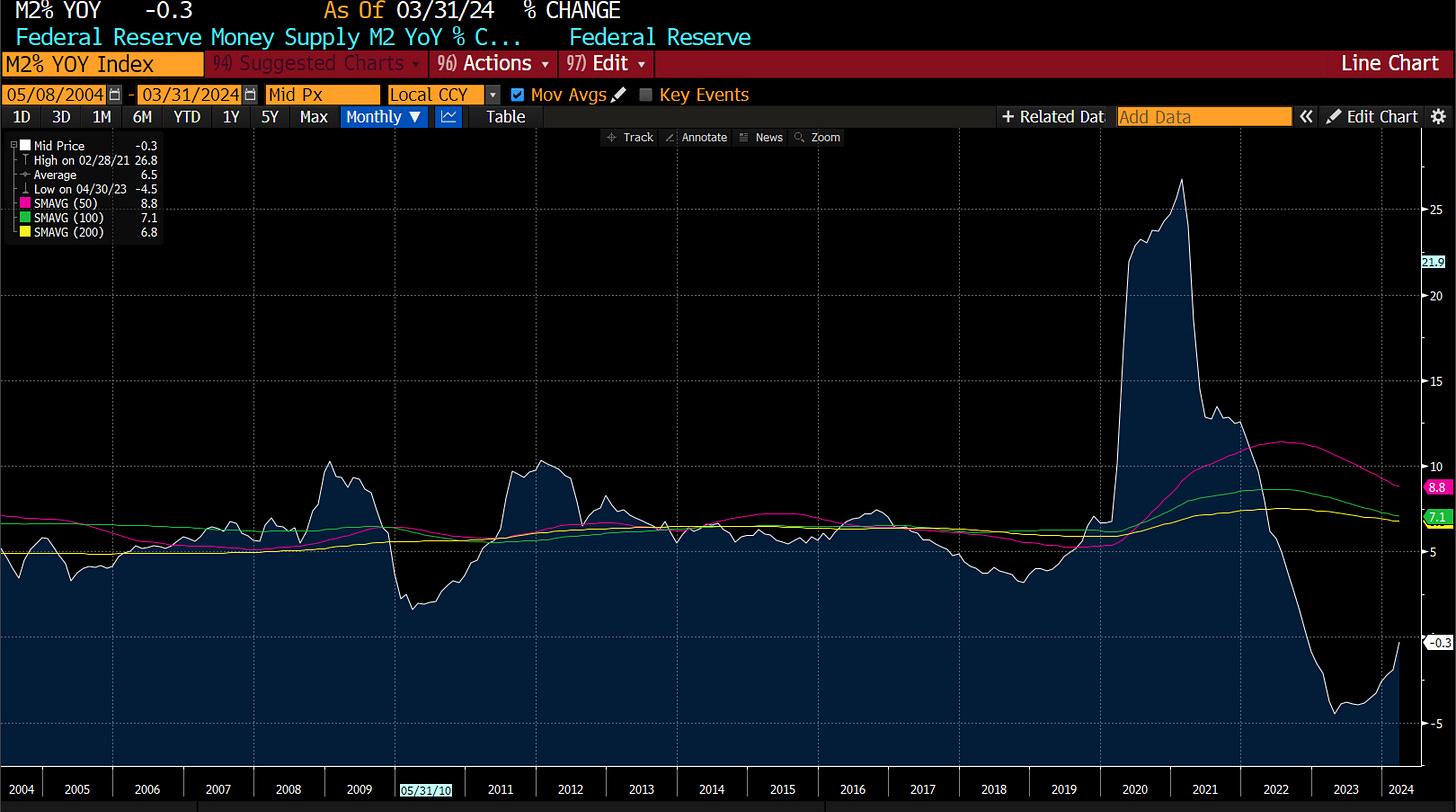

What I also thought was that we would transition from credit driven growth to wage driven growth. That is full employment and rising wages would be good for growth, but that the higher interest rates would see credit contraction. From a macro perspective, this has been correct, with US M2 growth turning deeply negative.

My inclination would be that commodities would do well, and that financial assets poorly. That being said, MSCI World has recently hit new all time highs.

Using a macro line of thinking like this, then assets like utilities should also be struggling. But we have recently seen US utilities break higher, I am thinking (in a conscious way) that this type of macro analysis does not really work.

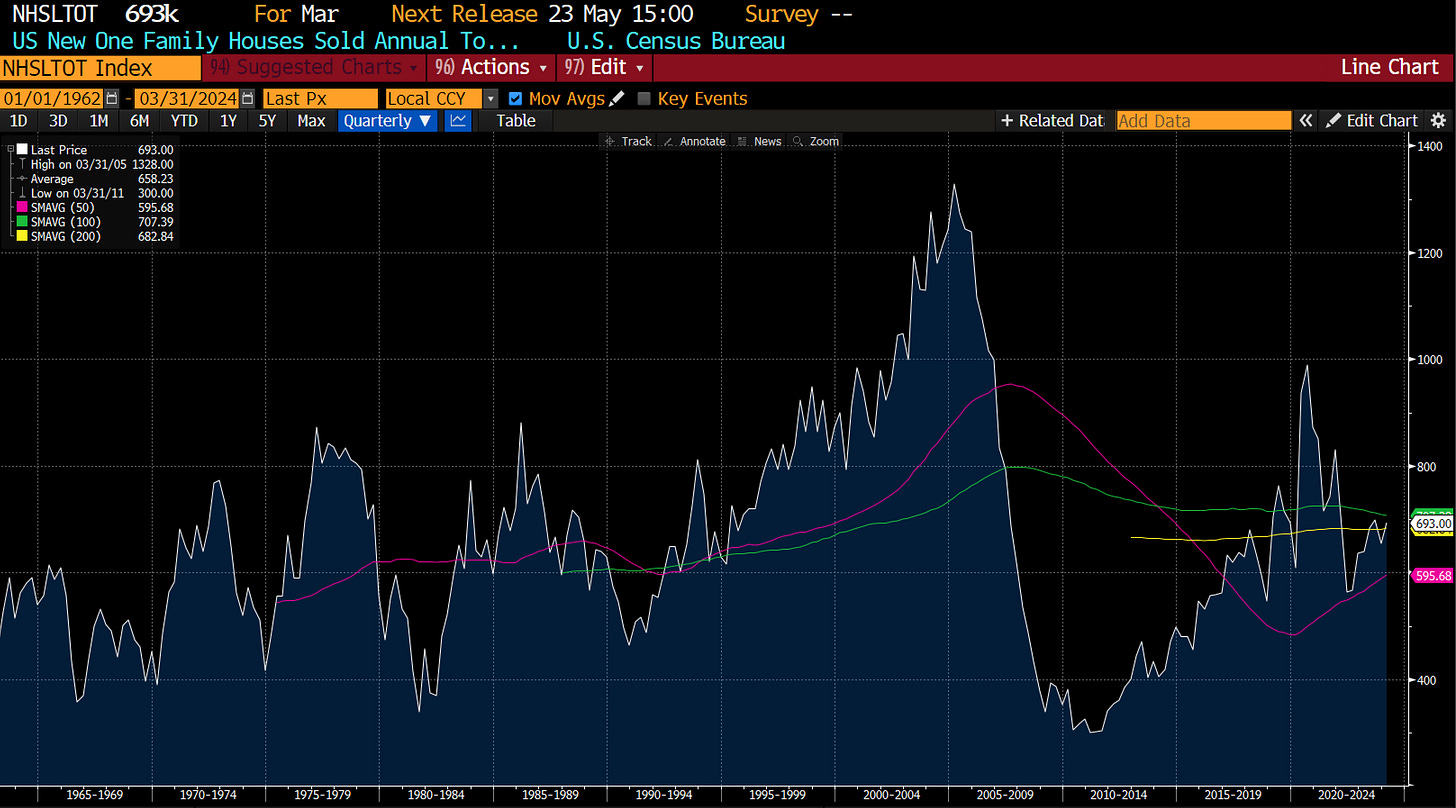

What I am starting to think, and with ample evidence, is that macro does not really matter that much. Industry and politics is the key ultimately. The subprime crisis, was the knock on effect of the US building too many houses.

The Eurocrisis was the knock on effect of Spain building too many houses.

The EM crisis of 2015 or so, was a knock on effect of too much commodity supply hitting the market.

As discussed, GLD/TLT could be working less because of some grand macro play, and rather many governments looking at how the US has tried to use financial sanctions to stop Russia and coming to the conclusion that Treasuries are not a “safe” asset.

I like shorting, but when I look at short ideas that have worked over the last few years, they have been driven by industry not macro analysis. Chinese tech was a good short because I read that the government was going to regulate them properly.

Starbucks has been a good short, because I started to see signs of a price war in the US, and Starbucks was trading by far the weakest of the food chains.

I think what my subconscious is trying to tell me is that macro analysis is fun - but has been generating declining returns for nearly 10 years now. Industry analysis, is really the key. Or buy industries where profits are going up, and short industries where profits are going down (hopefully where supply is overwhelming demand). Keep it simple, stupid.