Free market capitalism is a relatively new phenomenon. Many call the period before World War I as a period of free market capitalism, but that was the era of British Empire, where intra-empire trade could hardly be called free. The post World War II period was the era of Cold War and saw large swathes of the world run on Communist lines, and even in the West policy had a positively socialist bent. Only from 1990 onwards, with the collapse of socialism can we truly say we were living in a free market world, and in a world that is largely run along US political ideals. One thing that is clear, is that US corporates have outsized influence in setting policy. Ask anyone in the world to name famous CEOs, and the list will likely be 90% Americans, or CEOs for American corporation. Google search for famous CEOs pretty much sums up the US dominance.

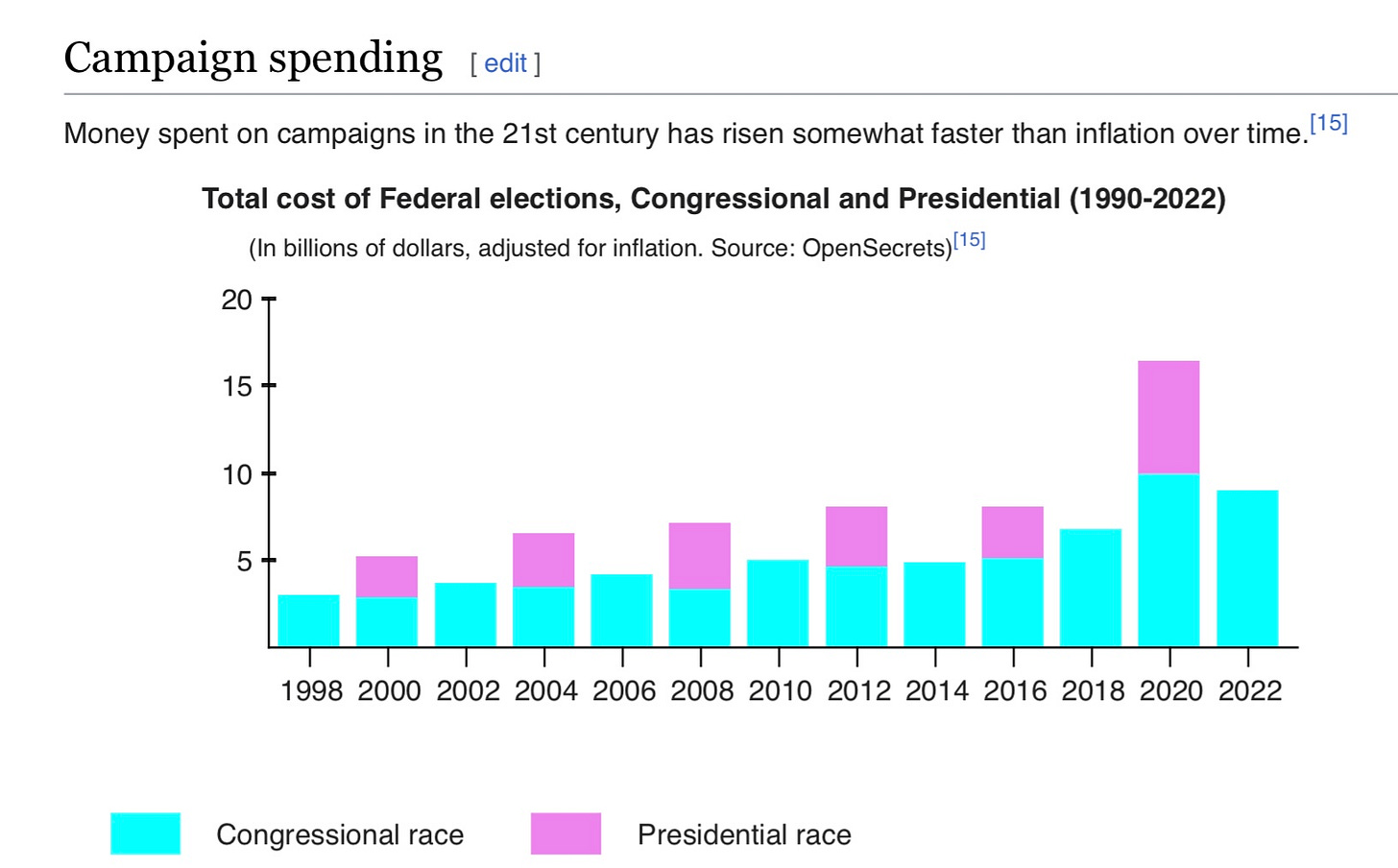

There are both positives and negatives to having a corporatocracy. It should be fluid, with new blood injected into leadership roles as new business models and industries evolve. Generally speaking, corporatocracy is considered a bad thing. On a positive side, I would say a political system driven by profit seeking/maximising behaviour tends to offer a great deal of clarity, and also tends to keep a society in dominant technical position. When the knowledge that a very successful business will also give you political power, it makes the profit seeking motive even stronger. With artificial intelligence been identified at the next big thing, the private sector investment this is driving by both existing players and new players is phenomenal. Historically speaking, corporatocracies are not politically popular. The Reagan/Thatcher revolution was really build on disillusionment with socialist policy making. Accepting that capitalism is the best form of government (or the least worst), then it follows that political power should follow economic power. In the US, politics has become more and more expensive as political and economic power has fused.

If you accept that US government is run for corporate interests, then it makes sense to maximise the US government balance sheet. That is borrow to the greatest extent possible, both to fund growth, and to minimise taxes to the corporate sector. This is entirely rational in a government run from profit maximising interests.

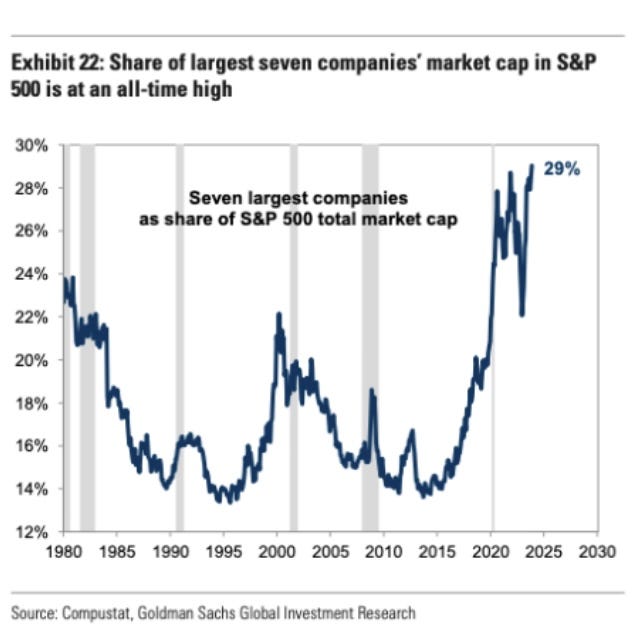

The logic of capitalism also suggests more and more consolidation, as dominant firms tend to be more profitable. This is also very apparent in modern markets. The concentration of market cap has become very extreme.

US policy making often looks to reduce government competition to the private sector as much as possible and to allow private sector to enter areas that are government dominated. Again a rational policy, which has yielded much success. Take the space industry. Allowing the entry of private sector players into this industry has transformed it. SpaceX now lifts more mass than all other government players combined. The Starlink system that this has allowed to deploy has become a strategic weapon, and a vital part of Ukrainian resistance to Russia.

If you fully accept the above arguments, then cryptocurrencies are just the next privatisation of a government controlled asset. This is not as far fetched as its sounds. The US had many private issuers of currency in the 1800s, but after the mass failure of many of their issuers, the “business of currency” was nationalised. Even today, the Hong Kong Dollar notes are issued by private banks, but backed by the government, who then runs a currency board which pegs it to the US dollar. Next time you are in HK, you can collect notes from the three banks authorised to issue HK dollar - HSBC, Standard Chartered and Bank of China. In the picture below, you can see the name of the issuing bank of the different notes. Cryptocurrencies are tech based version of bank issued private currencies.

The current logic of US markets and crypto implies an ever reducing role for government, which is often been an explicit goal of some leading technology players. Given the global reach of many US tech companies, the idea of a global currency would be compelling. Currently the US can compel any company or even government to follow its regulations, or pay tax by threatening to cut it off from the US financial system. Global usage of a cryptocurrency would greatly reduce the power of the US government to compel corporates to pay any tax, or at least strengthen their bargaining position. And that for me is the most bullish argument I have seen for cryptocurrencies - that it benefits US corporates. If this is true, you need to get long tech and crypto, and stay long. You also need to stay short treasuries, as the loss of tax revenue that crypto implies, combined with the massive wealth effect that crypto creates means much higher interest rates. My gut feeling is that like the 1970s was a time to buy financial assets as policy was slowly shifting from socialist to capitalist, I feel we are now in a period of capitalist overreach, and policy is slowly shifting from capitalist to socialist. That is the period of unfettered corporate power is coming to an end, but I can see how I could be wrong now. For me the real test will come when BOJ raise rates. Bull markets are built on dreams, and bear markets are based on realities. The true reality of markets will only be clear when the lender to the world taps on the brakes.