I met my wife in Japan over 30 years ago. We were both exchange students to Kansai University in Osaka in the 1990s. We were only ever friends in Japan, but when I moved to London in 2002, we met up again, and started dating in 2003 and have been together ever since. This year will be 20 years since we married. We had always talked about taking our two boys to Japan to see where we met, and with our oldest being 15, and our youngest at 12, this Christmas and New Years seemed like a good time to go. As the picture above shows, its hard not to like a country that likes the irony of using Tokyo building as a backdrop to a Godzilla movie where Tokyo buildings are about to get destroyed.

As both my wife and I had lived in Japan, we had a slightly unusual itinerary. We flew into Tokyo as that is the only airport you can fly directly to from the UK, and spent the night there. The next day on Christmas eve we got a Shinkansen to Kobe. My 12 year old had read that Japanese people eat KFC for Christmas, so I prebooked some KFC. One thing I found interesting was that I could only pay for it with Apple Pay. In fact, everything is easier in Japan with an iPhone - including paying for train tickets - which probably explains its 50% market share in Japan, higher than anywhere else. KFC for Christmas in Japan is pretty popular. I booked a month in advance, and could not get my first choice venue.

We spent a two more days in Kobe catching up with my old host family and my brother and his family who own a flat in Kobe. Kobe has a few tourist destinations, but generally speaking this was a tourist free zone. I think this made it even more affordable than other cities in Japan. After Kobe we spent a day in Awaji Island, going to Nijigen no Mori.

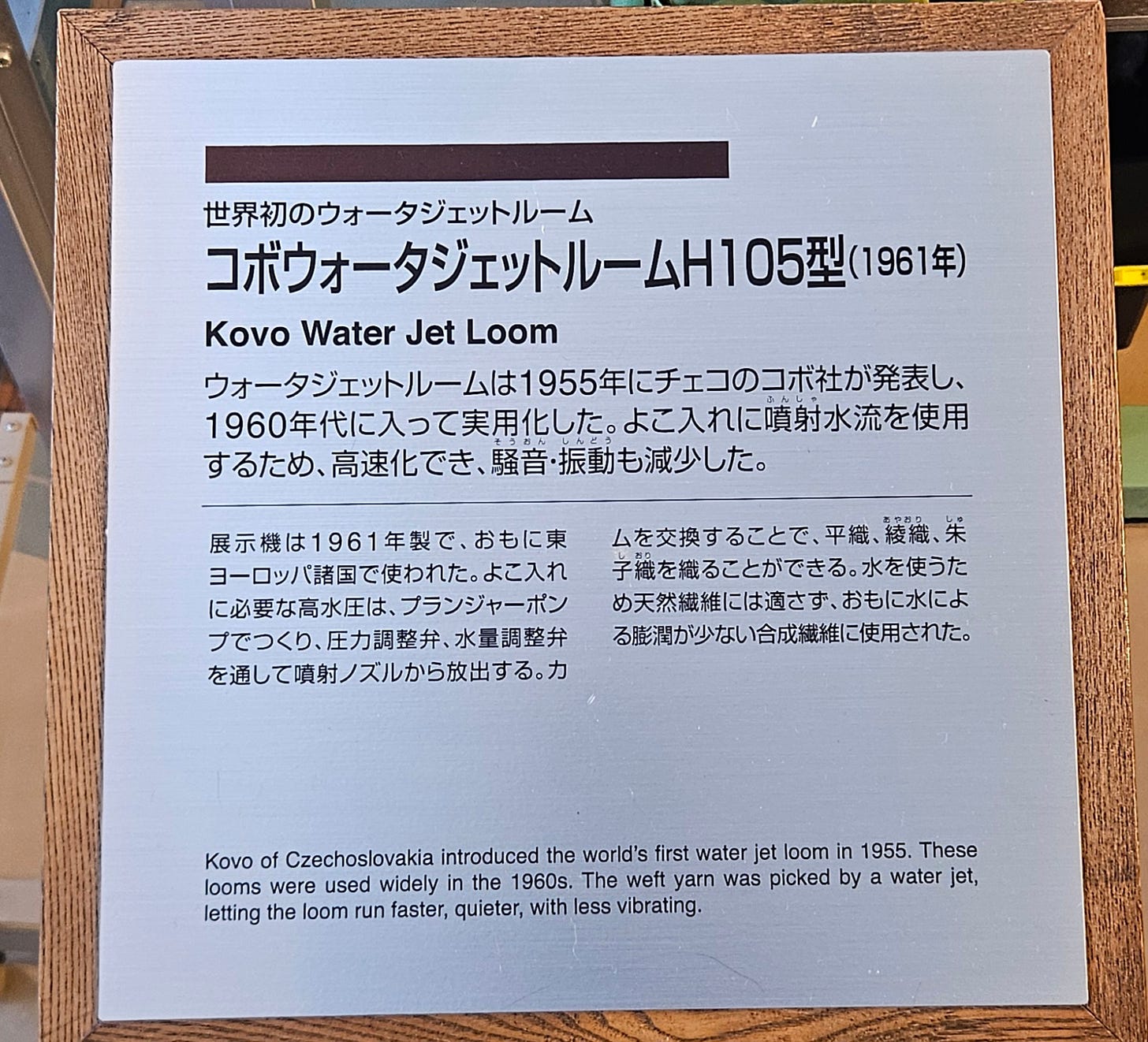

This is well off the beaten track, but there were a surprising number of foreign tourists here - mainly for the Naruto theme park. Naruto is a manga/anime series I am not familiar with, but my 12 year old loves. My wife and I were more excited by the Godzilla themed rides. After Awaji, we returned to a more usual Japan itinerary of staying in Osaka, Kyoto and Tokyo although we did take a day to go see the Toyota Commemorative Museum of Industry and Technology in Nagoya. While you think this would be about the development of the Japanese car industry, its most interesting part is the development of the loom industry. Toyota was a loom and textile company well before it was an automotive company. To see the development of looms through this room is to see the development of the industrial age. Highly recommended.

One of the more arresting looms was one that was developed in 1955 in Yugoslavia. It was the first loom to use a water jet - a huge technological breakthrough. I have become used to the idea that the Soviet Union and its client states were always followers in technology, but these seems to imply that in the 1960s, they were innovators. My brother’s view was that in 1950s you still had a properly educated workforce, and it is only once they started to leave that the rot set in.

Overall, it was a fun an interesting trip. The boys loved it, as we allowed them to run around in downtown Osaka (Namba) by themselves for a couple of days (the grid system makes it almost impossible to get lost). And my wife and I were able to do some side missions. One side mission was to visit our old university and dorm. The amount of construction that has happened in that area was extraordinary, and we barely recognised the area. There was also plenty of infill development, where a few parks turned into apartments. This seems at odds with the declining population of Japan - but the Japanese love building things, and are very good at it. The commitment to building has probably helped keep Japanese property prices reasonable.

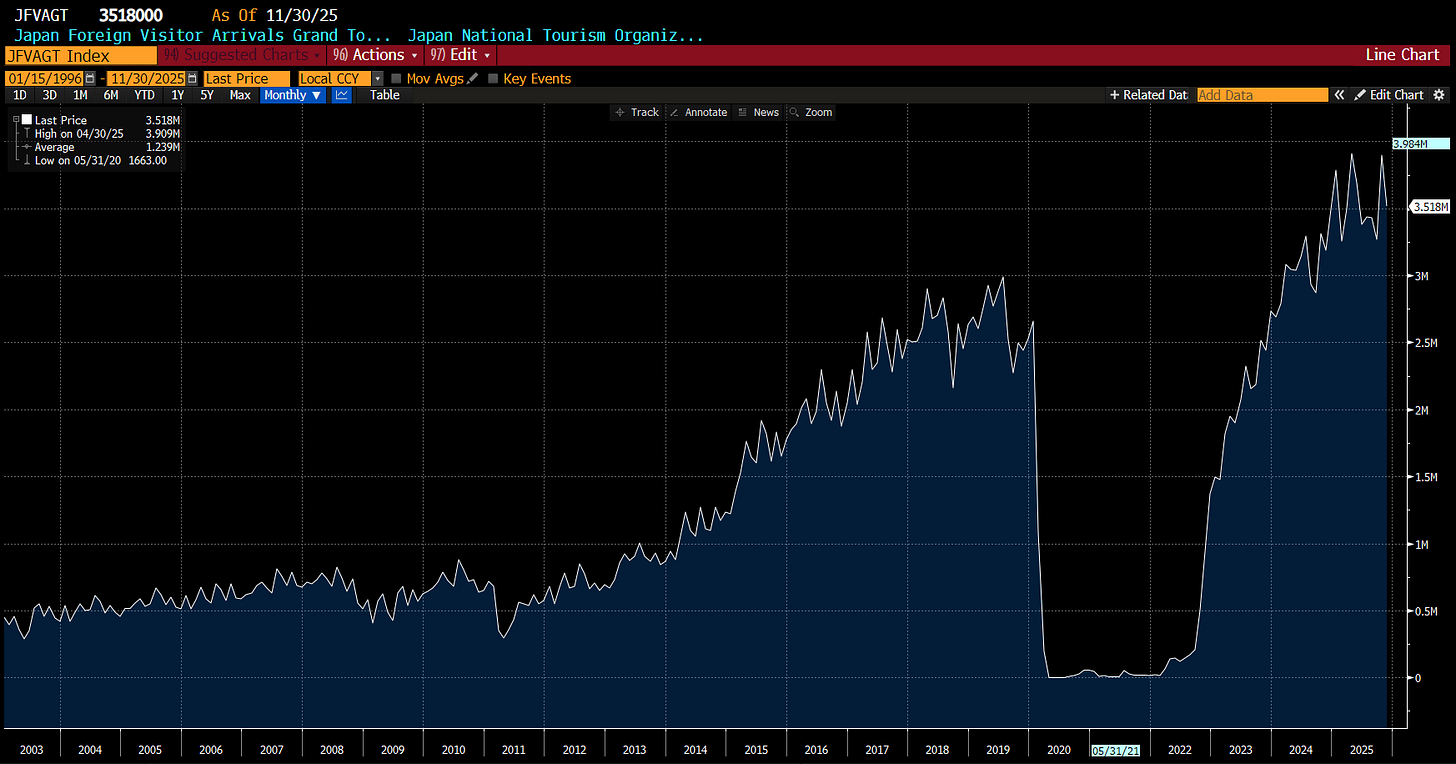

I first went to Japan in 1991, so I have a 35 year time frame to compare changes. The first and most obvious one is that there are far more foreigners in Japan than ever before. First of all tourist arrivals are up nearly 10 fold from 2011.

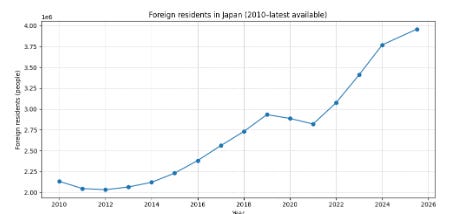

This has been coupled with a near doubling in the number of foreign residents in Japan since 2010.

Back in 1990s, outside of the tourist areas of Tokyo and Kyoto, you did not see that many foreigners. These days they are everywhere. This has caused three big changes in Japan. First, this has also meant that the English ability of the average Japanese person is now much better than it was. This also makes Japan much more accessible to non-Japanese speakers. Secondly, the boom in tourism has meant you now have the rise of tourist traps. Whereas in the 1990s, it was hard to have a bad meal, now it is very possible. Red flags are a preponderance of foreigners eating somewhere, and a bigger red flag is having a foreign chef. If its popular with social media influencers, the chances of it being average and bad value for money skyrocket. And thirdly, where as Japanese treated foreigners with some deference in the 1990s, this is largely eroded. In fact, the rise of tourism has probably turned Japanese suspicions of their own superiority into a firm belief.

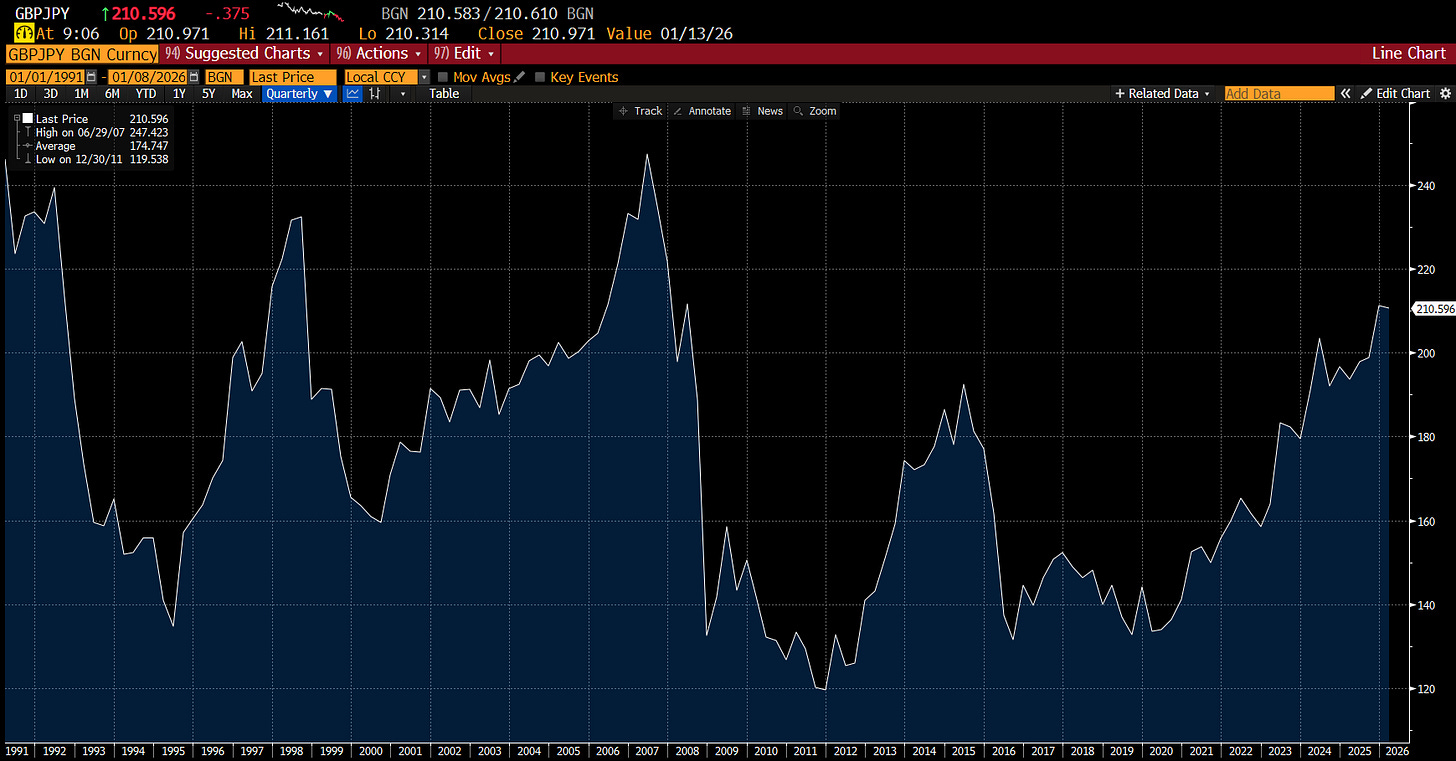

Getting to Japan was expensive, and hotels were also not that cheap, but eating in Japan is cheap. I think this has caused one of the more striking features of Japanese tourism boom, which is the rise of Asian middle class tourists. Getting to Japan from other parts of Asia is much cheaper than from Europe. Certainly I was struck by the number of Indian and Filipino tourists we saw. The idea of Japan as a holiday destination for middle class Asians would have been preposterous in the 1990s, but it is a reality today. But the fact of the matter, is that Japan is cheap place at the moment. GBP/JPY is the exchange rate that I think in which is currently at 210 - which is a level we saw back in the 1990s and a few times since.

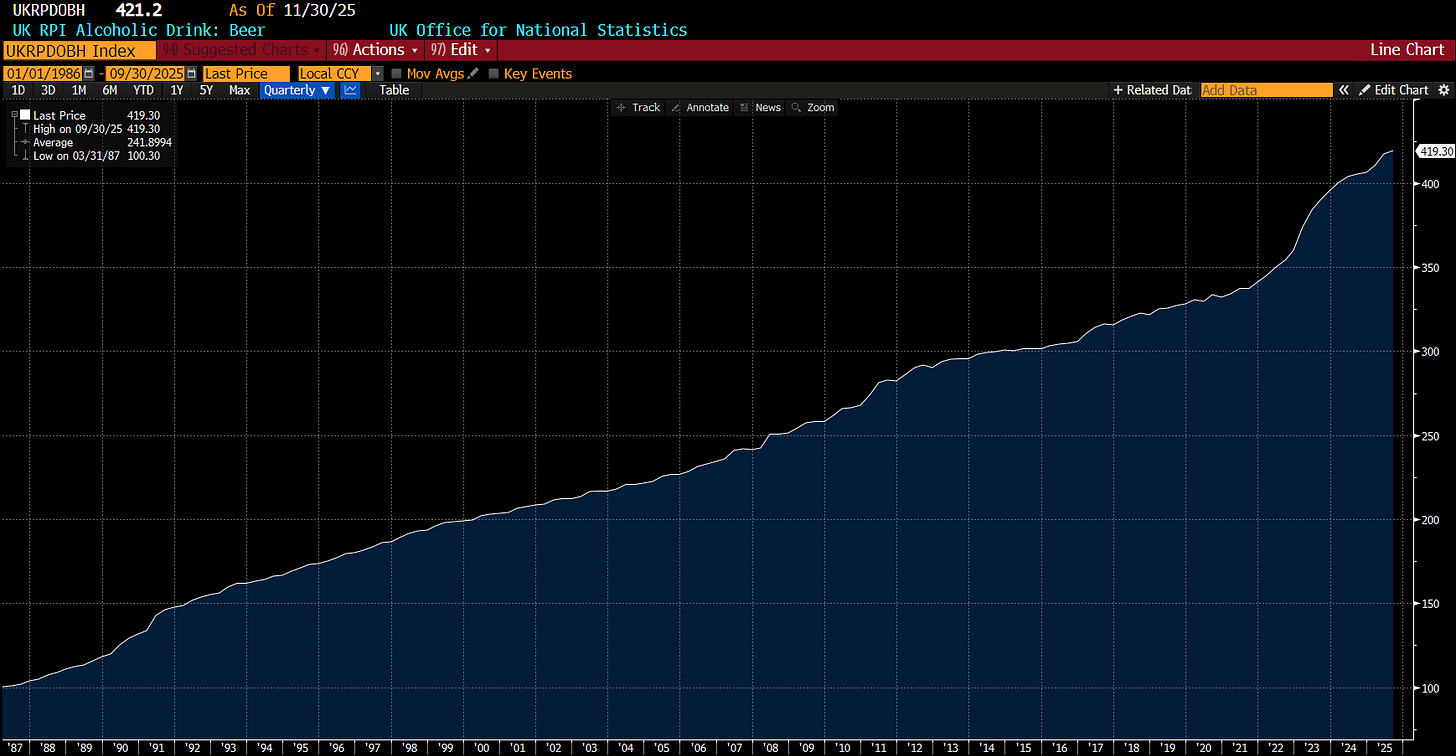

In the 1990s in Japan, beer cost around 500 to 700 Yen (sometimes more). Prices today are a bit higher, but cheap beer can be found. In the UK however, beer inflation (beerflation) has been steep - with beer prices up 300% from the early 1990s.

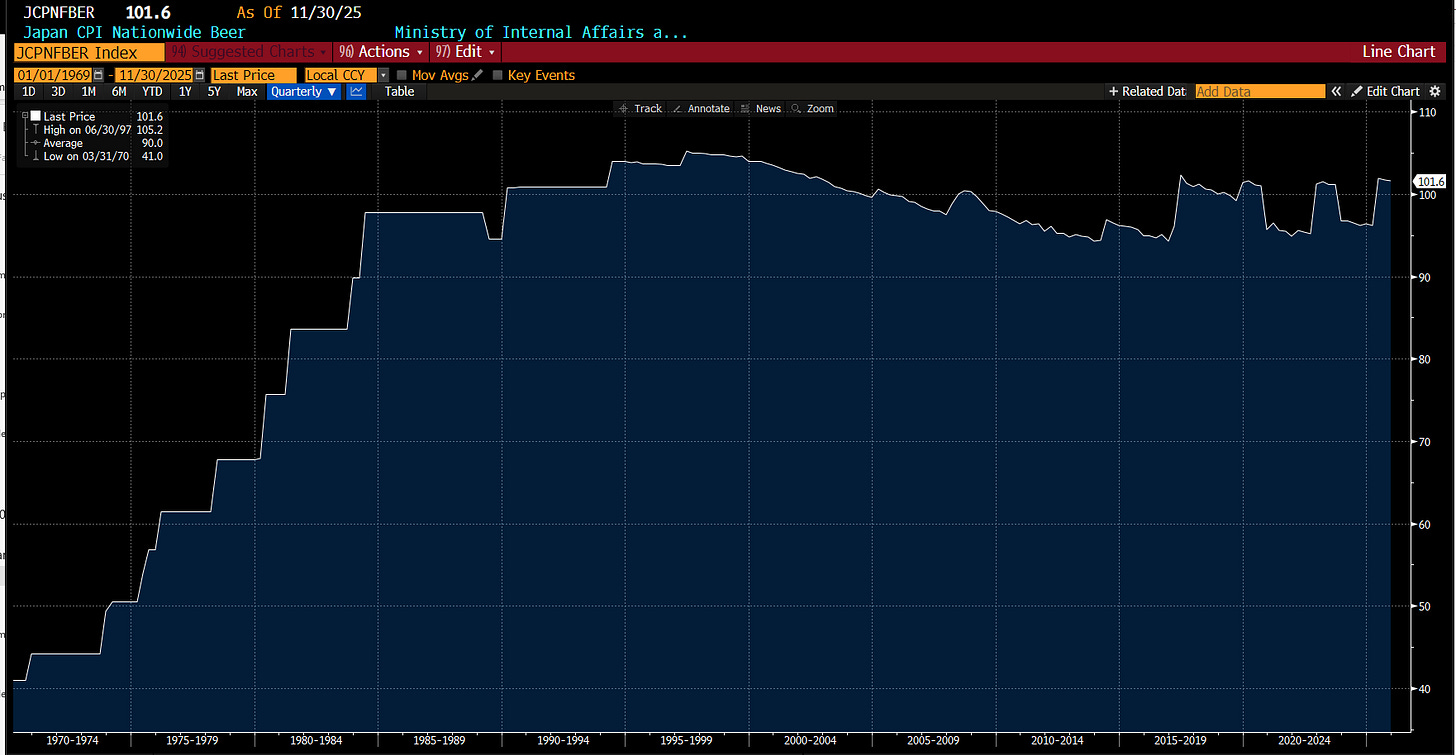

Japanese beerflation has been flat since the 1990s.

What that means in practical terms is that if you are not too fussy about where you eat, you can get a bowl of ramen, with gyoza and a beer for 1,900 Yen, or £9.50. In the UK, you would probably need to pay £25 at least for a beer, gyoza, ramen combo. If beer conversion rates were guides to exchange rates then GBPJPY would need to move from 210 to something closer to 80.

Japan is cheap for foreigners that is for sure. But one thing I heard regularly on the trip, from taxi drivers, to chefs and from friends is that Japanese wages are too low. Much like the rest of the world, Japan is suffering from a cost of living crisis. Generally speaking, I struggle to see how the price of goods can fall in Japan with the tourist boom providing support to prices. This means that wages will have to rise at some point, which is why I think JGB yield continue to rise. Rising wages will drive inflation higher.

So what is my advice on Japan? For tourists, go now, while prices are cheap, particularly if you can find cheap flights. Avoid eating anywhere with too many foreigners as customers, and anywhere with foreign chefs. For investors, I think the Japan boom will continue. Policy seems set to get prices to rise, and wages and land prices have room to move. Generally speaking I dislike investing in countries that seem expensive - which in this case would be the UK and the US.