In macro world, there seems to some existential angst as to why gold is performing so well in a rising real rate environment. Generally speaking, positive real rates, and in particular moving from negative to positive real rates has been negative for gold.

This mystery is compounded by the strength of the dollar. Rising real rates in the US should drive a strong dollar, but also a weak gold price according to theory. In this case gold seems to be acting odd.

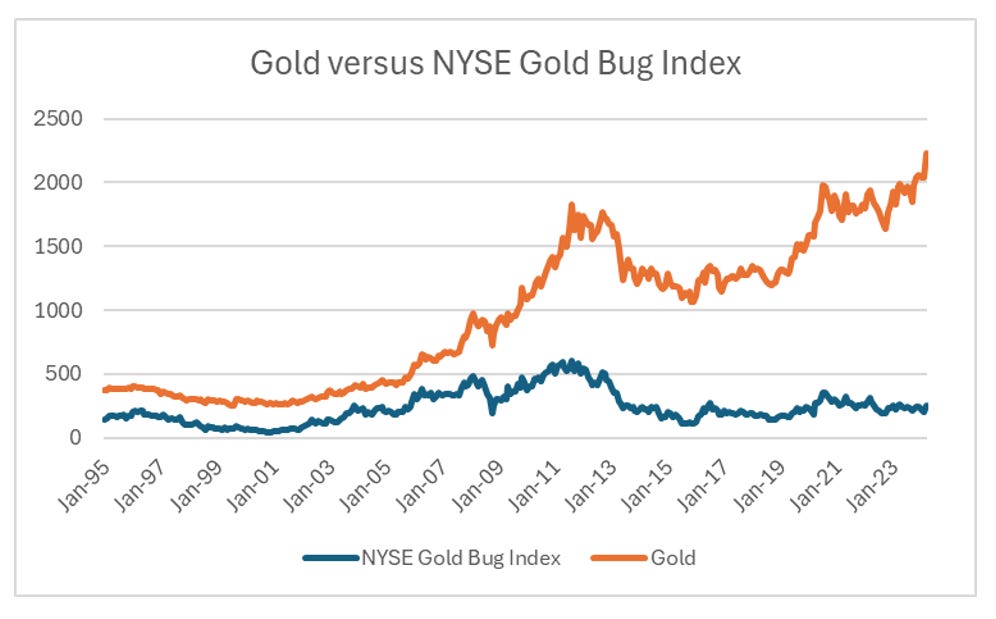

Compounding the pain of macro strategists, gold miners have massively underperformed the price of gold.

No doubt the same strategist are now pounding the table on these dislocations, either saying gold is the wrong price, or the US dollar is wrong, or Fed is about to cut rates or some other combination of “market is wrong”. But as I have said before, and will say again, the market price is truth, the question is whether you are willing to accept that truth. The truth that markets are telling you is that the cost of mining is rising. Last year, I have an ex-client tell me that cost of hiring a gold miner in Australia was AUD 1mn a year. I was incredulous, until he explained that you needed two employees at an Australian mine to make the equivalent of a one full time employee. You then needed to add in accommodation, food, health, and insurance for these two workers, on top of AUD 250,000 salary, and you got to AUD 1m a year. Taking current gold price, and Australian dollar exchange rate, this one worker equivalent needs to mine 300 ounces of gold (3/4 of a gold bar). This is 8500 grams of gold. A high quality mine will have 10 grams of gold per tonne of ore, which basically mean 850 tonnes of ore will need to be mined, or bit more than 2 tonnes a day, to find 20 grams of gold (I am not a gold mining specialist, but these numbers seem about right to me - please contact me if I am wrong).

What the all time highs in gold, and the weakness in gold miners tells me is that mining costs are rising as quickly as the gold price. You would think the strong dollar would be putting downward pressure on mining costs, but the strong dollar is really a reflection of a weak Yen the pressure its putting on other exporting nations. Mexico, a large gold and silver mining nation has seen extraordinary currency strength.

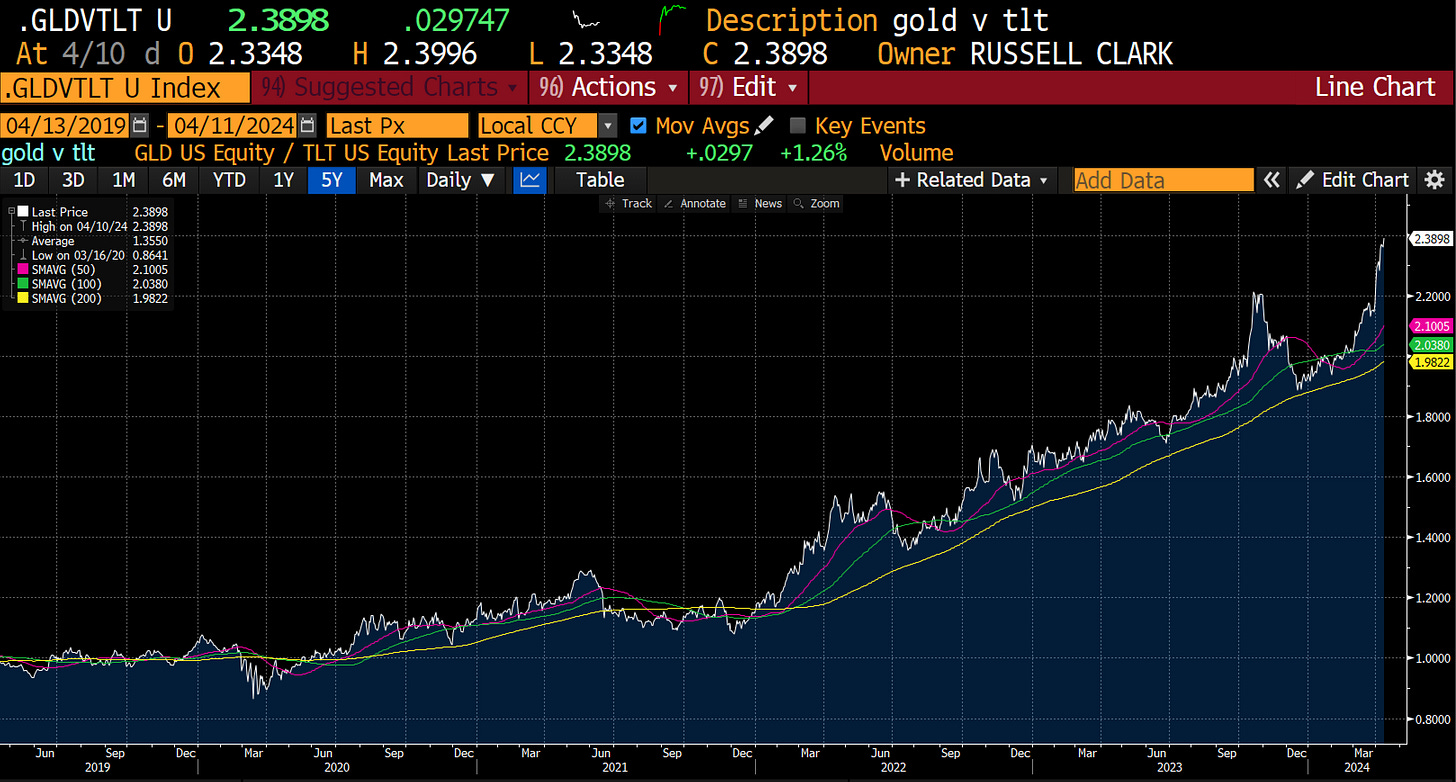

Pro-labour polices are inflationary, and this cost pressure is driving gold higher and bonds lower. GLD/TLT has broken to new highs.

Its a pro-labour world - and no-one really cares if gold miners make profits or not, as long as workers see REAL wage increases.