In the UK, Labour has the opportunity to introduce pro-labour policies. Given that the election was more about the rejection of the Tories than embrace of Labour, the new government should be under real pressure to deliver results in its 5 year term. If we assume a “neo-con” policy like the US is not possible in the UK, then what should we expect? Labour winning the election has been widely expected, so unlike with Brexit or Trump’s election in 2016, there were no wild gyrations in bond or currency markets. But Labour does have some clear policy objectives that it needs to achieve it hopes to be re-elected. One of this areas is to get house prices under control.

With recent rises in interest rates, affordability for first time buyer has worsened. With mortgage payments taking 36.5% of take home pay.

This has led to mortgage volumes being lower ever since the GFC.

The recent reduction in housing affordability is driven by rising interest rates. a 2 year fixed mortgage has from from 1.5% in 2021 to 5.16% today.

Let make some reasonable assumptions. First, Labour want to avoid the fall in house prices that happened in 2008, and any rise in unemployment. That means, they basically want house prices to stay flat. If interest rates stay at 5%, how much do wages need to rise by in 5 years to get back to “reasonable” house price? So lets say, 25% of income is used on mortgage payments - and also assume that house prices stay flat. What would the rise in income needed to be? Well using available data, we can see that the cost of a first time buyer has risen significantly as interest rates have risen. (For anyone trying to replicate below, I use BOE Base Rates + 2%, and a 25 year mortgage, at 75% LTV)

UK Wages have risen recently, but not as fast as mortgage costs have risen.

If we assume that house prices stay flat, how much would wages need to rise to get back 2000 levels of affordability? In 2000, wages were £16300, mortgage rates of 8%, and house prices were £90,000, or 5.5 times wages. Assuming similar mortgage costs, wages would need to be £51,500, or 46% higher. Over the five year term of parliament, would imply 8% increase in wages annually. Real wages in the UK have risen around 2% a year since 2000. This implies 6% inflation.

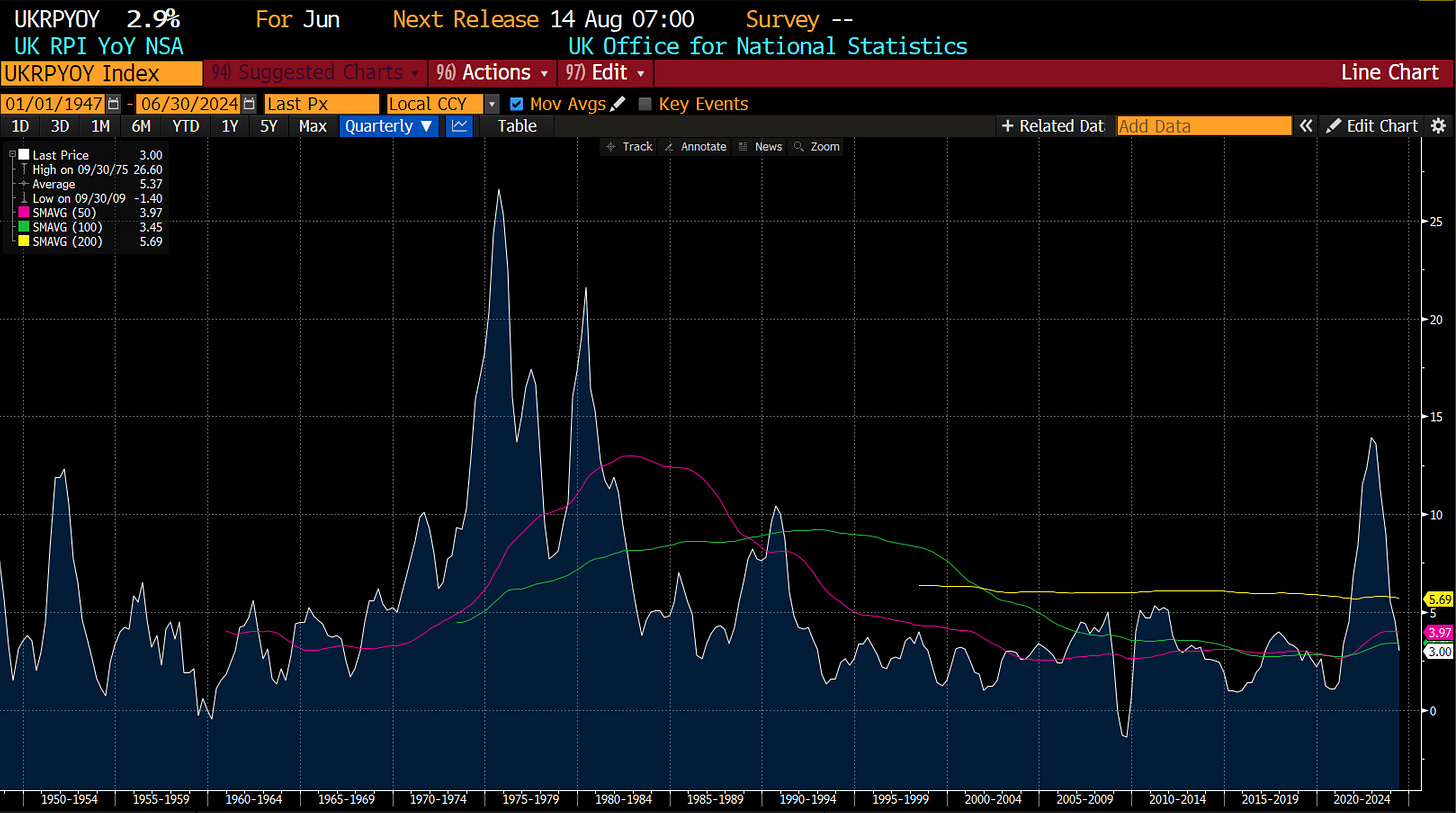

Politically, it hard to see how inflation does not return to the UK, even if recent numbers are suggesting a return to disinflation.

One thing I think Labour is trying to do is to crash the first time buyer market for housing, by greatly increasing supply. If they can achieve this, then wages will not have to rise so much, but I suspect would make winning the next election harder. Lower interest rates that push up house prices would not be beneficial either. Another option would be to reform council tax, to encourage empty nesters to downsize to a smaller home. But absent a recession, I would pencil in 8% nominal increase in wages in the UK. UK 10 year gilts at 4% look a sell to me.

One complicating factor I left out of this analysis was the effect of higher inflation causing interest rates to rise, requiring more rapid wage increases, leading to an inflation spiral. I think that is possible, but is not my base case. Lets see if Labour can work for labour.