One of the quiet joys of writing a newsletter is that everyone knows what you are thinking so without any encouragement on my part, I am often told how I am wrong. The trades that I am “wrong” on, tend to be the best ones. And of late, I seem to be inundated with people telling me how wrong I am on bonds. Like the grim reaper, the solemnly tell me the short bond trade is done - and my demise is imminent. Of course many of these same people were screaming that JGBs were shorts through the 1990s and 2000s, but having a memory is a (marketing) hazard in financial markets. The reason that JGBs were a raging buy (and short JGBs were the original widowmaker trade) during the 1990s and 2000s was because wages stopped rising in Japan. Below is the IMF Japan Wages Monthly Earnings tracker.

What happens when population growth is stagnant, and wage growth is stagnant? You get stagnant GDP growth.

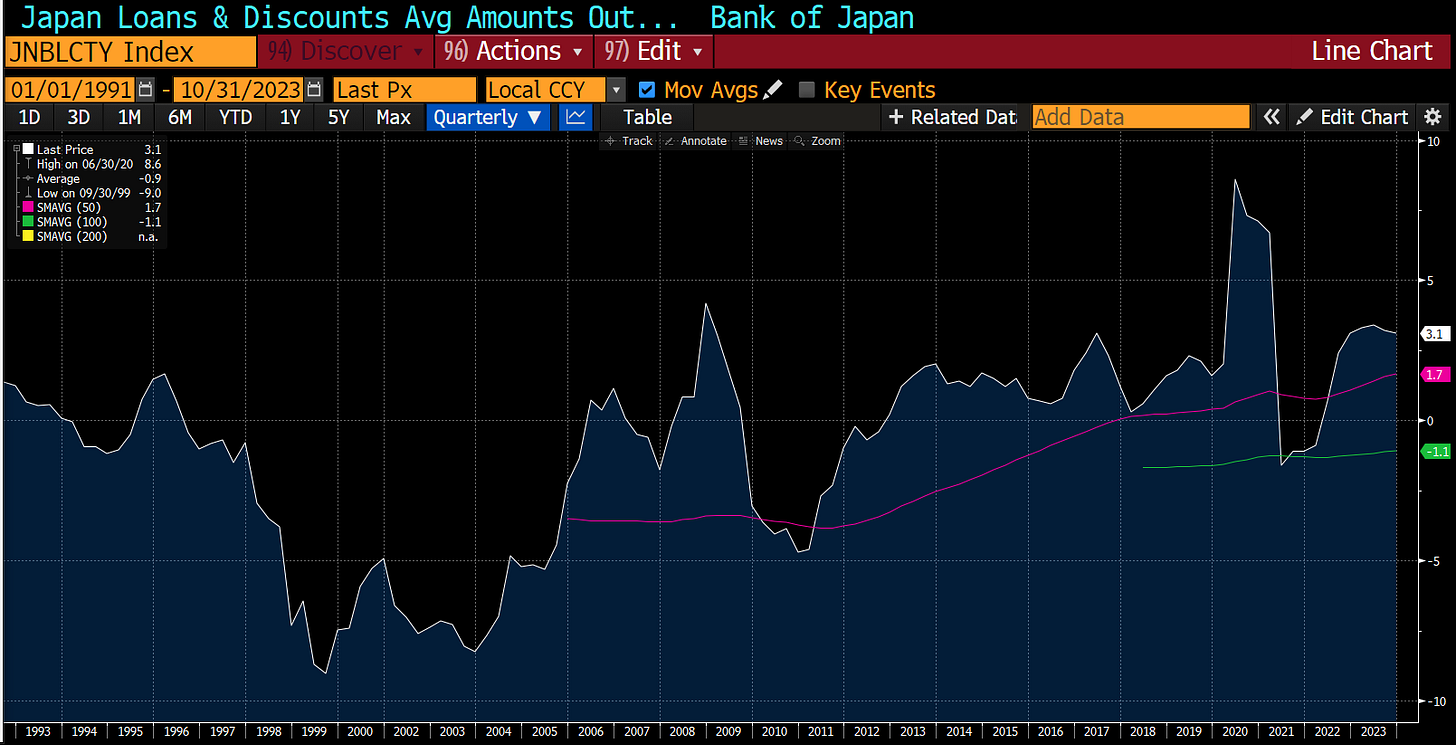

In such an environment, the credit cycle is the business cycle, and central banks have to do their best to encourage this by keeping interest rates low. Whenever you have seen credit cycle turn down in Japan, crisis was soon to follow.

Japan is an extreme example as in 1990s Japanese wages were so much higher than the rest of Asia, and with slowing population growth, caused outright deflation. But the same lessons broadly applied to the US as well. When ever the US credit cycle turned, crisis and bond rally returned.

With collapsing mortgage refinancing, I can understand the bond bullishness.

The problem with this analysis is that it ignoring the political and financial priorities of governments. Moving to a pro-labour policy means nominal growth will accelerate. We are already seeing this as work.

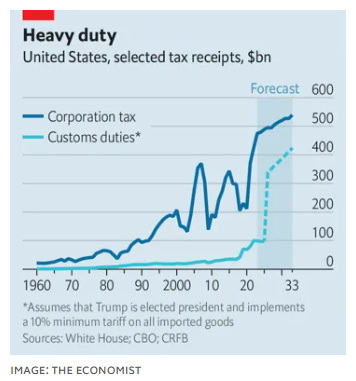

There is another huge benefit for the US government to promote wage growth. Individuals pay tax, while corporates have generally found ways to avoid paying tax. US corporate tax take is still at 2006 levels, while individual and social insurance tax take has soared.

What Trump has shown is that custom duties can be collected much easier than it is to collect corporation tax. As the Economist points out Trump’s proposed 10% minimum tariff would collect almost as much tax revenue as corporation tax.

The pro-capital policies of the last 40 years have come to their natural end. The market power and concentration of US markets has led to the benefits of economic growth being concentrated in tax advantaged corporates. Politics and finance concerns all point to pro labour policies and rising wages. What this means is that economic growth can be separate from credit growth. There are already some signs of this change. Very high real rates are having little effect on economic activity.

Technically my favourite idea, GLD/TLT has come back to its 50 day moving average after spiking last month.

I also think that alot of people have put their money where their mouth is, by buying TLT aggressively. Shares outstanding in TLT continues to surge.

For 40 years, short JGBs was the widowmaker trade. I think long TLT is the new widowmaker.