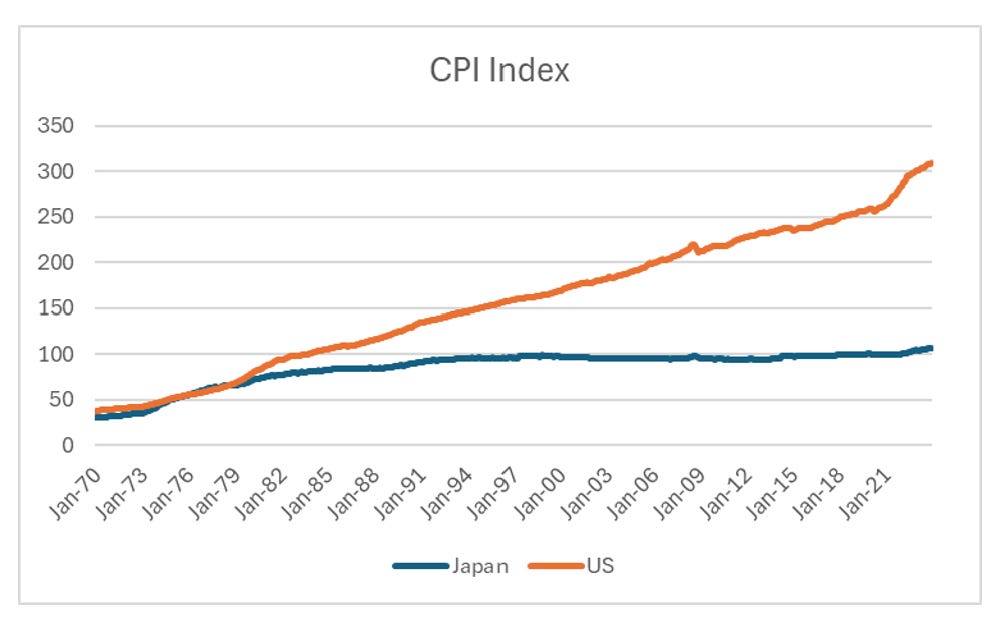

Japan has and remains fascinating. For years economists and hedge funds always assumed the yen would collapse, and JGBs were a short. This was based on the history of every other country that had run large fiscal deficits and a central bank that kept interest rates very low. My original thoughts on this was that “free markets” were keeping the Yen strong, and JGB yields low. By free markets I meant that without inflation, Japan should have a strong currency to keep its prices near a “free market” level. Japanese prices have not moved very much since the 1990s, while the US has doubled.

One upshot of this “free market” view was that it made me think central banks were broadly speaking “useless”. They could talk about inflation targeting, forward guidance and all that other stuff, but in a free market world it would be broadly pointless, and possibly even self defeating. Forcing credit and currencies to non-economic levels would just lead to greater deflation when the “free market” worked again. This for me explained the Yen as a safe haven currency phenomenon that existed until relatively