As laid out in a recent post, I think I see an opportunity for a fund. As explained in many posts, I see politics moving pro-labour and away from pro-capital. This makes me bullish on wages and real assets, and bearish on financial assets. The simplest (and so far best) way to express this has been long GLD, short TLT. If central banks shy away from tight monetary policy, then I expect assets like gold to do well, and long dated treasuries to do poorly. So far, the GLD/TLT idea has worked like a dream, with a very big break out recently. I suspect the very big move in recent days is coming from some talk of the Federal Reserve being done with rate hikes. In a pro labour world, this will drive a sell off in TLT and a rally in GLD. Central banks are the only thing that can restrain inflation, and rates will need to keep rising.

For people that do not like the negative carry of the GLD/TLT idea, I suggested the idea of long HYG short TLT. In a pro-labour, rising wage world, credit expansion is unnecessary for growth. So while many macro analysts are calling for a credit contraction driven recession, I doubt we will see one. That means HYG, will do better than expected, and the shorter duration of HYG should see it outperform TLT. This has been the case.

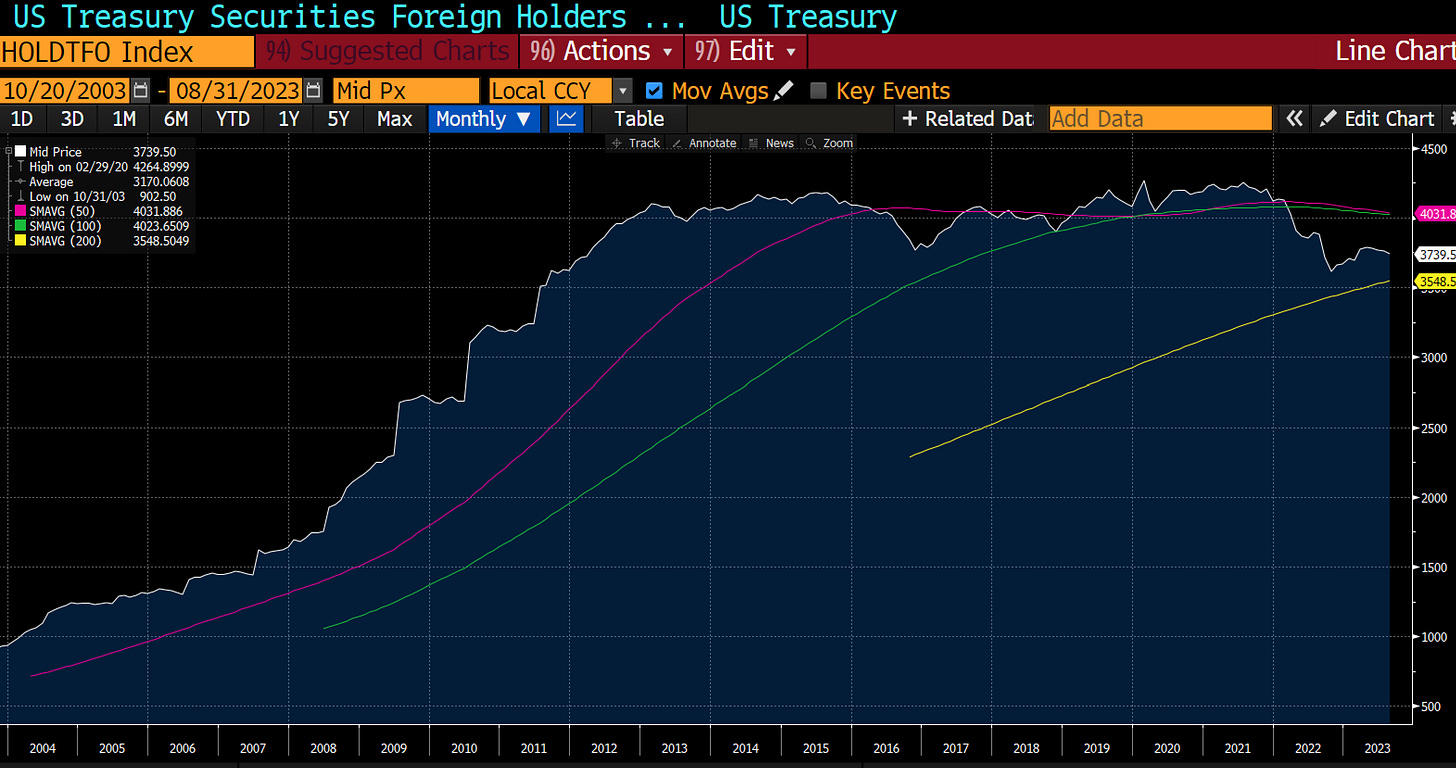

In a pro-labour world, regulations and tariffs are necessary to protect domestic wages. This also means there is little benefit to devaluing the currency, as this just reduces real wages. This makes the exporter led treasury buying unnecessary. What this means is that foreigners are no longer the main buyers of treasuries. And this is what we see (at least in foreign exchange holdings).

If foreigners are not buying treasuries, then who is? Well locals are (the ones getting the wage increases). This can be seen in the surge in shares outstanding for TLT or in the large increase in money market funds.

GLD is representing real assets, namely commodities, while TLT is meant to represent financial assets. The problem is that S&P 500 continues to outperform treasuries. Using long dated Treasury return index, and comparing to the S&P 500, I would have assumed at least some weakness in the S&P 500 this year. This has made short selling problematic.

So the pro-labour “system” makes sense to me. GLD/TLT has been great, but the surprise for me has been how well the S&P 500 has held up. S&P 500 has held its value against gold surprisingly well.

However, the S&P 500 has been dominated by a few mega caps. Getting way from these names, we can see the outlines of a short portfolio. Roughly speaking, this model would suggest a short portfolio of bond proxies and businesses that don’t work at interest rates north of 7%.