I used to get asked by young fund managers for advice in making it in the hedge fund industry. I always gave the same advice. There are two key jobs, making money, and raising money. Of the two, the second is the most important. Most young managers think of themselves as proto-Warren Buffett’s, and just want to focus on investing. I then point out, as great as an investor that Warren Buffett is, he also solved the raising capital part of the business by buying an insurance company, and investing “the float”. Without this captive capital base, Berkshire Hathaway would be a forced seller of assets in the GFC just like all other long biased fund managers.

Most fund managers are terrible presenters, which is why they hire large sales teams to do the talking for them. Of all the fund managers I have seen present, I would say Bill Ackman is one of the best. He is very good at building rapport with allocators, and very good at explaining his ideas. As an investor he has generally outperformed the market, except for the period from 2015 to 2017.

This period of underperfomance was driven by Valeant Pharmaceuticals, which was covered in the Netflix Dirty Money series. Valeant Pharmaceuticals was the biggest corporate fatality of the generic drug scam that Martin Shkreli (pharma bro) was famous for. Valeant is now listed as Bausch Health Cos - the loss of value was phenomenal, but Ackman also rode the escalator up on Valeant, which led to him having outstanding performance in 2014.

It was after this period of outperformance that Ackman sought to raise “permanent capital” in the form a closed fund listed in London and Amsterdam. The raising of permanent capital was close to the top of performance, and the problems with Valeant saw the Pershing Square Holdings perform poorly, losing half its value, but investors that held on have been reward with excellent performance over the last 5 years.

Ackman tends to run a concentrated and transparent portfolio. His big winner recently has been Chipotle, but he also has a large position in Restaurant Brands International.

Chipotle has been a consistent winner for Ackman. As I have pointed out a few times, I personally have found the trends in US fast food industry very difficult to read, but to Ackman’s credit, he bought into Chipotle when the business was suffering due to a salmonella outbreak, and has reaped the rewards.

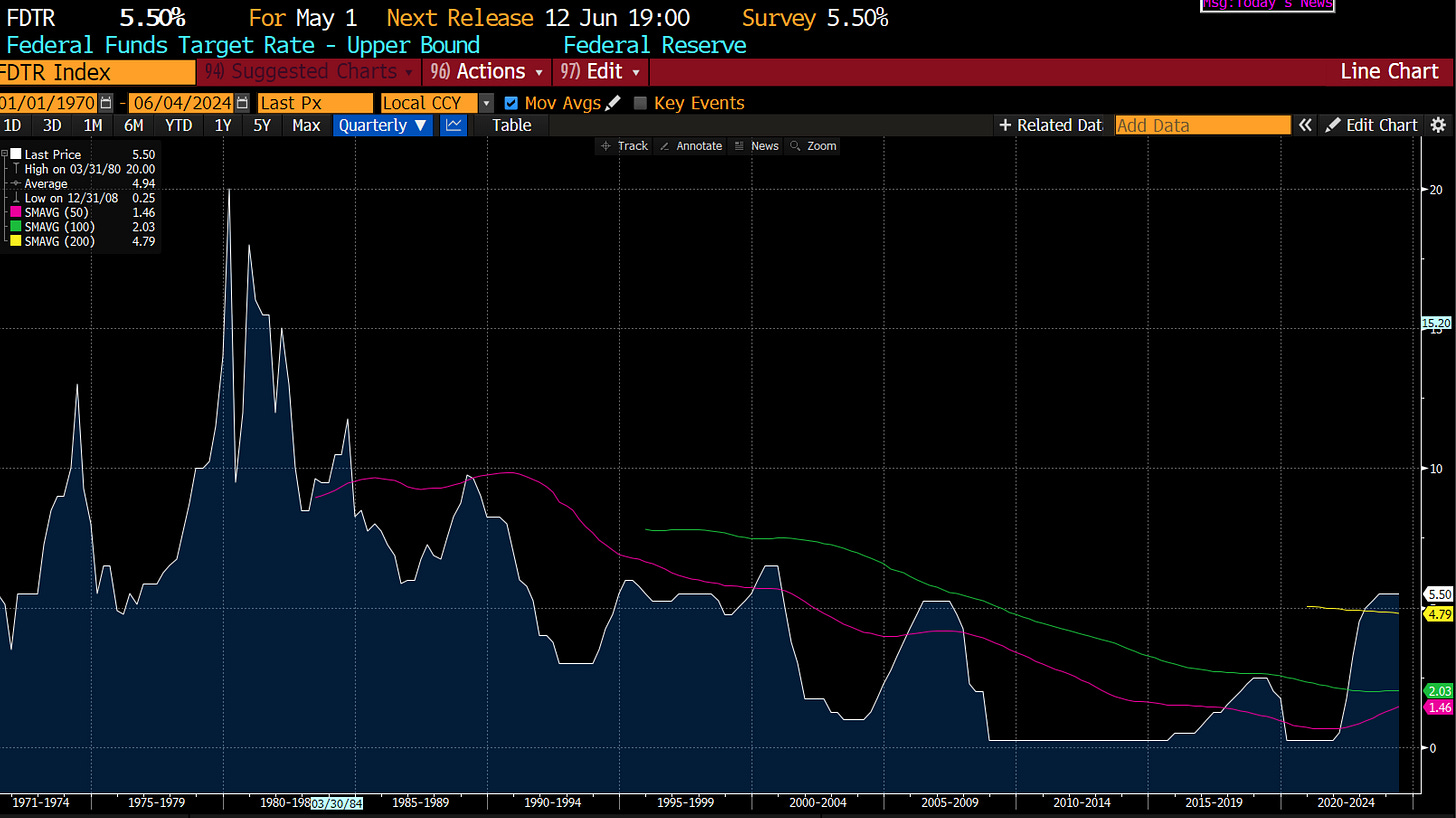

Ackman is in the news as he plans to launch another closed end fund for US retail investors, with a planned size of USD 25bn, and has sold a 10% stake in the firm for US 1bn. If, and this is a big if, he successful raises the US 25bn for the closed end fund, this would value the firm at around 22% of AUM. (Current assets of USD 19bn, plus prospective USD 25bn, gives us USD 44bn, with an implied business valuation of USD 10bn). This is punchy, but inline with other listed alternative asset managers. That he sold the stake in the firm before actually raising the money underlies how great a salesman he is. But I do wonder, Pershing Capital has been in operation since 2004, a period of fundamental low interest rates. Fed Fund rates have been below 2% for most of this time, in contrast to the 1990s and 1980s.

In my pro-labour view of the world, high interest rates are here to stay. Is Dollar Bill timing an exit to perfection? Looks like it to me.