The new Dune movie is beautiful - but some how I love the batshit craziness of 1984 Dune movie - starring Kyle MacLachlan as Paul Atreides. This was the first time I heard the term “The Sleeper Has Awakened” and somehow it hit home for me.

For much of my life I have been alternatively criticised and/or praised for operating at very low levels of effort. Criticism was along the lines of “wake up”, praise was along the lines of “how the hell do you get all this done with so little effort”. As I aged, I realised that I like to conserve my energy for when things really matter. Or as my mother told me once, “Only the mediocre are always at their best”.

For the last few years, I have had only had a passing interest in markets. That might seem odd to you, dear subscriber, as I seem to publish notes far in excess of other financial analysts/commentators, but I assure you, that is me operating at 50%. Back when I was running a fund, I would be reading endless company presentations, economic releases, financial histories, researching manufacturing processes, dissecting pan-national banking statistics, and relentless looking at markets for unusual correlations to use to my advantage. On top of that would be the endless calls with investors and prospects, and the brutal two day trips to New York to raise money. In 2022, after 15 years of doing this, and realising that Western governments were determined to protect markets at all costs, I decided I needed a break. I needed to become a “sleeper”.

“Sleeping” for me, meant pursuing other interests for a while, until I found markets interesting again. Other interests included playing basketball and tennis, running an Australian Literature Book Club (recommendations are: Boy Swallows Universe, Picnic At Hanging Rock, Too Much Lip, Dirt Music, Scrublands and the Long Narrow Road To The North), helping my son in this motorsport career (www.jarrettclarkracing.com), helping my other son in his sporting career (blakeyc_6 on instagram), and learning how to bake a great lamington (I am distantly related to Lord Lamington after which this cake is named - and I think have a passing resemblance to).

But suddenly, I am interested in market again. I have found myself updating spreadsheets untouched for 4 years. I am reading company presentations, and wondering why one set of numbers do not match with another. I am curious in how people are positioned. And probably most importantly, I am beginning to have a vision of the future. But before we get to the future, we need to bury the past. It has been common for fund managers, journalists, and commentators to say that short selling has been impossible for the last few years. This is bullshit. Short selling has been totally possible, as long as you have been willing to stay short China. From 2011, I was long US and short China and it made loads of sense, and I assumed that this trade would be done with some sort of Asian Financial Crisis style currency or financial blow up. Sadly I took this trade off in 2016. What has happened is China staved off the crisis, but the underperformance of Chinese equities has been ongoing.

In my defence in 2016, China stocks did rally, but over the last few years they have been dreadful again. The truth is that I gave up on a great trade too early. But this is how markets often work - trades have a tendency to work for much longer than you think is possible, so much so that you never think they are going to end.

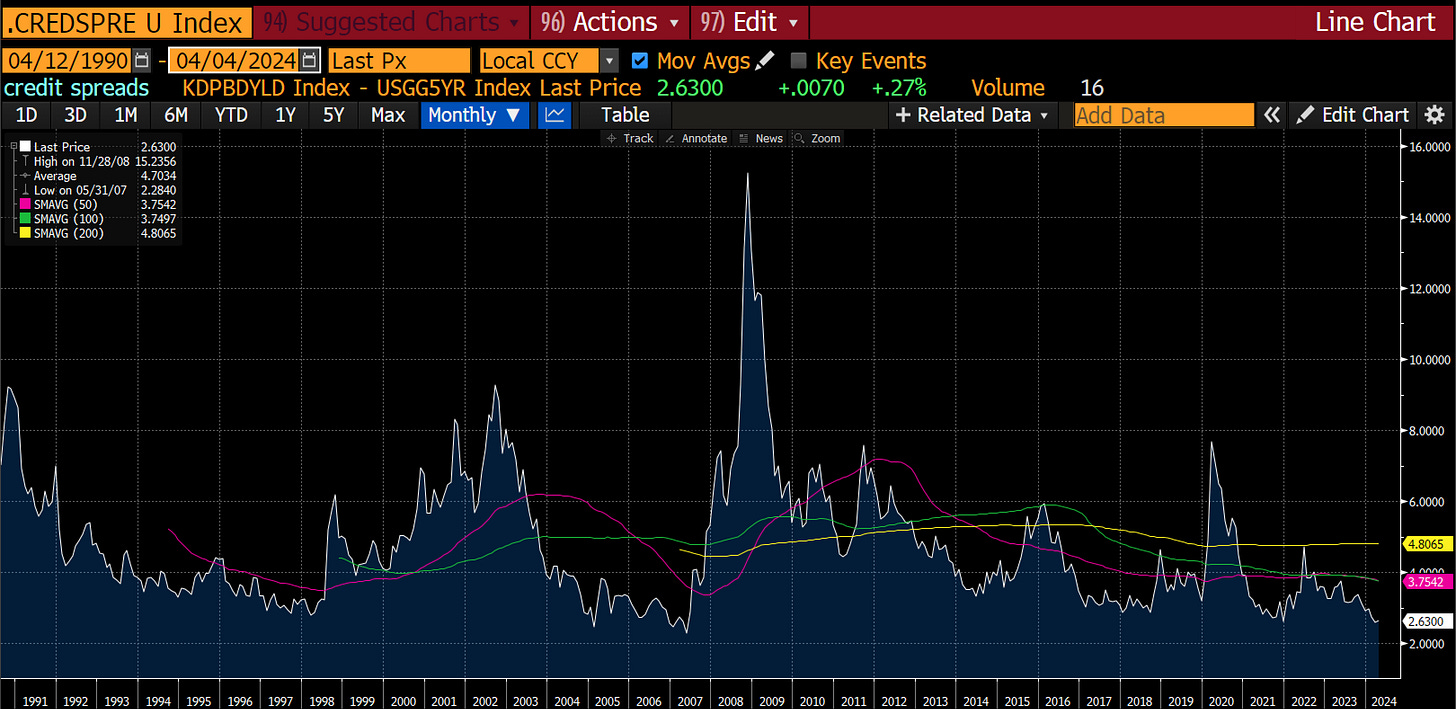

So why am I interested in markets again? Why has the sleeper awakened? Three different trends are coming together. Firstly, markets have learnt that government policy (including the Federal Reserve) is all about saving the markets. One of the reasons a trade like HYG/TLT has worked so well is that the US government has effectively extended a government guarantee to corporate credit. If you think back to the pre-GFC days, investors assumed Greek debt and Fannie Mae were backstopped by governments, and markets acted accordingly. Today is a similar position, but with corporate credit. And this is the driver of the share buyback, private equitization of the S&P 500 we have seen over the last decade.

You don’t need to be Kissinger to understand that government guaranteeing corporate debt is a disastrously stupid policy, that will be punished at the ballot box. And this is happening. But for central banks, the shale boom, which has kept commodity prices low, has allowed them to pursue these policies with little fear of commodity price spikes. But the shale boom is running out of steam. The inventory of wells has been steadily falling since 2020.

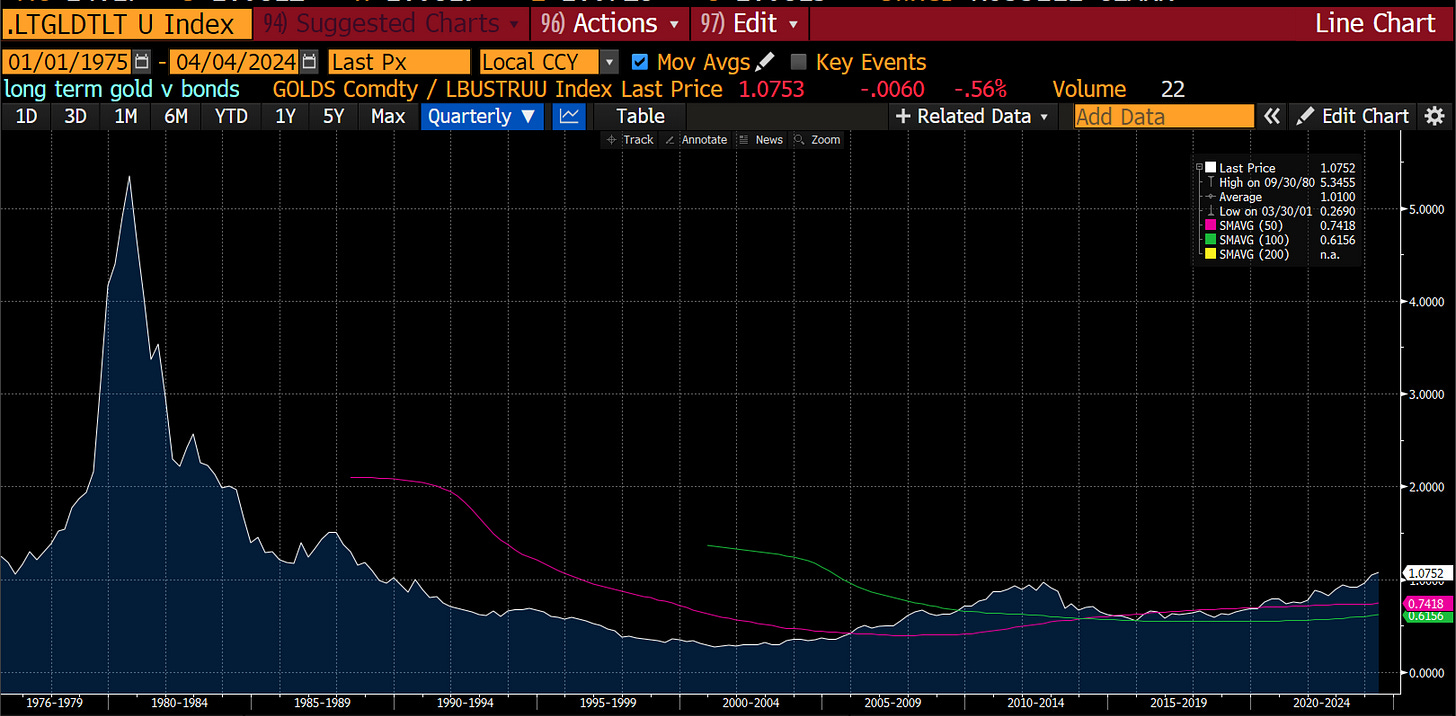

The extension of government guarantees to corporate America, combined with a failure to tax them has been noticed by markets. Gold had broken out of its downtrend against treasuries.

Why is this important? Well markets are assuming that governments will support markets at every turn. The break out of gold versus treasuries is the market way of saying we need you to break this guarantee, and allow failure. In 1980 at the end of the pro-labour period, the government needed to show tolerance of rising unemployment and falling real wages to regain confidence in treasuries. So I see a world, where treasuries sell off, and at some point the government has to raise taxes on corporates, and/or break up the cartels in the US. When I look at high yield spreads, I see markets completely mispricing the politics of the world we live in.

But how do I know now is the right time? Well most encouragingly, the US government is beginning to go after Apple. In my view, Apple is probably the “cleanest” of the big tech companies. Amazon, Alphabet, Microsoft and Meta all have a history of nobbling rivals or stealing data. If Apple is fair game, they all are.

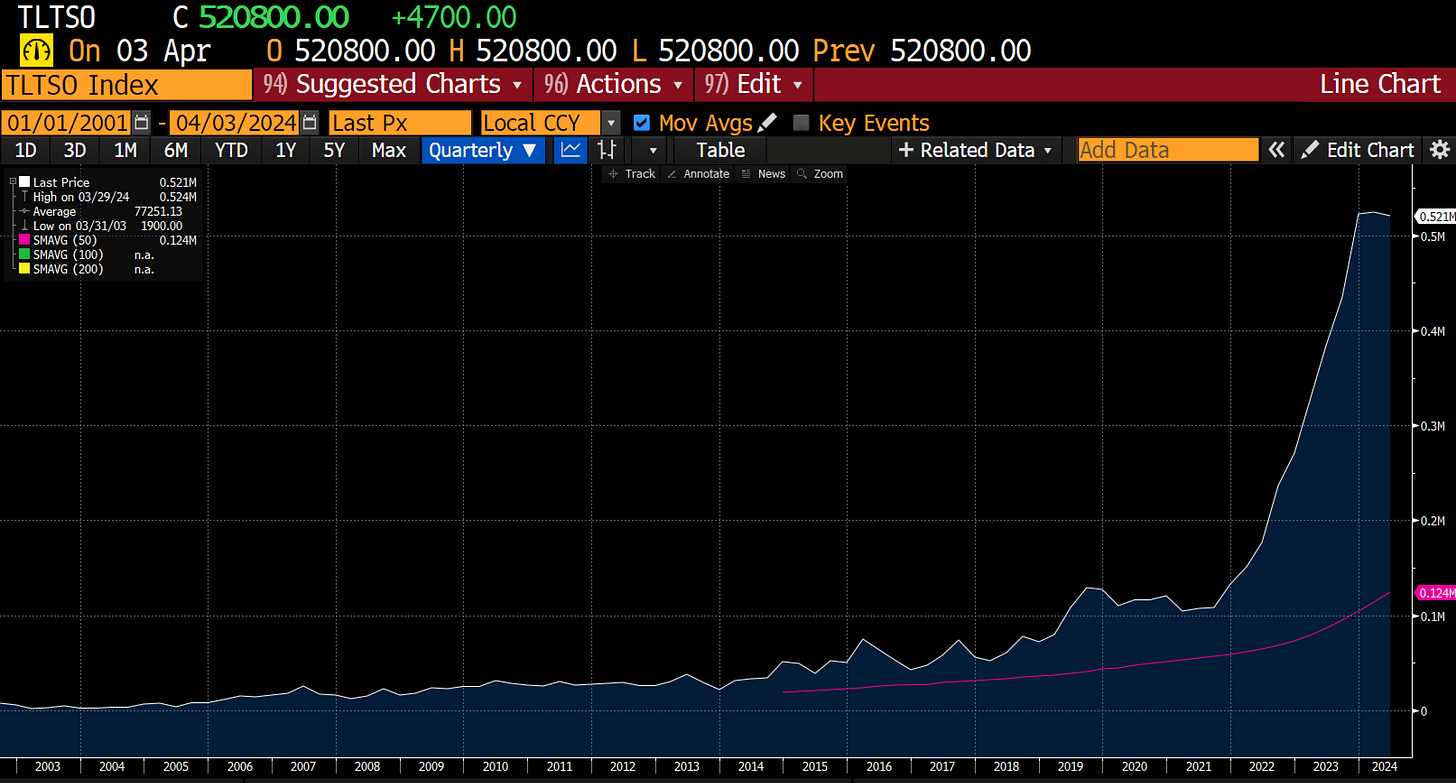

The politics and commodity markets all point towards inflation (tell me, is Biden or Trump the inflationary candidate? Trick question - they both are!). And yet investors have poured money in to TLT US, desperately looking to lock in a 4% yield for the next 30 years!

So what next? Well I need to broaden and deepen my short portfolio. I think some old favourites might be worth a look again. I have a few other bucket list things I want to tick off first before being 100% markets, but its getting pretty close. I have also banished my fear of failure - which is most important thing. Fear is the mind-killer. The little-death than brings total obliteration.

May thy knife chip and shatter.