I have begun to tire of reading articles about how Trump is changing the world, and everything is going to change. Why? Because it is basically backward looking, and tells me what has happened, not what is going to happen. Reactive research is basically toilet paper, no matter how well written it is. Unless your research produces a clear forecast of the future, please stop bothering me.

What predictive research do I have? My “big idea” was that politics globally was shifting to a pro-labour era. The idea of a pro-labour shift leading to surging inflation is very appealing, as it is very simple. This made me think we were going to see a repeat of the gold/treasury price action that we saw in the 1970s. And so far so good.

What I liked about this analysis was that pro-labour shift gave a prediction that assets markets would not do well. That is that a pro-labour government tended not to be great for stock markets. In Mexico, where pro-labour policy has been implemented has seen its stock market go sideways in US dollar terms.

The UK, which I also feel has moved pro-labour has also had a sideways moving market in US dollar terms.

The logic is that higher wages drives higher interest rates, which means business sees slower profit growth, AND, suffers from a multiple compression. In USD terms, this has not happened with the S&P 500. If anything, the emergence of Trump has been good for the stock market.

Maybe we are beginning to see some change with gold/SPX beginning to break higher - but we have had Trumpian politics since 2016, and this pro-labour shift in asset markets may only just beginning in the US, and even then, only potentially.

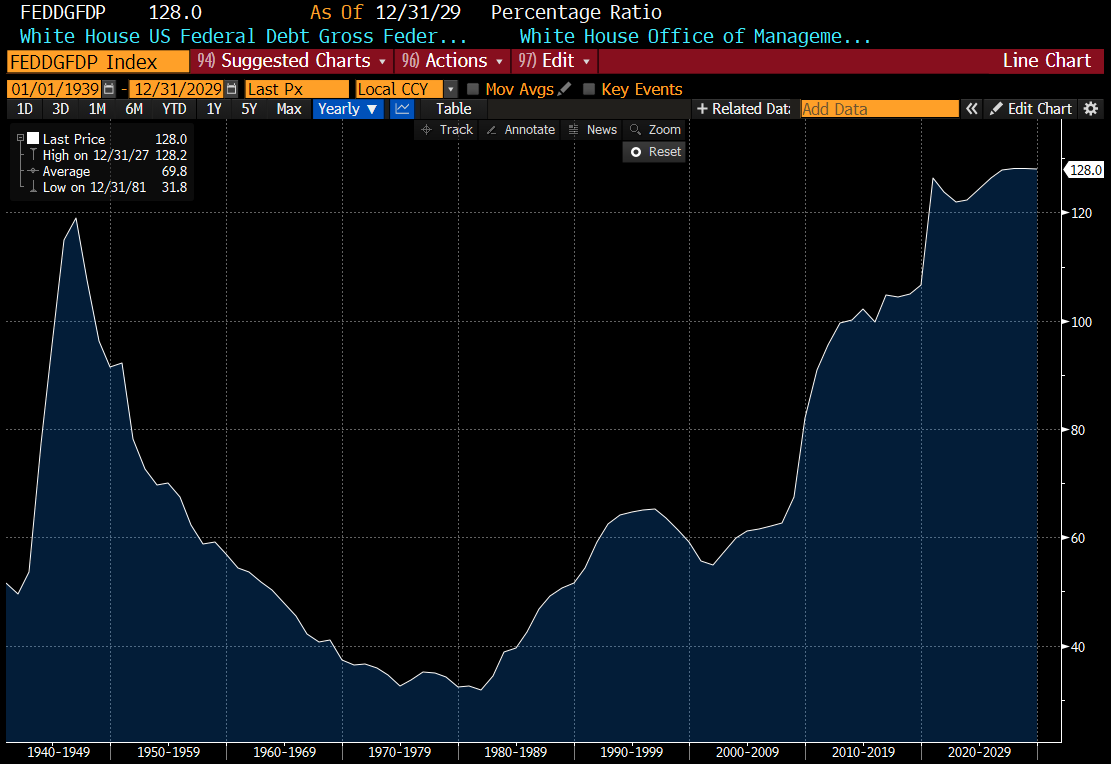

I have started to wonder if the move in gold versus treasuries is signalling something other than a “pro-labour” move. In Trump’s second presidency there has been a strong shift to reduce the power and effectiveness of government. DOGE gutted the IRS and other agencies - and there has been cutting of funding to agencies, and now to various elite universities. What we have also seen with Trump second’s presidency most clearly with Section 889 is the US Government acting to make it difficult for foreign governments to tax US multinationals. What I am seeing, and what makes most sense to me, is that the Trump administration is trying to destroy the power of the Federal government. But why would it do that? Well as I understand it, big government came into existence after World War II to counteract two other strong political powers - the rich elite, and religion. The Spanish Civil War was as much a religious war as a progressives versus conservative war. Much of what big government does in terms of social work was carried out by the church before World War II. Destroying the ability of the Federal government to act would benefit both big business and big religion, who often find their ability to act constrained restricted by government agencies (think anti-monopoly investigations, and legal restrictions on religious displays in public spaces). Here is where it gets interesting I think. If you want to destroy the Federal Government, how would you do it? Well the most obvious way would be to make it unable to meet its financial obligations. The first step build up debt levels. Job done.

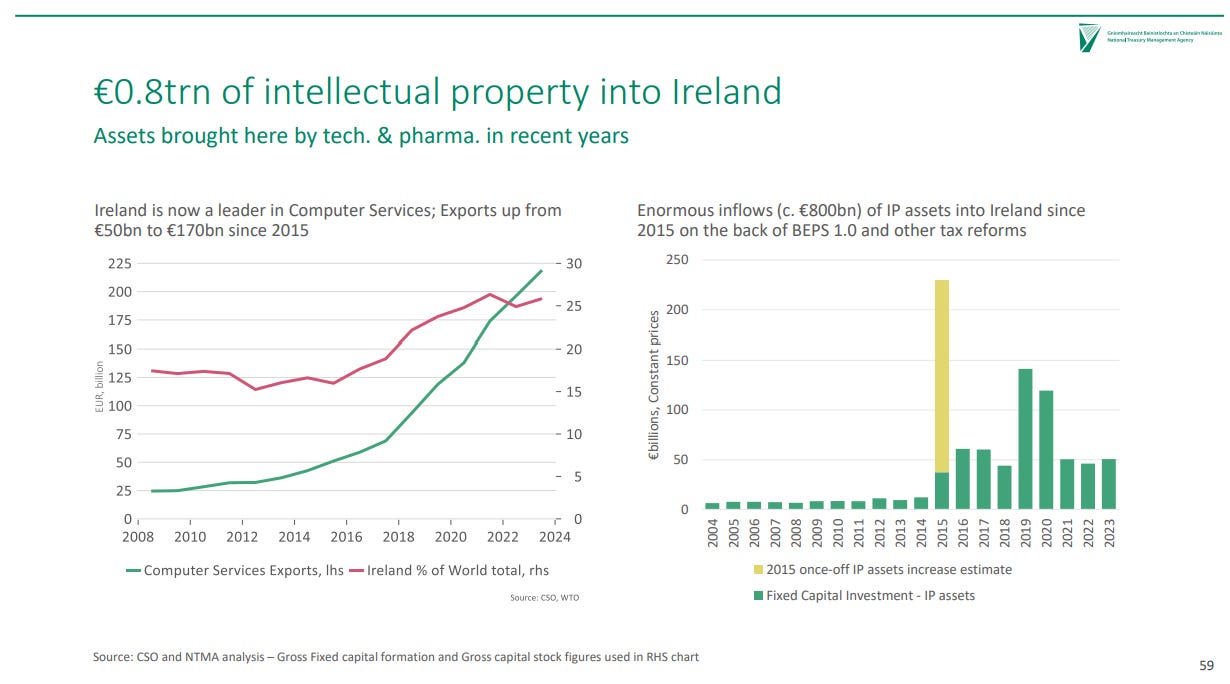

Second step is make as much US multinational profits tax remote. We can see from the investment into tax haven Ireland, that this has been achieved. Section 889 will make it much harder to access this revenue.

This combined with Conservative tilt of the Supreme Court lead me what will seem an extreme view - but likely true. President Trump and his big tech and religious supporters would probably like to see a the US default on Federal debt, so that the government is forced to shrink. For fans of the Simpsons, the famous “Bart to the Future” episode pretty much predicts this outcome.

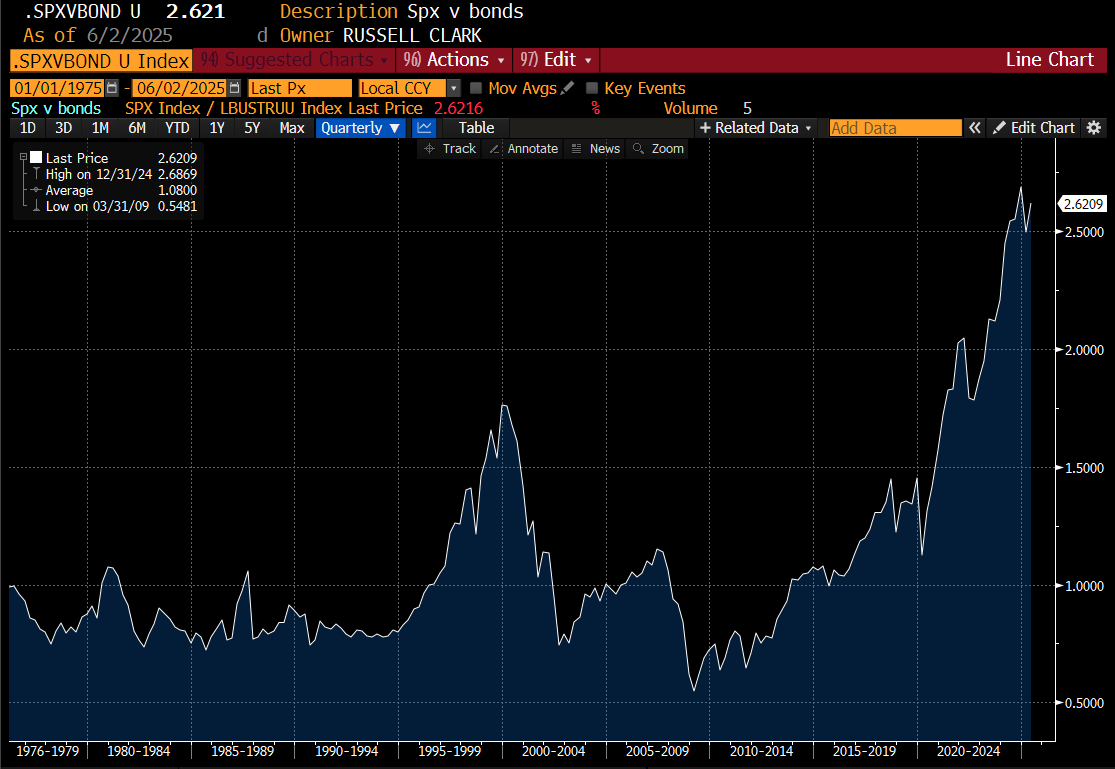

What is appealing about this analysis, is that when we go back to long term gold versus treasury chart, it first inflected higher with President George W Bush, and his first efforts at applying the “Starve the Beast” political strategy. The Obama administration saw this trend reverse, and the Trump, Biden, Trump administration has seen this trend take off.

What I also like about this analysis is that it would imply you need to be long S&P 500 and short treasuries, a trade that historically did not work, but has worked very well in recent years.

The ideas that are driving this, and as Peter Theil explains in his essay, Straussian Moment, is that conflict will be good for the US. Certainly World War II cemented the US as the leading power, and this line of thinking is that promoting chaos will weaken the rest of the world and strengthen the US. As someone not living in the US, I would prefer the multilateral approach the US took after World War II. But voters in the US have felt this approach has failed them. The only thing that I would say has changed recently is that the true believers in big government and multilateral organisations now know that they are in a knife fight to the death. Unless they can bring policies that benefit the vast majority of voters, their days are numbered. Meanwhile, its hard to beat long gold short treasuries as a macro trade.