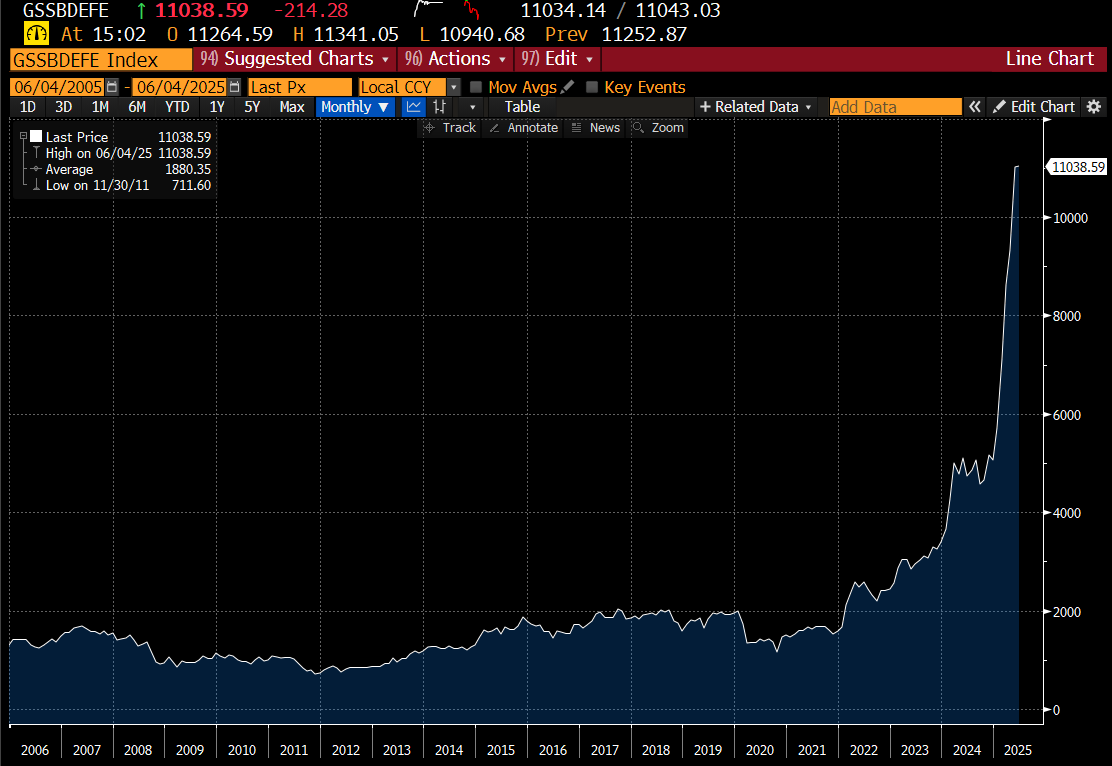

European defence is a hot area to invest right now. You can always tell its become a big topic among allocators when Goldman Sachs develops a thematic basket.

In case you were wondering what stocks this included - here is the make up of this index.

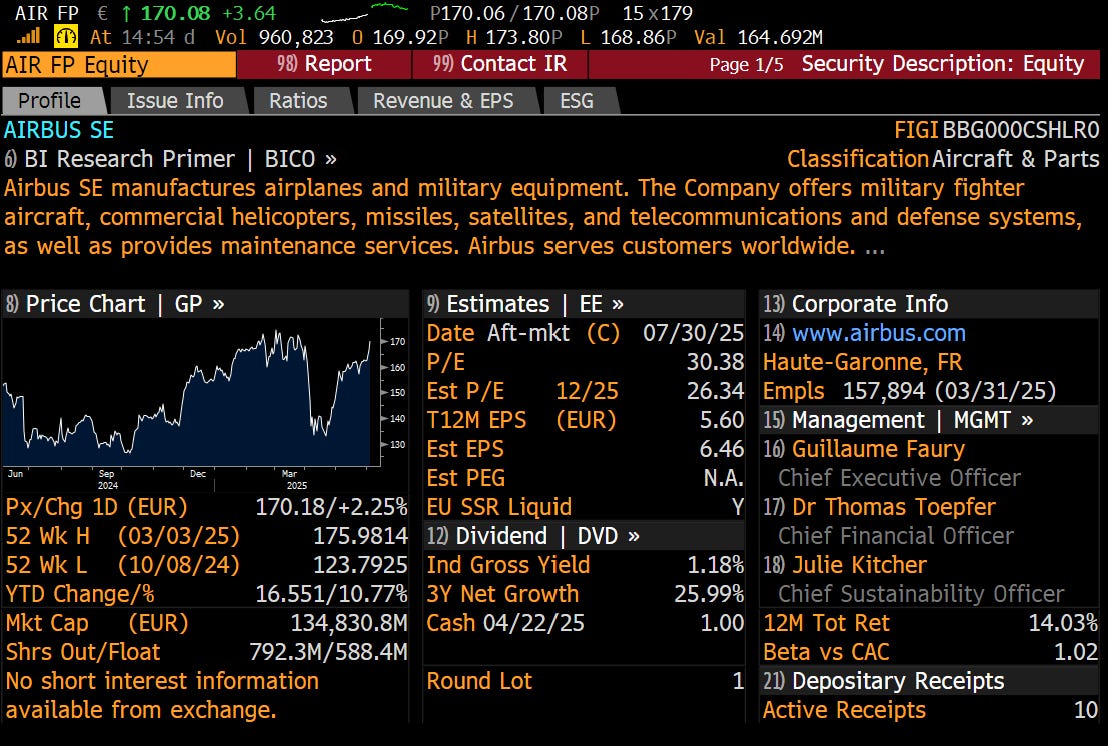

The first stock, Rheinmetall, is now EUR82bn market capitalisation (USD93bn market capitalisation). This compares to USD 113bn market capitalisation for Lockheed martin, or EUR 134bn market capitalisation for Airbus, with a duopoly position in commercial aircraft and a very large stake in European missile business MBDA. Or in other words, Rheinmetall is pricing in very serious growth.

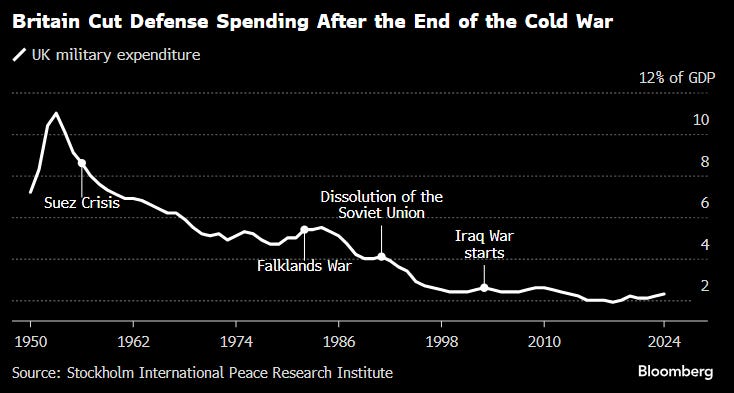

The excitement around defence related stocks is pretty easy to understand. The UK, which has always fancied itself as a warrior nation (with good reason), finds itself needing to spend a lot of money. This chart makes revenue growth of 200 or even 300 percent in real terms (let alone nominal terms) seem likely.

The problem for me, is that current expectations on defence spending rests on two assumptions that look problematic. First, Russia needs to stay very hostile. I am not sure this is the as solid as it looks. Russian losses now exceed losses seen by the US in Vietnam, the US in Korea, and more importantly the Soviet Union in Afghanistan. The Soviet Union war in Afghanistan is rarely talked about (other than but aficionados of Rambo 3). The military losses in Afghanistan certainly led to disillusionment with the Soviet Union and sped up its dissolution. One cannot but think that Putin must be coming under similar pressure.

Secondly, Ukraine’s extraordinary raid to destroy large parts of the Russian bombing fleet must count as one of the more historic moments in military history. It will change war as we know it, just at the “Charge of the Light Brigade” signalled the end of mounted military, and Hiroshima and Nagasaki ended the possibility of Great Powers directly attacking each other.

According to the Economist, 150 drones and 300 bombs were used in a raid that destroyed 41 aircraft, which included Russian equivalents of AWACs. Using very rough numbers, Ukraine maybe used USD 1mn of hardware to inflict USD 3bn of damage to Russia. For this reason, I am very cautious on builders of equipment that is non-drone related. The risk is that military budget suddenly and radically get redirected. For that reason, I only like three areas in defence for investing.

Firsts, munition and armaments. We may move from fighters to drones, but they will still need to be armed, and the war in Ukraine has drained inventory across Europe.

Second, countermeasures and jamming technology. The ability to secure areas against drones has become vital.

Third, potentially submarines. And only potentially. The ability to approach a target and then launch drones seems to be vitally important. Could submarines launch drone swarms from offshore, and then be able to leave the area undetected? Given that the drones in the Ukraine war are able to hover for extended periods, and operate remotely using AI, this seems very possible.

Given the ubiquitous nature of drones, it seems all wars will be drone wars going forward. Heavy equipment will still be needed, but the ability to defend against drown swarms will be vital. Jamming and munitions and submarines is where I think the best place to be is. I suspect when drones successfully start attacking aircraft carriers, then politicians will recognise the new world.