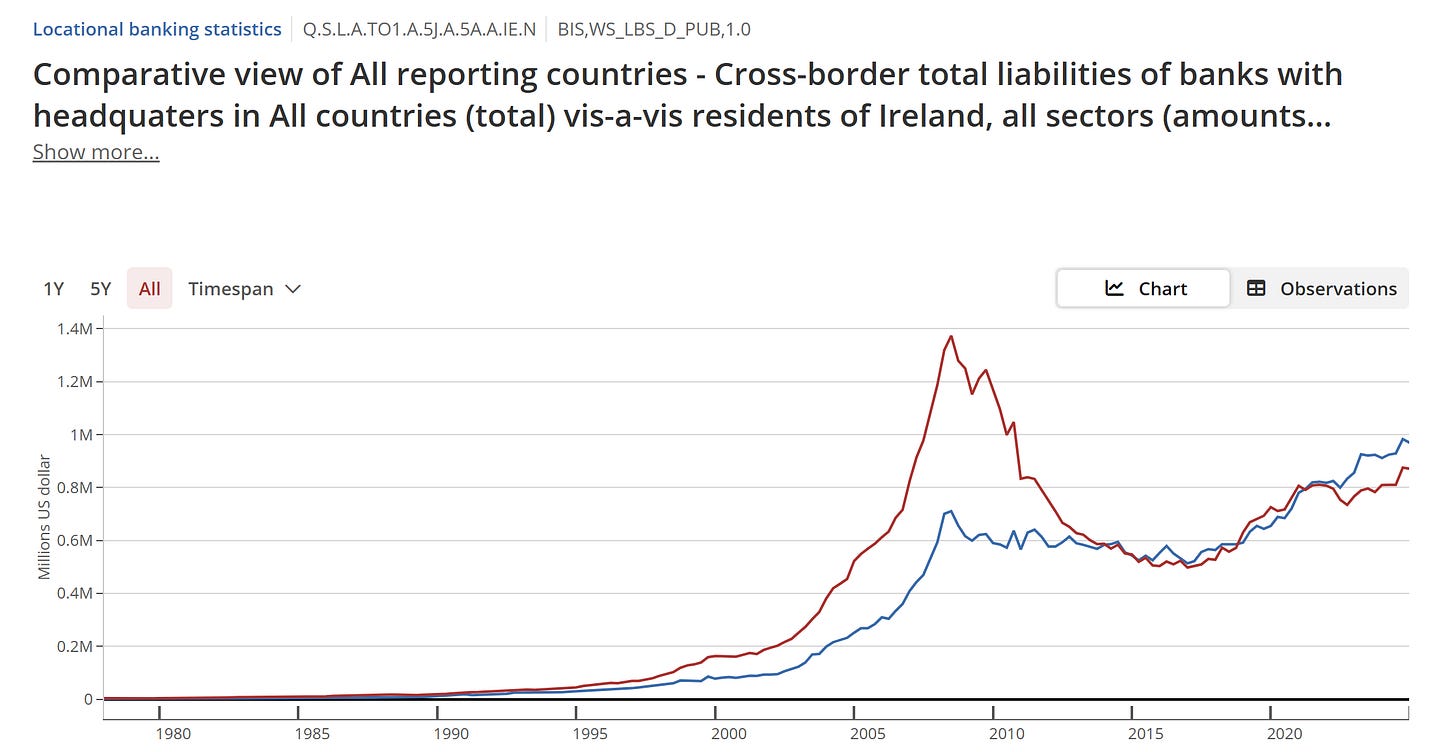

My interest in markets began in 1998 with the Asian financial crisis, grew with the dot com bust, and matured with the global financial crisis. If you wanted to make it, you needed to be the smartest guy in the room - and a sure fire way to win was to keep an eye on where capital had flowed the most. If you could get out and short markets as capital started to leave, this was a winning strategy. Capital flows drove asset markets. A good example of this was using BIS data to see how capital flowed into Ireland, then out again during the Eurocrisis. Below is BIS data on lending flows into and out of Ireland. The red line and blue line should roughly move together - but in early 2000s, capital flows surged before reversing.

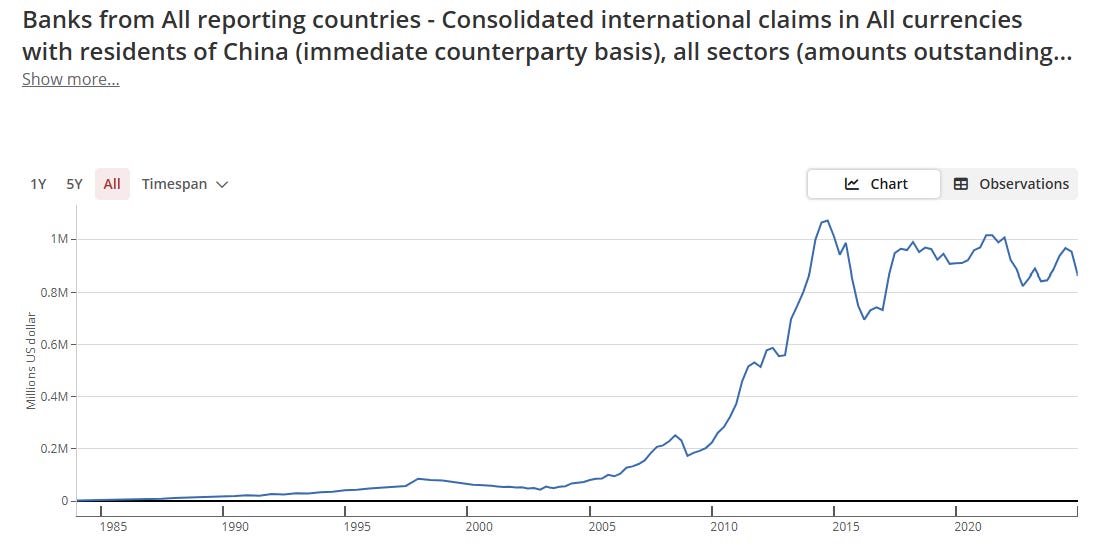

Using BIS data, you could see similar problems brewing in China in early 2010s. After the GFC, capital surged into China - and has been trapped ever since.

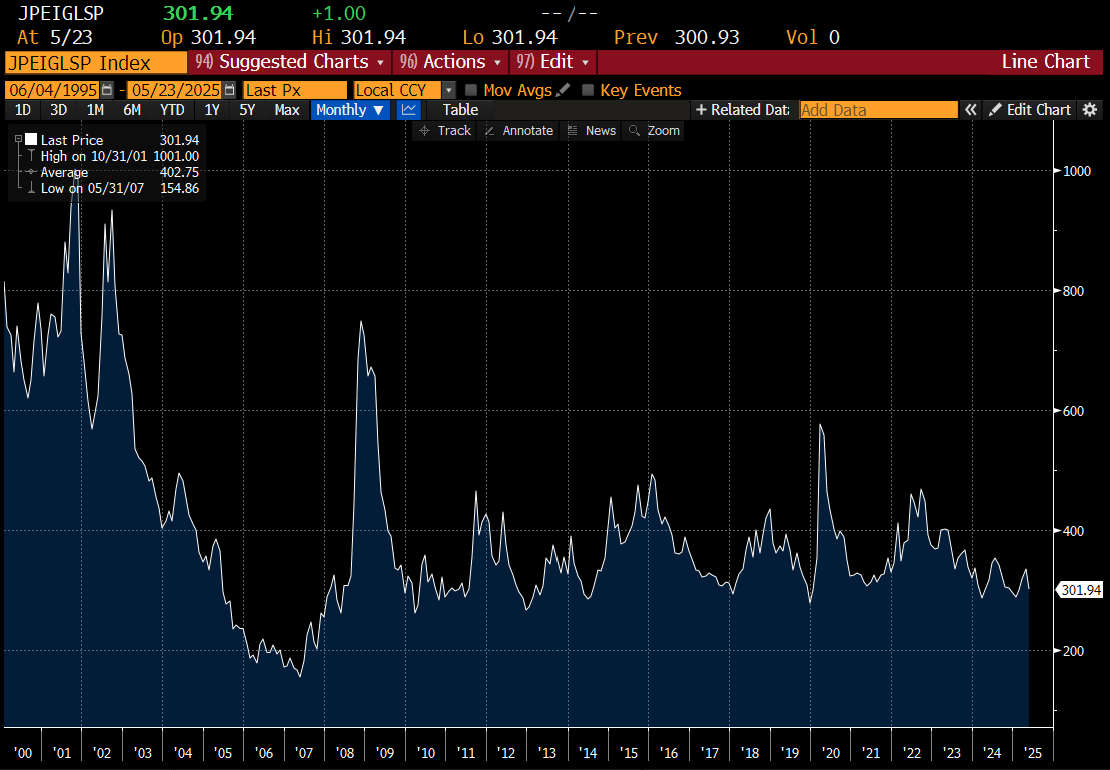

Capital flowing in then out again to create a crisis was easy to understand. What was unusual was where this capital would flow back to. There seemed to be a set of assets that would always attract flows in crisis: JGBs, Treasuries, Bunds, Yen and Swiss Franc. All of these assets came to be known as safe haven assets. I used to own all of these assets when I thought a crisis was brewing. But why did that work? Well the most obvious reason I think that a very large chunk of the market was pursuing what I would call a carry trade. That would be to buy a high yielding asset, and then short a low yielding asset. If I was to characterise my finance career, it was being long the emerging market carry trade from 2002 to 2007, short it from 2008 to 2016. Why did I stop in 2016? I thought China would devalue, and we would go back to a emerging market crisis - instead, China closed its capital account - and EMBI Bond spreads have behaved pretty well. That is I thought we would have a long period of EMBI bond spreads back at the 800 level rather the sitting at the 400 to 300 level.

For a few years now, we have been seeing now is that the old safe haven assets are no longer safe havens. Long yen has been a widowmaker trade, and treasuries and JGBs have been pretty poor. In April in particular, JGB yields have surged.

Even more unusually, treasuries have traded poorly in periods of market stress. From a macro/political perspective, you could argue that markets are seeing more and more inflationary policies being put in place, so investors are acting like “bond vigilantes”. Its a nice idea - and maybe there is some truth to it. But I suspect there is a far better and satisfying explanation.