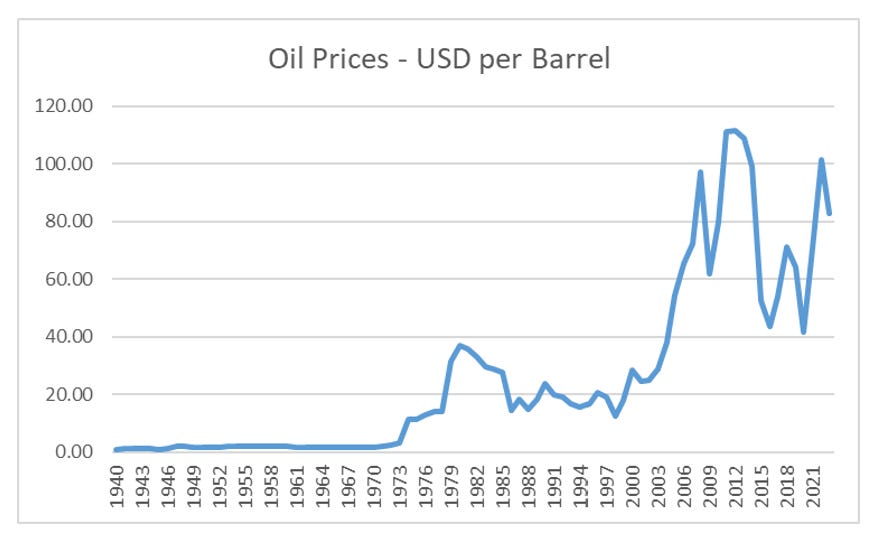

It is hard to believe now, but after the Great Depression, FDR regulated the production of oil so that prices would not fall. The Texas Railroad Commission (TRC) was charged with controlling production to prevent falling prices. As almost all oil was drilled in the Texas, they had great power. The TRC was in some ways too successful, as drilling and exploration slowed in the US, and then in time, so did production, until the shale revolution.

Restriction on oil production were implemented as the US government was seeking to control the deflationary forces of excess competition and excess production that had plagued the country in the 1930s. However the oil shocks of the 1970s ushered in a new “pro-capital” era of management, with substantial deregulation.

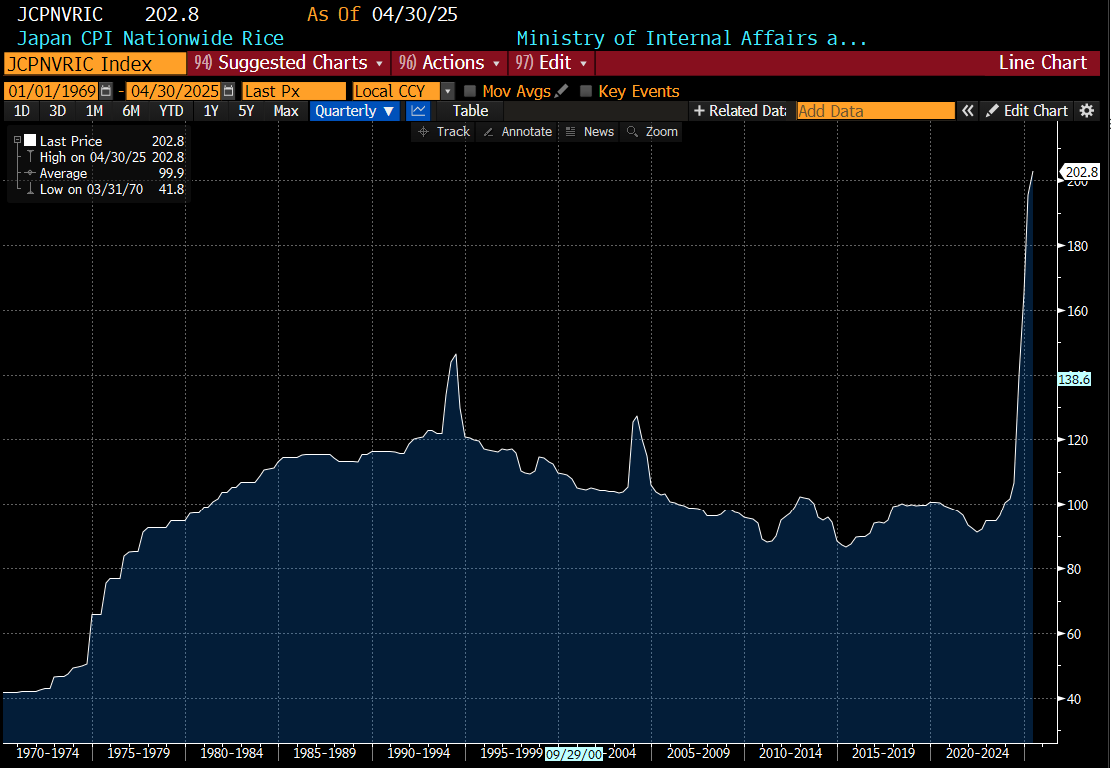

I have been wondering if the current rice shock in Japan might usher in a policy change as well. Rice prices in Japan have been stable for decades, but have suddenly surged. The price of “gas” in America is probably as important at the price of “rice” in Japan.

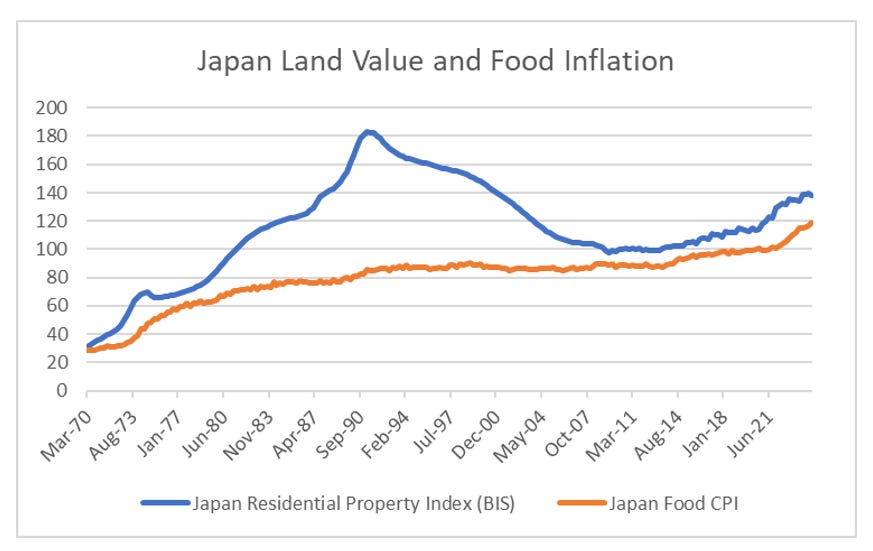

Before I go on to what policy changes this might engender, the surging rice price does make me bullish on Japanese land values. To me Japanese property prices surged well above food prices in the 1980s, and then spent three decades catching down. Assuming wages follow food prices (which they must) then Japanese property prices should do well if rice prices stay strong.

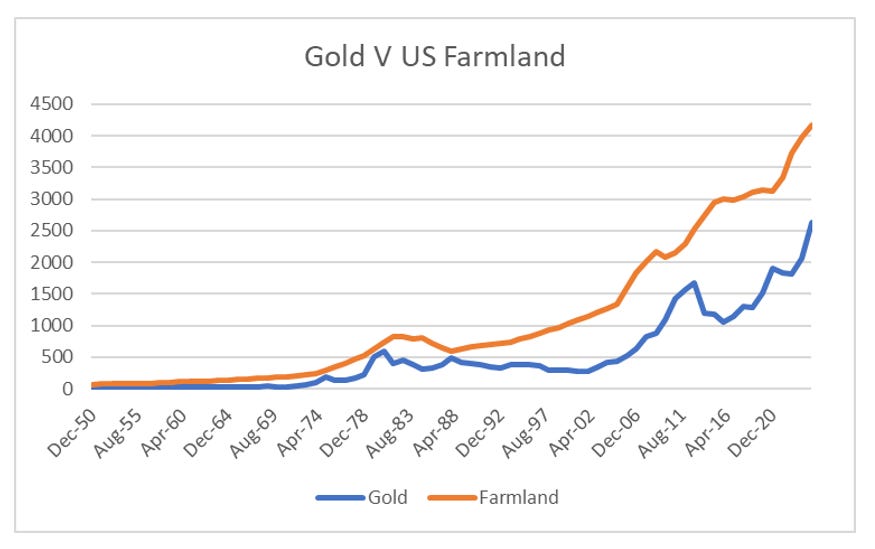

For context, US farm land has been a great inflation hedge - trading closely with gold, even to the extend that farm land weakened in the 1980s at the same time as gold.

Even more extraordinary is that Japanese farm land is now half the price of US farmland.

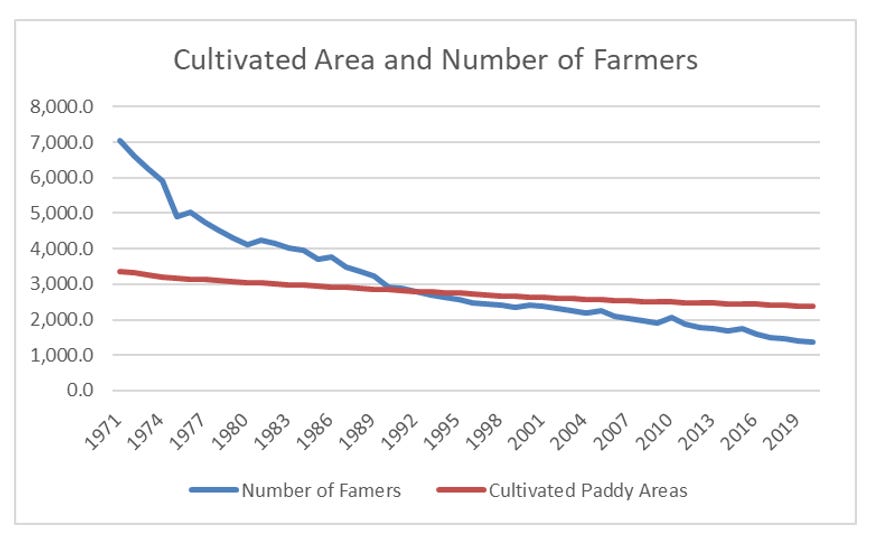

How has this come to be? Well Japanese rice prices have always been higher than the rest of the world. During the industrialisation boom years, keeping rice prices high was seen as a way of transferring wealth from the cities back to rural areas. The problem was that the government had to come in and buy production at high prices, which they did not want to do, so a policy was instituted to pay farmers to keep land fallow. This has been largely successful, with the area for cultivated paddies and number of farmers declining.

While Japan is largely self sufficient in rice production, Japan has become steadily less sufficient in total food over time. Many vegetables used in Japan come from China these days.

Bit like the oil shock led to deregulation in the US of the oil industry, I am wondering if the rice shock will lead to a deregulation of the agriculture industry in Japan? I am encouraged by the appointment of the Shinjiro Koizumi as Agriculture Minister. His father, Junichiro Koizumi, was a very reform minded Prime Minister, and that most rare thing in Japanese politics - unpredictable and willing to take on entrenched interests.

Most obvious reforms would be allow profitability of farming to rise, and to deregulate the industry. Being reliant on China for food supply seems also a good driver for reform. For me, there has been one stock that I thought would do well on any possible reform - and it is beginning to move.