As the Western world deals with uncomfortably high inflation, China has been cruising along at inflation levels that could even be considered too low. Its latest print it only just above zero. In recent years, US CPI has been above China - allowing the US economy to grow much faster than China in nominal terms.

Almost all market participants have been surprised by the lack of a “reopening” trade in China - that is surging demand that pushes up the price of everything. On a pure revenge travel style Covid boost, we can see that flights to Macau for example have recovered to the highest level since Covid. So why has the reopening trade not worked?

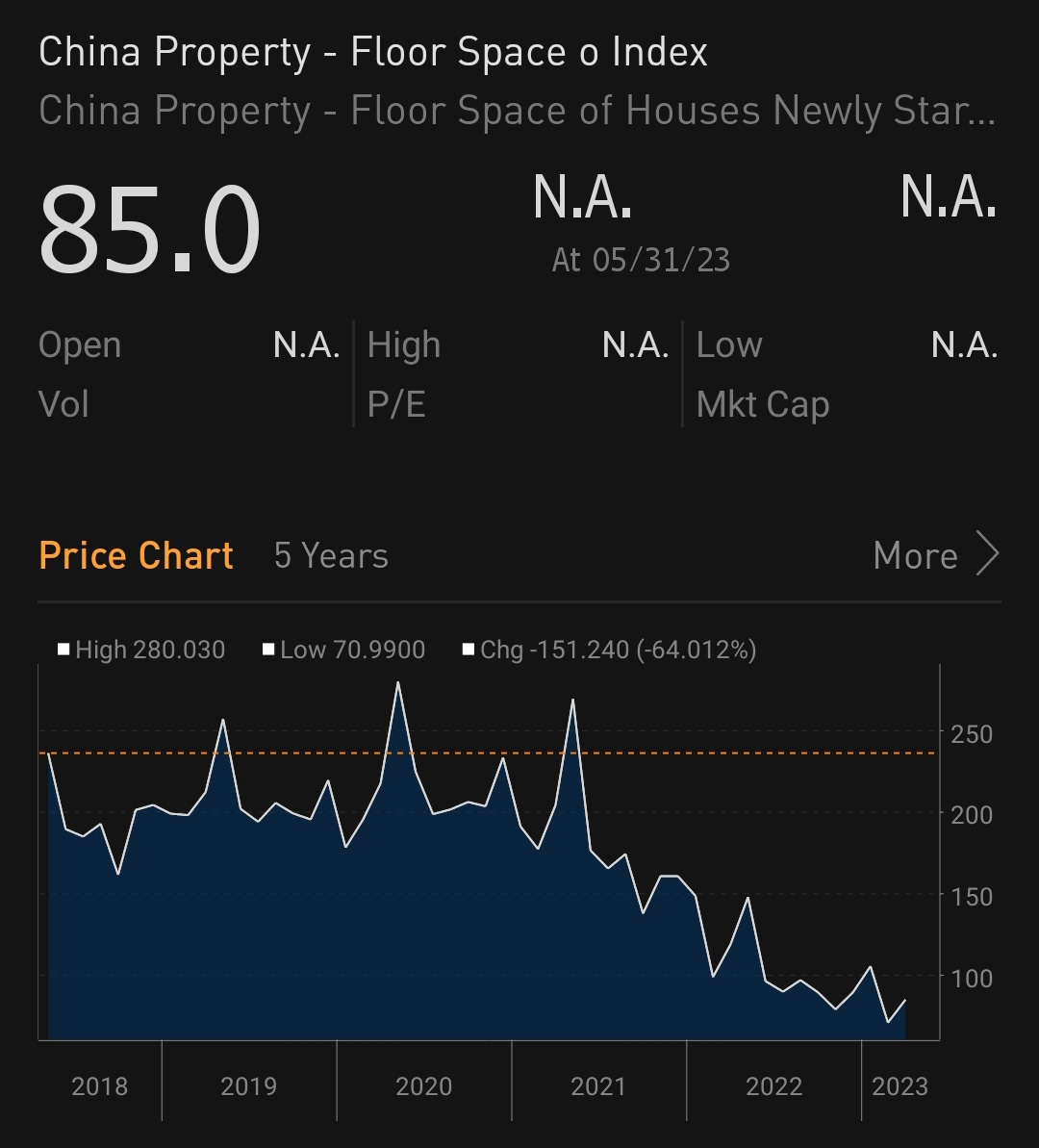

The biggest difference in my mind is that the Chinese authorities have taken the opportunity of Covid reopening to move away from the property led economic model that has dominated since the GFC. There is a better chart showing the surge in property development after GFC, and it now returning to that level - but I am on the road, so this will have to do.

In contrast, the US is still building houses at near peak levels (ex pre GFC).

In my mind, China has spent the last few years teaching the market that the government will not guarantee all corporates - in fact, bigger is not better in China. Investors in Asian credit would have done much better in Chinese government bonds than in corporate bonds. Singapore listed Asian High Yield bond ETF is a good proxy.

In the US, all bonds have been not so good - but what we have seen is that corporate bond spreads have remained tight. My read of this is that the Federal Reserve offering to guarantee all bonds during Covid has taught the market to treat corporate debt similarly to treasury debt. I am using the KDP High Yield Debt Index and 5 year treasuries to generate the spread here.

Oddly enough, China is probably the country most closely following economic orthodoxy but is considered uninvestable. The uninvestable part of China is policy making that aims to maximise real wages not profits - but by doing so, is keeping inflation low. China does show it’s possible to have low inflation - it’s just that corporates don’t like it.