Even though I have been pushing GLD/TLT as a good idea, and I am actually long gold, I am not a “gold bug”. Until I was asked by a friend, I had completely ignored the other precious metals. As you should be aware, gold has surged to new all time highs.

Platinum, on the other hand, is sitting at around half of its highs set all the way back in 2007.

If you look at the gold/platinum ratio until 2014, platinum was usually more expensive that gold. But since 2014, gold has completely dominated platinum, and is now 2.5 times more expensive.

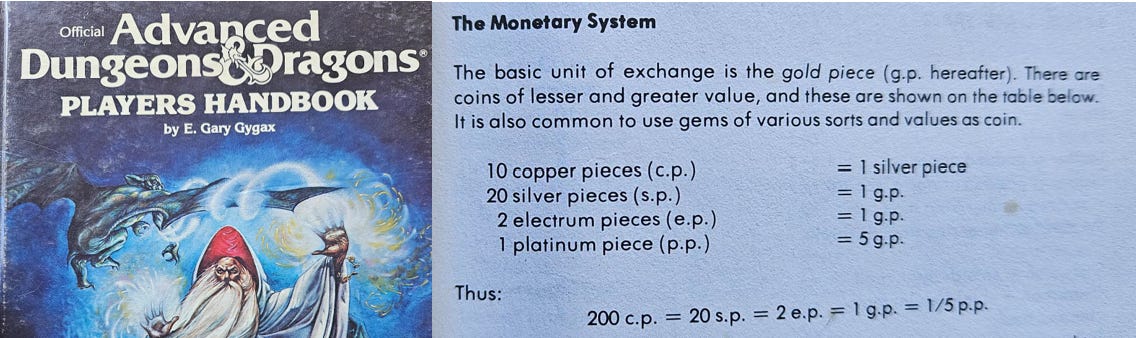

This is truly a very large historical aberration. Consulting my trusty Advanced Dungeon and Dragons Player’s Handbook (published in 1978) that I happened to have at hand (don’t judge - D&D is cool again), platinum should be worth 5 times gold. The other exchange rates are below (electrum is a gold/silver alloy, so ignore for our purposes). If D&D exchange rates were to asset themselves again, either gold is about to fall 90%, or platinum is going to USD 10,000.

Looking at this, I suddenly understand why fellow substacker Trader Ferg, had included this particular raunchy illustration in a recent post.

The problem with the excitement for other precious metals, as any grey haired, battle scarred investor (like myself), will tell you, if you cannot explain to me why platinum has been so poor recently, why would I expect it to change. The trend is your friend, and has been for awhile now. I think it would also be remiss of me to point out that the relative gold move has not only smoked commodity investors and D&D enthusiasts, but also the macro community. For years, the copper/gold ratio and the US 10 year Treasury yield were highly correlated. Not anymore.

Now I have a THEORY (please note this is purely a theory - but one I quite like - but could be proved wrong) about why gold is golden, and every other commodity has been a waste of time. As this is a THEORY please feel to tell me how wrong it is in the comments - in fact I welcome it! So here it goes. When Russia invaded Ukraine, and the West put sanctions on Russia, I assumed that Russian supply of all commodities would be forever banished from global supply. On this basis, I wanted commodities where Russian and Ukraine were large producers. For me, oil, natural gas, fertilisers and nickel supply were all potentially at risk. It is true that Russia is a large gold supplier, but gold is relatively easy to move, so I did not think Russian supply would leave global markets.

And sure enough, commodity prices did spike, but then they have collapsed. What we have seen is that financial sanctions on Russia have been largely ignored by emerging markets, and even more surprisingly, Ukraine has been able to reopen the Black Sea export route. That is commodity markets where meant to be supply constrained have proven not to be. We all turned into Mortimer.

So why has gold not been given the frozen orange juice treatment? Well, why I (we?) focused on the potential supply disruption from the Russia/Ukraine war, we have not focused on the gold demand creating aspects of sanctions. The West basically froze Russian central bank holdings. What is the point of having US treasuries as foreign reserves if you don’t know you can use them when you really need them. This is particularly true for China, but will be equally true for any nation in the world that does not 100% agree with US policy (Australia and the UK don’t have foreign reserves- so for our purposes, every foreign reserve holder). What is true for Treasuries, is equally true for Bunds, Gilts and JGBs. So buying fixed income for foreign reserves is now a dead policy. That is sanctions on Russia did not disrupt Russian gold supply, but it did create huge new demand for gold. China has been buying more gold.

It seems obvious, but as the US moves away from free trade, the world will move away from Treasuries as a reserve asset. GLD/TLT captures that trade.

Now the question is, when do other commodity prices catch up? Well if reserve management is the big driver of markets, then the most likely metal to do well is silver. And to be fair its beginning to move. Using D&D monetary system, it should be closer to USD 100, given where gold is.

The biggest problem for other commodities is that Chinese interest rates have continued to point to a growth slowdown in China.

For me, gold and silver, look okay. I am not sure about any other commodity as it does not have the foreign reserve demand that seems to be a driver or markets today. But then again, I am only a level 20 Paladin, and not a commodity expert.