In my recent post, I made fun of the macro community, as the old correlation of gold/copper and US ten year treasury yields had broken down.

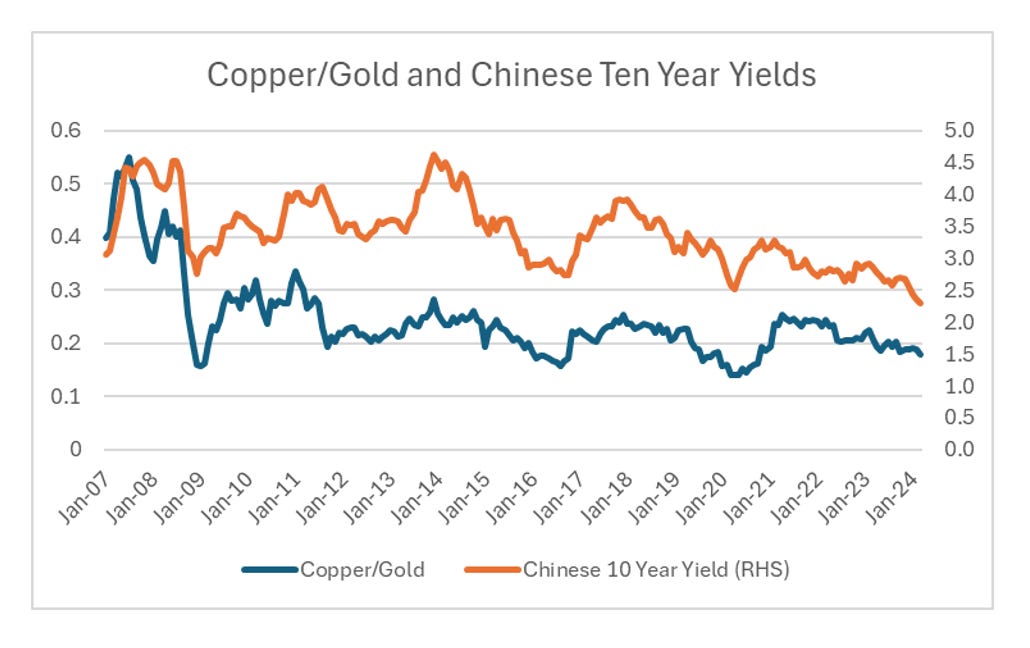

However, I would be remiss to not point out that the copper/gold ratio still works quite well when we replace US 10 year with China 10 year bond yield.

And Chinese yields are so low as the domestic property market has been going through a huge slowdown.

If you think China is getting close to cyclical turn, then industrial commodities potentially offer huge upside. I personally have no idea, but it is amazing to see how well commodity prices have held up despite this slowdown.