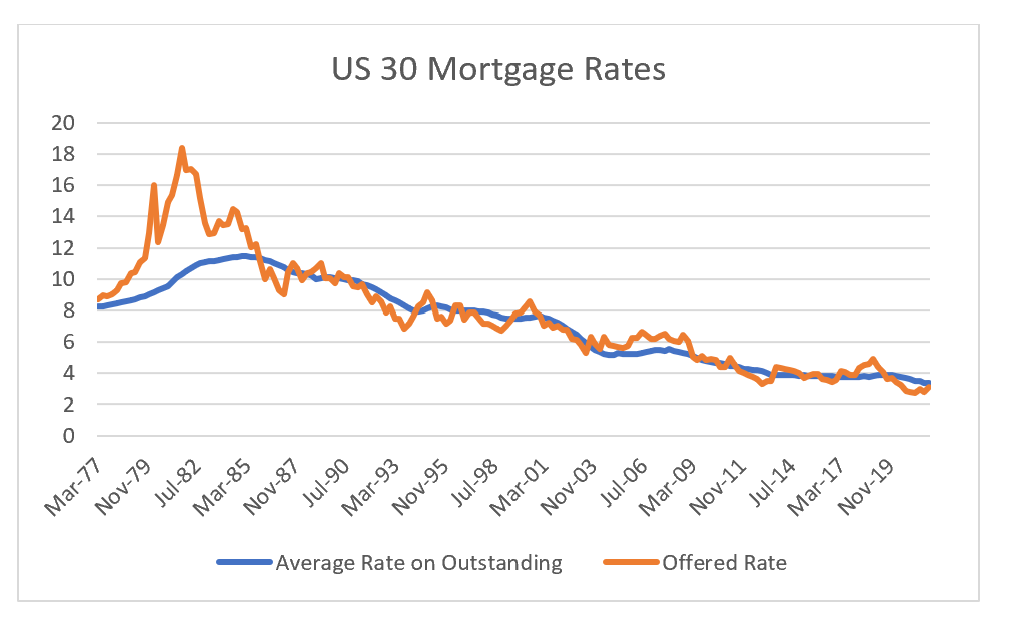

As everyone should know, the US has a very unusual mortgage system. I am not going to go into the details, but the key upshot of this mortgage system is that it is relative easily for homeowners with mortgages to refinance when long term interest rates fall. Offered rates on mortgages went as high at 18% under Volker, and fell below 3% under Powell recently.

Since 1982, the average rate on outstanding mortgages has rarely risen, and when it has done so, it has been for brief periods. Periods of offered mortgage rates above outstanding rates have been associated with US economic weakness, which of course has then led to long term bond yields falling and refinancing beginning again. Other than 1970s, the period from 2005 to 2008 saw the longest period of offered rates about outstanding rates - but the heavy usage of adjustable rate mortgages in this period means offered rates are probably overstated from 2004 to 2007. The late sell off in 2018 in US equities also coincided with offered rates rising above outstanding rates.

Despite mortgage rates that are still low by historical standards, the University of Michigan survey is finding prospective home buyers as current markets as some of the most unattractive markets to be a buyer since the early 1980s.

Since 1990, the Mortgage Bankers Association have produced a refinancing index that allows us to see the trend in refinancing. As can be seen, its has a strong countercyclical nature, as lower interest rates tends to drive stronger activity, most recently seen during Covid in 2020. However, both new buyer interest and refinancing seems to be dropping off at the same time.

The fall in refinancing is fairly easy to understand. Bankrate.com gives us daily updates of mortgage rates. We can see in 2022, mortgage rates are rising rapidly, and far more quickly than in 2018.

One very negative aspect I think about quite a lot, is that for most of my adult life, US demand has been the key driver for commodity prices, but in 2022 China seems to be far more dominant driver. What if the Federal Reserve is aggressive with rate hikes to combat commodity driven inflation, but it makes no difference to commodity prices? What happens then?

I am going to start experimenting with adding paid bits to this website.

Why? I have enjoyed writing the website as I have been winding up other parts of my life, but I have other options that I could take up. Unless I can put some monetary value on doing this website, I will have to focus on more lucrative uses of my time.

How? I think I will give paying subscribers early access to my posts. Particularly those that could be used by financial professionals. That will mean for non-professionals who are not time sensitive, they should see no meaningful change in access.

When? I will start playing around with paywall options now.

What should I do? If you find my writing useful, and can afford it, then pay up. If you like my writing, but don’t want to pay, become a free subscriber today. You will still get access, but with a delay.

What else do I get? Well if you pay me some money, then I will very happy take on requests at anything you want me to look out - with the proviso I will only actually publish anything if it actually interesting.