This will be made available to free subscribers next week.

Within the framework of “free markets”, my working assumption was that ever lower bond yields reflected the deflationary pressures of competitive currency devaluations. The great depression was an era of competitive currency devaluations, and even the inflationary 1970s gives us an example of currency devaluation pressures forcing down bond yields. Up until the US left the gold standard, yields between the US and Switzerland broadly followed each other, but as the US left the gold standard, its currency fell against the Swiss franc - exporting its problems to Switzerland which drove its bond yields lower.

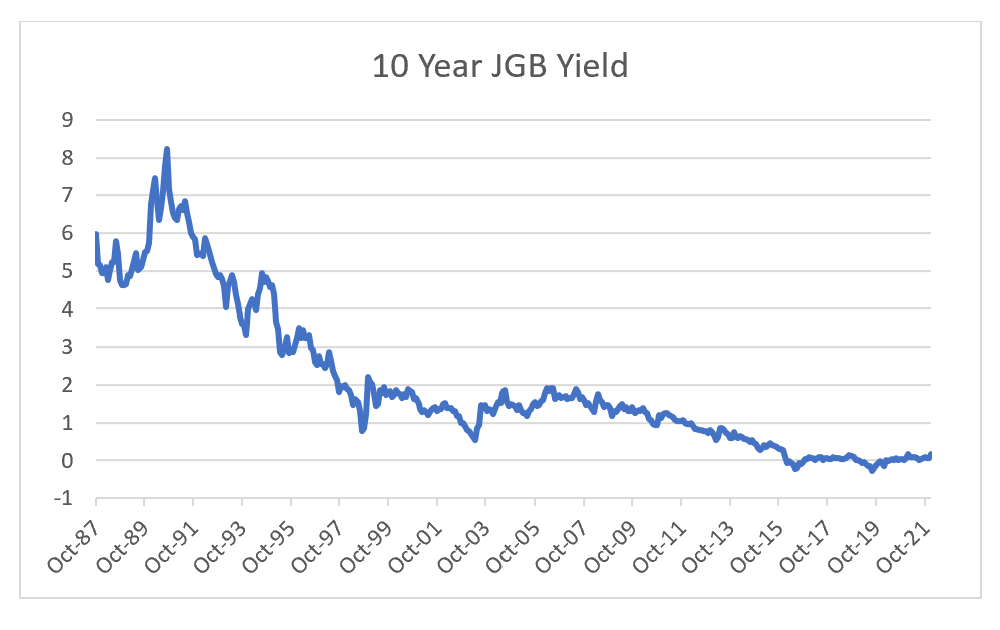

If there is a spiritual home to the bond bull market, then it is Japan. Very low bond yields in Japan were originally seen an aberration in financial markets, but are now seen as a harbinger of things to come. Within this context of bond yields reflecting currency preferences, very low Japanese bond yields have reflected the governments policy objective of keeping the yen weak. In this context, the opening up of free trade in the rest of Asia and China would have also put downward pressure on Japanese yields.

So bond yields, at least in developed markets, reflect the political or institutional appetite for devaluating the currency. This makes sense when we look at various emerging markets that have pegged their currencies to the US dollar. They have committed to higher interest rates policy when needed. The question is what type of POLITICAL environment would you need to force governments to commit to strong currency policies?