One of the things about finance is that markets tend to trend, and people who make money get promoted. If you get a twenty to thirty year trend in markets, then all the people in charge will be people who 100%, total believe in that trend. And when it changes, they cant believe it has really changed - “old dogs can’t learn new tricks”.

When I started in markets in the late 90s, early 2000s, all the senior people tended to be bearish/skittish about bonds. That’s because the great bond bear market of 60s, 70s and 80s, had wiped out anyone who thought bonds was a good investment.

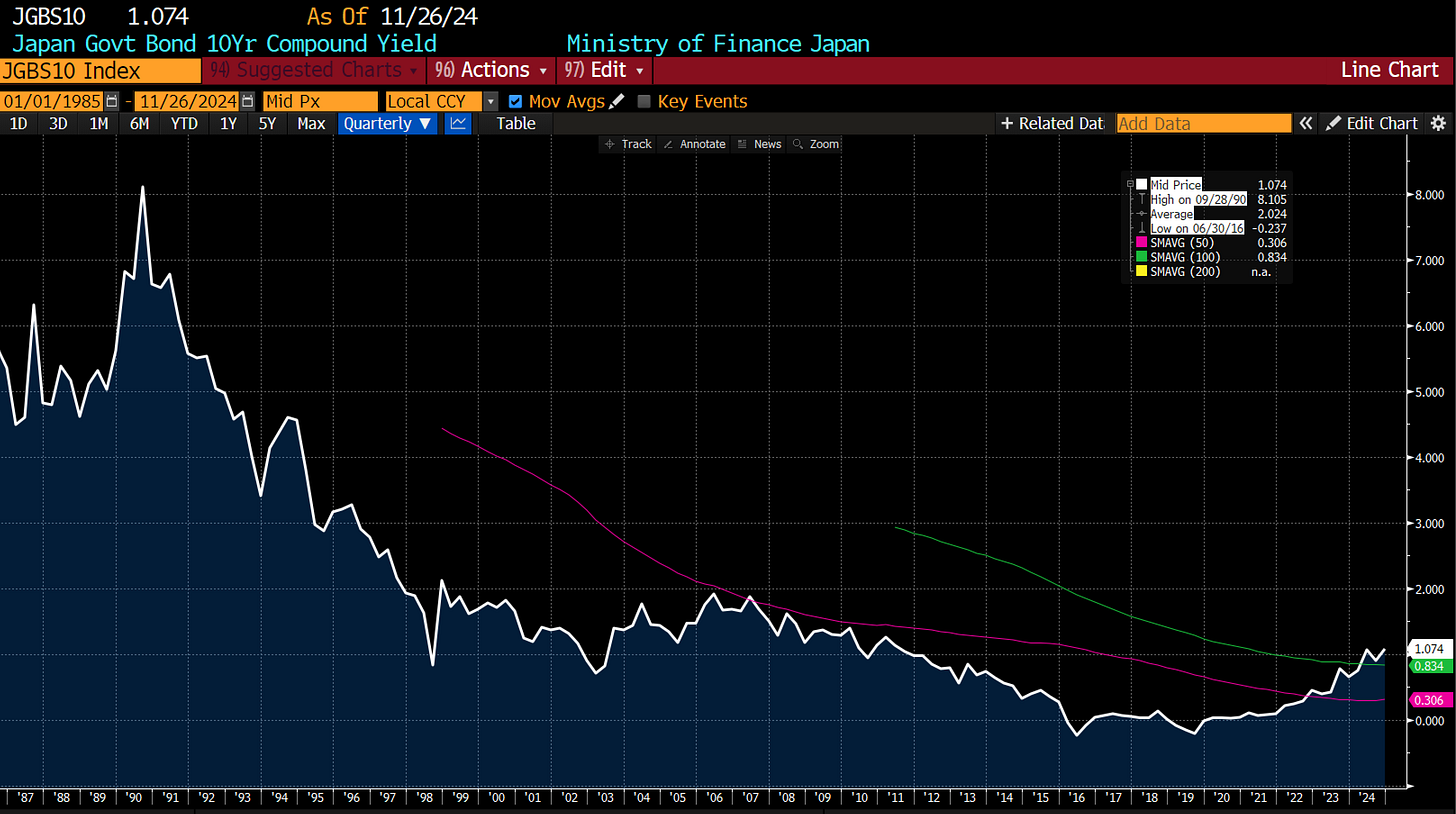

To be fair, while the US treasury has been in a bull market since the mid 80s until 2020, there were plenty of other sovereign bond bear markets - Latam almost constantly, and even Europe in 2009-2011. But these bear markets were not inflation driven, but currency driven bear markets - which is my view are very different things. But the idea that bonds were dangerous was something that ingrained into the senior managers. It led to the invention of the “widowmaker” trade - shorting JGBs. Many leading thinkers declared JGBs as a short from 1995 onwards. All were wrong. Barton Biggs was maybe the one I remember the most, but he passed on in 2012, thankfully before JGB yields went negative!

If I was to make a corollary, I think JGBs are a short now, but most managers who remember the past 30 years would feel very anxious about such a trade. You can see this muscle memory of shorting bonds in how investors have being piling into TLT even as it massively underperforms the S&P 500. The old dogs have learnt to never short bonds.