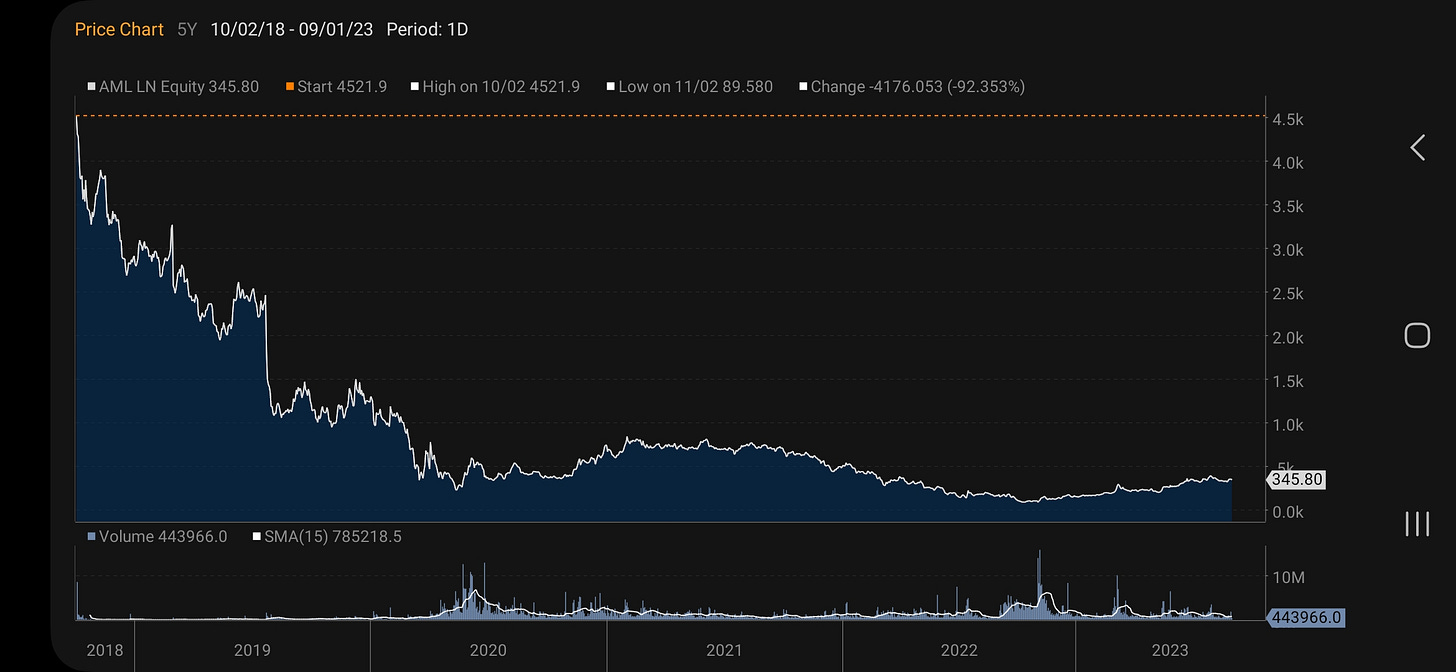

Aston Martin is an iconic car brand. It has been James Bond’s choice of car since the 1960s. It is a brand that could be compared to Porsche, Ferrari and other premium car marques. The problem is that the brand has not been managed as well as these other brands. Aston Martin the company can been generally loss making since 2011. Initial investors in its 2018 IPO have lost over 90% of their capital. Over this time their have been multiple rights issues, which has seen shares outstanding rise from 95 million shares to over 700 million shares today. This leaves Aston Martin with a market capitalisation of GBP 2.7bn (USD 3.4bn).

The investment opportunity in Aston Martin is pretty obvious. Take its heritage and brand and make it more like Ferrari. The contrast in share prices is striking. Ferrari share price is at all time highs, and worth a cool USD 55bn. On a valuation basis, Aston Martin is 2 times sales to market cap, while Ferrari is closer to 10.

The problem with the idea of making Aston Martin more like Ferrari, was that you needed an investor with the long term patience of the Ferrari family to build brand value, something that had been lacking at Aston Martin. Enter Lawrence Stroll - who began building a stake in Aston Martin in 2020. He also greatly increased his investment in 2022 at very low prices, and with a big rally in the share price in 2023, he might be making money on this investment. However, Lawrence Stroll is not just investing with a view to turning Aston Martin into the next Ferrari. He has been involved in F1 since 2017 to get his son, Lance Stroll, a drive. This has included a reputed USD80m payment to Williams for his first drive in F1 in 2017, and then the purchase of failed F1 team, Force India rebranded to Racing Point, for another USD 100m. Racing Point was folded into Aston Martin, so it actually not very clear to me how much money Lawrence Stroll has invested in F1, but lets say somewhere between USD 500m to USD 1bn. For investors in Aston Martin, here is the unknowable question - is Lawrence Stroll trying to build a new Ferrari, or is he trying to buy a drivers championship for his son?

There are two main championships you compete for in F1, the driver’s championship and the manufacturer’s championship. Without question, money can buy you a manufacturing championship. In 2005, Red Bull, a company with no previous car manufacturing experience entered Formula 1. For them an F1 team, which costs at least US 300m to run annually was seen as a marketing spend. The idea was to extend the Red Bull brand from nightclubs and truck drivers, to health and sport. Although Red Bull entered F1 as a marketing ploy, the team is intensely focused on winning. Underperforming drivers are replaced, and ruthless tactics are used when necessary. Red Bull has shown that with enough money, you can buy a F1 manufacturing championship. Ferrari has also historically been ruthless with drivers. For both teams, the brand is bigger than the drivers.

Lawrence Stroll has bought a controlling stake in Aston Martin, the business idea is turn it to a luxury auto brand like Ferrari. For this, he needs success in Formula 1, and to achieve that has paid up to get the services of two former world champions, first Sebastian Vettel, and now Fernando Alonso. Technical improvements have improved Aston Martin phenomenally, to a degree that Alonso is on track this season to score the most points since 2013. Currently, he is 3rd in the standings behind the two Red Bull drivers. Despite Alonso’s success, Aston Martin is only 4th in manufacturers championship. Why? Well the Aston Martin team is keeping faith with the long serving driver, Lance Stroll.

As a karting parent (see www.jarrettclarkracing.com for more details), I can put myself in Lawrence Stroll’s shoes (although sadly, not spend that much money). He paid to get his son a drive and experience in F1 with Williams, but with an underpowered car that has no chance of winning. He then bought a failing team, and did a deal with Mercedes to get it a good engine. He has then bought a famous brand, and brought in top drivers who are near retirement, to act as mentors as well as bring prestige to the brand such as Vettel and Alonso. Despite all this, the chances of Lance Stroll winning a driver’s championship is remote. His big problem, and the same problem all karting parents face when you try and buy wins, is eventually you will come up against someone with as much or more money as you. While Lawrence is worth a USD 4 billion, Mark Mateshcitz, who controls 49% of Red Bull is worth USD 52 billion. Ferrari with a market cap of USD 55 billion would all have the financial resources to stop anyone buying a driver championship. And even if he wanted to throw everything he could at Lance, new spending rules would make this very difficult. For me the business choice is obvious, and Aston Martin offers huge upside potential if Lawrence Stroll is like Keyser Söze from 1995 film, The Usual Suspects.

At one point in the movie, the characters tell a story about Keyser Söze, a legendary gangster. Apparently a rival gang kidnapped his family to try and bend Keyser Söze to their will. Keyser Söze found the kidnappers, and killed all of them except one. With this last kidnapper as a witness he then killed his family to show that no one could ever control him or threaten him, and left this kidnapper alive to make sure that everyone would know that no one could get to him, that business was more important than family.

From a business perspective, Aston Martin should fire Lance Stroll, and hire a British driver who could lean into the existing James Bond legacy of the brand. George Russell would be an obvious choice. He would also significantly boost the chances of a manufacturers championship and all the kudos that would bring to the brand. I do not know the mind of Lawrence Stroll, so your guess is as good as mine. If he continues to put family before business in a rising interest rate environment, then the stock is too risky for my liking. If he fires Lance, and focuses on brand building, then I think the strategy could work. As a karting parent, I find it unimaginable that Lawrence would fire his son - but then again, I am not a billionaire. I leave it to your judgement, is Lawrence Stroll a Keyser Söze?

(Thank you to my karting parent friends Nici Chapfield and Travis Domain for helping me generate this idea. All errors and objectionable bits are mine alone.)